Best Asset Class this Millenium

News

|

Posted 27/06/2022

|

13834

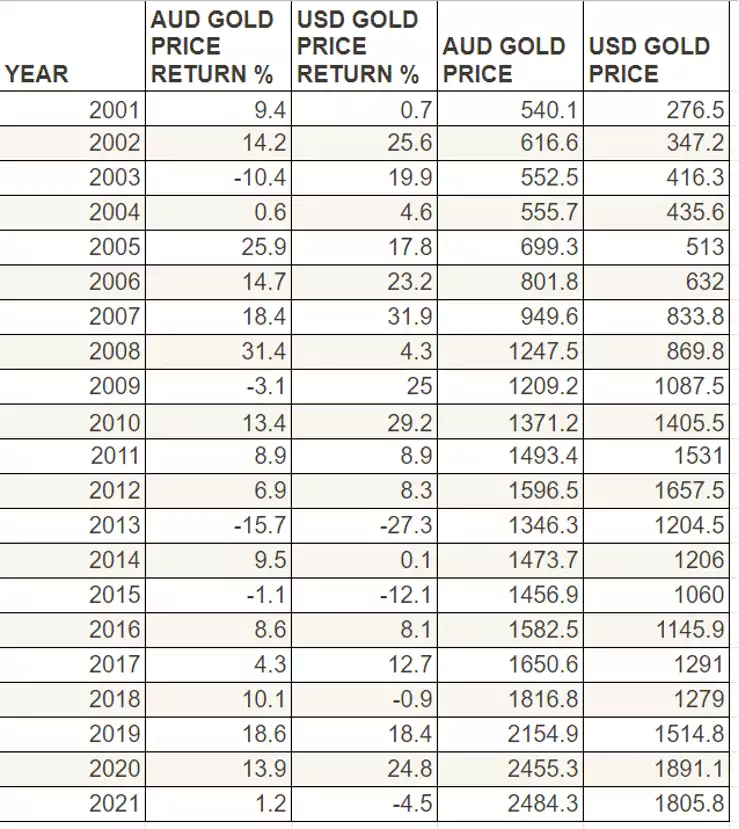

Since 2001, Gold has outperformed any other mainstream asset class, although that’s not what you are likely to hear from the mainstream. While gold lagged in 2013 and 2015, for long term investors, the yellow metal is up 553% in USD terms and 360% in AUD.

Over the last fifteen years, gold has outperformed every other mainstream asset class in Australia, making gold ‘best of class’ in the new millenium.

Source: The Perth Mint, World Gold Council, LBMA, RBA

Reading down, comparing the changes in performance in USD and AUD terms also lends some insight into how gold is also a currency hedge. The other way to think of it is that gold’s value remains stable, and the USD and AUD currencies move up and down in relation to gold. Any trading pair can be flipped to have the other value as the denominator. Over the same period, the Aussie has varied from 50c USD in the early 2000s to above parity in 2011. If you were holding gold throughout this period, it would have also served as a currency hedge and the impact of the % changes would have not been felt as much. Obviously, if you aren’t exporting or importing items this has less effect but everyone purchases goods either locally produced or internationally, so the impact is felt much the same.

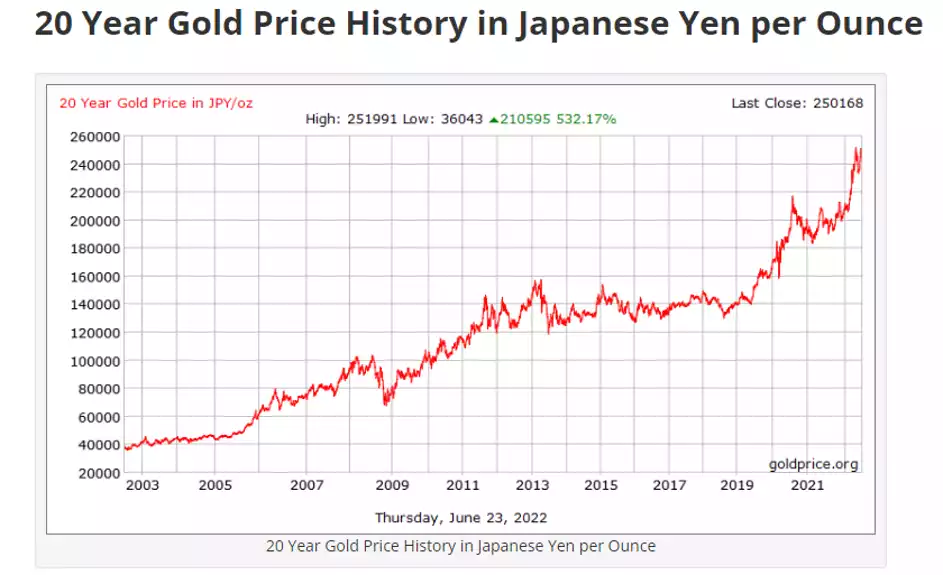

While we usually think of gold in USD terms, looking at gold’s performance in almost every other fiat currency will see gold reaching all time highs and accelerating into the screen top right.

Looking at the Gold price in Japanese Yen over the same time period, we can see that it’s grown from 40,000 yen to an ounce to now over 240,000 – not a bad business to be in at a 532% clip.

The Chinese Yuan shares a similar looking trajectory to the USD with the second ten years tilting further to the top right for a 356% gain.

The Euro shows a pronounced local peak in 2011-12, but we are now 439% above where we were 20 years ago.

And not good news for holders of the British Pound. In gold terms their currency has gone down significantly with gold rising 635%. Brits who held more of their savings in the yellow metal would have been able to buy 6.35 times more lamingtons and doilies in 2022 than those who stuck to the government issued paper.

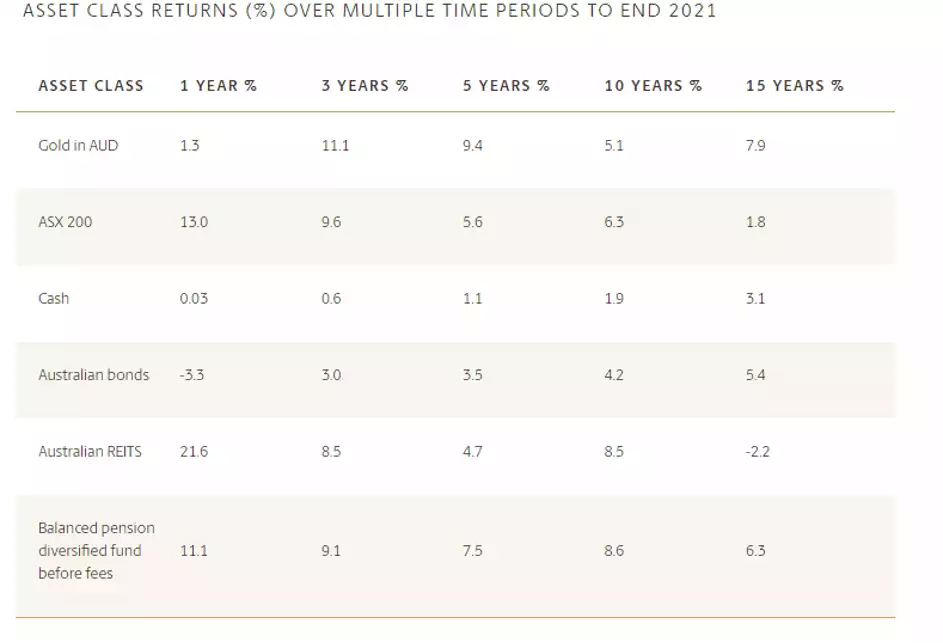

Gains in dollar terms are relative though to other major asset classes such as real estate, bonds and the ASX 200. Contextually, it’s worth considering how gold has performed in relation to these other asset classes. We can see from the table below that over the last 15 years gold has outperformed.

Source: Chant West, The Perth Mint, Australian Bureau of Statistics, World Gold Council.

Gold, as well as silver and platinum, are well known for their ability to act as a hedge against downside risk in the stock market. Remaining stable while other asset classes melt, precious metals provide a stabilising role when markets are in turmoil.

The trend is clear. Short term fluctuations in the price on a day to day basis are like ripples on the surface of a lake. Over time, gold maintains its value steadily through various market cycles.