Australia’s OTHER Problem

News

|

Posted 26/11/2018

|

7448

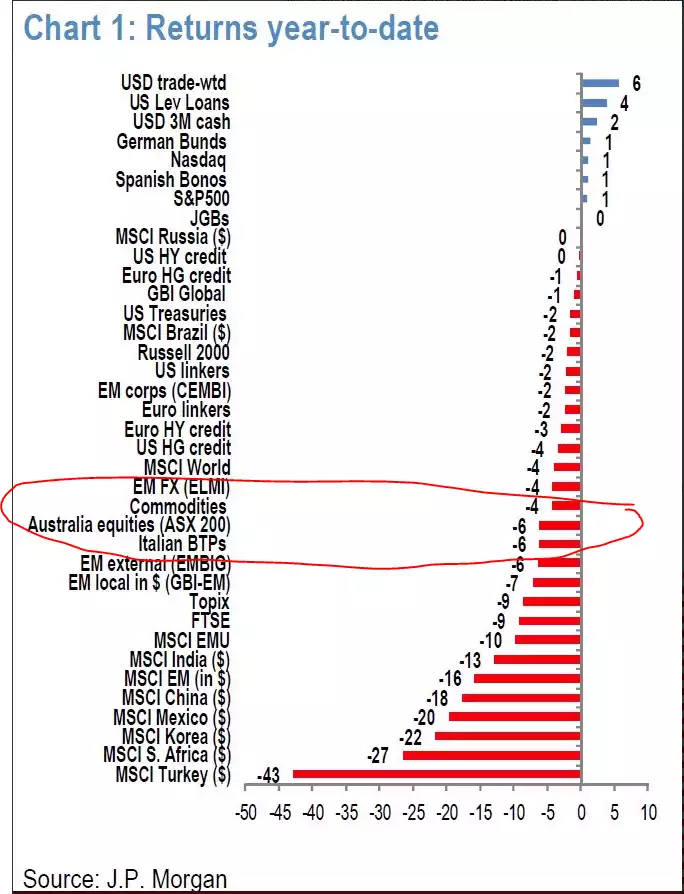

Australia is enjoying low unemployment and strong GDP prints in the 4’s%. Yet wage growth remains low, house prices are falling and our sharemarket is down 6% for the year. The graph below of year to date returns around the world shows we are even worse than a spluttering Euro and outright bearish Emerging Markets.

Yet the RBA has talked of maintaining strong GDP growth and the next rate move, albeit not for some time, likely to be up. However a couple of weeks ago they started adding some caveats to this forecast:

“There continues to be uncertainty about how quickly the unemployment rate will decline and how quickly that will feed into wage pressures and inflation…..Uncertainty about wages growth also translates into uncertainty about the outlook for household disposable income, which has a direct bearing on consumption growth, as does the evolution of housing prices through household wealth.”

Indeed most of the focus has been on the impacts of the housing correction on the economy, which we last discussed here (a must read if you missed it). In essence the tightening of lending into property by the besieged banks and disappearing Chinese investors has left settlement failures, forced sales, and languishing sales rates resulting in declining property prices. The impacts on the broader economy are potentially huge.

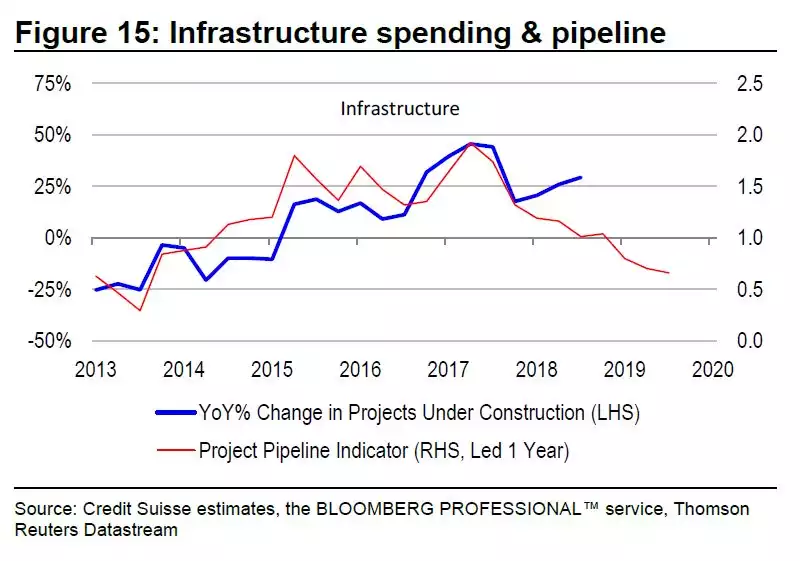

And now Credit Suisse are raising further concerns for the Aussie economy but from a different angle. They believe that all the infrastructure project underway have been propping up the economy and the current pipeline sees that coming off in the next few quarters. Indeed when they plot the annual change in actual infrastructure investment against the expected pipeline ahead there is both a clear historic correlation and a clear overshoot of spending playing out right now. They point to the saying ‘serenity now, insanity later’ as an apt description of what we are currently experiencing.

That pull forward of infrastructure, they think, has masked the effects of the property slowdown, but not for much longer.

“Our concern is that the economy is very much driven by housing and consumption…..Indeed, the multiplier effects of housing on the rest of the economy are very large. In this respect, conditions do not look particularly healthy.”

“Infrastructure spending is providing a circuit breaker between falling house prices and the aggregate spending. Employment growth has been remarkably resilient, allowing households to absorb negative wealth and credit effects from housing downturn…..But if the infrastructure pipeline is not topped up in a timely fashion, the risk is that the public spending impulse will fade, employment growth will slow, and private sector de-leveraging forces will take over.”

The Australian economy therefore has 2 options to prevent an economic crisis – RBA lowers interest rates or Governments go on an infrastructure spending spree (ala Trump).

Should the former occur we run the risk of re-inflating the property market before the ‘correction it had to have’ together with the clear message of economic concern it sends to the market. It also is unlikely to be effective on its own and will need the second regardless. Should the Government ramp up infrastructure spending (and let’s face it, we have an election soon…) we stare down the barrel of more and bigger deficits, even higher government debt, and that oh so tenuous credit rating becoming surely under immense pressure.

This is not an unusual situation on the global stage, but rather reinforces any outdated ‘she’ll be right’ perceptions of ‘the lucky country’ being somehow different. It’s not. Diversify your wealth to protect from the various scenarios before us.