Australia’s Dollar Challenges

News

|

Posted 02/05/2017

|

7126

Today we address two critical factors for Australia’s economic future off the back of two separate headlines late last week.

Firstly that perplexingly strong Aussie dollar... Amid plummeting iron ore prices and a strengthening USD our little Aussie battler has ignored both and remained stuck in a 70-80c trading band and particularly around 75c.

From the AFR: “The dollar's potential loss of its status as a high-yielding currency could cause the Aussie to plunge to US62¢, forcing the Reserve Bank to raise interest rates despite still-weak domestic growth, according to one of Asia's most prominent currency strategists.”

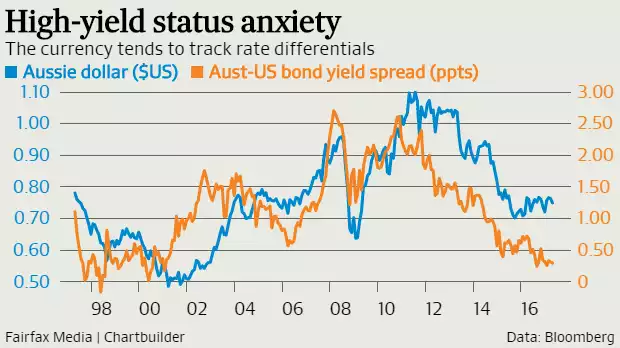

Despite our cash rate being the lowest in history (at 1.5%) that is still relatively high in this zero (and even negative) interest rate world and hence money has continued to buy the AUD. But the Fed seems set on a path of raising rates which means the spread between Aussie and US bond yields is closing, per the chart below:

TD Securities chief Asia-Pacific strategist says:

"We're spending a bit too much time saying inflation isn't high, therefore the RBA doesn't need to hike. We all know the RBA wants a lower currency. But you have to be careful what you wish for…. If the Fed hikes three or four times, and the RBA sits tight, we won't be high-yield. That doesn't mean the Aussie falls to US72¢. It means it collapses to US62¢. And think of the inflation shock that would cause."

Think too what that would do to your AUD gold and silver price… <insert smiley face, insert #$2000 gold>…

And that is before predictions iron ore has plenty of falling still to do… From BMI Research, the research arm of ratings giant Fitch “The commodity will drop to $US70 a tonne this year, $US55 in 2018, and slump to $US46 by 2021”

We also heard from Minack Advisor’s Gerard Minack (former global strategist for Morgan Stanley and famed predictor of the GFC) that Australia is facing a one-in-three risk of a home-grown recession next year.

He says that whilst the housing boom saved us from the mining bust, it wasn’t clear what would support growth if it stalled, let alone the bursting of the bubble everyone is talking about.

"It is fairly clear that housing's contribution to growth will fade in 2018 - indeed, even with a soft landing it is likely to drag on growth."

His other key concern is the energy cost debacle. Cheap energy has been one our biggest global advantages, overcoming in part our sky high labour and red tape costs. He says:

"Uncertainty about medium-term energy pricing will presumably reduce the prospect of stronger investment spending in any industry where energy is a significant cost," Mr Minack said.

"If non-mining investment weakens at the same time as housing, there is a material risk of recession in 2018."

That too bodes badly for the Aussie dollar. To newcomers, as the AUD goes down the price of AUD gold and silver (against the USD spot price) go up.