Aussie Construction Shutdown. Silicon the straw to break the back?

News

|

Posted 11/10/2021

|

11708

Whilst all focus on construction in the press appears to concentrate on COVID workplace restrictions, an even bigger threat is quietly building, and that is the supply and cost of materials. We discussed this last week here, however with so much riding on construction in this country the lack of discourse on materials threatens a rude shock.

The COVID restrictions on the production of polymers have been exacerbated by the cost of oil, repeated hurricanes where most are made and now shipping, not just in shipping costs but also constant wharf disruptions due to COVID. Polymers are used in a vast array of building and civil constriction materials and have seen another 30% rise already this year.

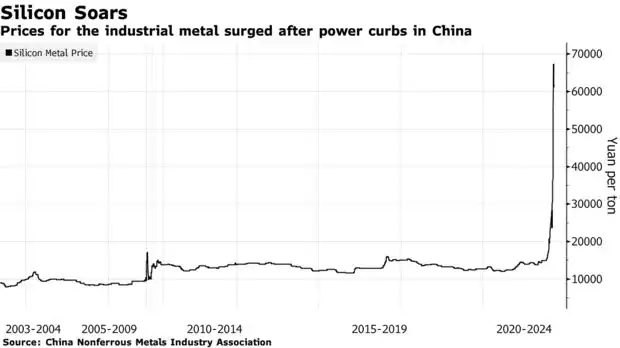

Just as prevalent is silicon. Ironically, the second most abundant element in the earth’s crust is in critical shortage. The core reason is a familiar one…. China’s energy supply curbs. China is by far the biggest producer but the Beijing enforced power cuts have slashed production, by as much as 90% in the second biggest production province.

From Bloomberg:

“Silicon, which makes up 28% of the earth’s crust by weight, is one of mankind’s most diverse building blocks. It’s used in everything from computer chips and concrete, to glass and car parts. It can be purified into the ultra-conductive material that helps convert sunlight into electricity in solar panels. And it’s the raw material for silicone -- a water- and heat-resistant compound used widely in medical implants, caulk, deodorants, oven mitts and more.”

When you consider there are already shortages in timber, when you add polymer and silicon based materials you have the core building blocks of any form of construction. The inflationary pressures are clear. From Bloomberg:

“Along with higher prices for oil, and metals such as aluminum and copper, the silicon shortage is feeding a squeeze that’s already taken hold across supply chains, from producers and shippers to trucking firms and retailers. Their choice is either suck it up and take the margin hit, or pass the cost on to customers.

Either way, the damaging twin effect on inflation and growth has raised concern about stagflation forces taking hold globally.”

One industry source in Australia was even suggesting that beyond the 5x price rise in silicon based products we could even see the Australian construction industry literally grind to a halt in early 2022.

Inflation is one thing, but just as a single silicon chip can stop the production of an entire car, so too do silicon reliant products on a house, a tower, a bridge, a pipeline etc etc.

This comes at a time when China has little personal need to fix the problem as its property market continues to implode. Indeed its increasingly hostile stance toward the west gives it little strategic imperative to rectify this. You will recall part of the electric power crunch genesis is China’s refusal to buy Australian coal for its largely coal based power generators. From Doug Noland:

“Evergrande bonds ended the week at 20 cents on the dollar, with yields surging to 72.5%. China’s real estate sector was hammered this week following the surprise default by mid-sized developer Fantasia Holdings.

Many major developers have lost access to new finance, while real estate transactions throughout China have slowed dramatically. Mounting evidence suggests China’s historic apartment Bubble has been pierced. Now it’s a matter of how rapidly prices deflate. There appears no place to hide. Country Garden Holdings, China’s largest developer, saw yields (7.25%, 2026) surge 181 bps this week to 7.60%. Yields for this perceived pristine, investment-grade credit began September at 4.74%.”

China and a robust national balance sheet beforehand saved Australia from the GFC. Money printing got us through COVID Part1. China may well be the cause of Australia’s next recession at a time when our balance sheet is hugely impaired from the effects of COVID Part 1.

Australia is often referred to economically as a ‘2 trick pony’ – mining and debt fuelled domestic property. This spells a double whammy hit that could see a not so ‘lucky country’ sooner than many think. The ASX200 is only 4% off its all time high in August. That certainly won’t be the case if this all unravels.

Gold and silver are both proven havens in a crisis but also inflation hedges. We can’t discount both are not imminent….