AUD hits 65c - Where to for RBA?

News

|

Posted 27/02/2020

|

20509

Another night of red on financial markets last night. In USD terms gold had a mild increase despite a stronger USD but in AUD terms it rallied strongly as the AUD dropped again, down to $0.654. Next Tuesday the RBA holds its March meeting and all eyes are upon it as to whether the events of the last month see them capitulate and drop rates again. Or start talking about implementing QE.

The dropping AUD is exactly what the RBA want to see but with the Coronavirus having real impacts in the northern hemisphere there is a growing expectation that central banks will start stimulus to counter the effects. In a world of relative value, that puts pressure on the RBA to do the same or risk the AUD rising against those other lower yielding currencies. Their reluctance to drop to date has been based primarily on concerns of further inflating the property bubble and keeping some bullets in the gun for when the recession fully hits. The AFR ran the following yesterday:

“The coronavirus could trigger the next financial crisis but the underlying cause will be subprime corporate loans, contrarian investor and chief stock picker for the $19 billion Ariel Investments Rupal Bhansali warns.

…”We did not know if the economic shock would come from coronavirus or something else [but] in the worst-case scenario many, many companies will default on their bonds,” she says, pointing to the decline in GE’s value over recent years as a “canary in the coal mine … That was a 150-year-old company that was on its knees,” she says.

“Tourism is a prime example of a first-order effect but it’s also luxury goods. When people’s confidence is down, big-ticket-item spending like property sales are down a lot in China; real estate will have a tough time in geographies with a predominance of Chinese buyers. Australia and Canada come to mind.””

Wall Street is worried.

Such thoughts, if shared by the RBA, would suggest their reluctance may be evaporating, particularly against some pretty ordinary early figures for Q4. Construction spending for Q4 fell 7.4% year on year and was across the board of residential, non-residential and engineering. Retail sales too look weak, private business capex at -0.2%, and net exports whilst OK, are before the effects of the virus in Q1 of this year. Credit Suisse have a Q4 GDP range of -0.1% to 0.1% on current data and an ‘optimistic’ forecast of just 0.2% with all data in. That’s pretty weak. From their latest analysis:

“To be sure, we could be optimistic, and assume a bounce back afterwards, reflecting the rebuilding effort from bushfires, and peak disruption from COVID-19. But on the other side of the equation, the negative impact of COVID-19 on household wealth, via higher uncertainty pricing, and slowing employment growth in response to weak domestic demand in 2019 are major dampeners on activity growth. And then of course, there are the unknowns about COVID-19 to consider.

As far as the RBA officials are concerned, they really do not want to cut. Investors are heeding this message at present, and anchoring the Australian 10-year yield at around 0.9%, despite the US 10-year yield plunging. Consequently, Australian-US yield differentials are moving in the AUD/USD’s favour, and the AUD/USD is becoming increasingly undervalued relative to fundamentals, even as it stands still around 66c. In other words, the AUD/USD for now is doing the easing work for the RBA. This is good and self-fulfilling for the RBA position now – but it might not work out so well in the future. After all, the housing market remains highly susceptible to a de-risking event from the drying up of global liquidity and capital flows from China. Commodity prices are clearly an inverse function of COVID-19 infectiousness at present. And of course, if the AUD/USD is already doing a lot of the heavy lifting, there is a limit to how much more we can ask the currency to do going forward.

Our view is that unless the Fed can hold its nerve and not cut in response to market turbulence, the RBA will ultimately not be able to hold either.”

Part of the dilemma for the RBA though is that the big 4 banks have been cutting deposit rates despite the RBA not cutting official rates since October. From Business Insider:

“ANZ and CBA customers who make any withdrawals or don’t deposit monthly required amounts, can expect to make all of 0.01% interest on their money. After fees, they’d likely end up in a worse position than where they began. NAB’s base rate meanwhile is a measly 0.11% while Westpac offers no more than 0.45%.”

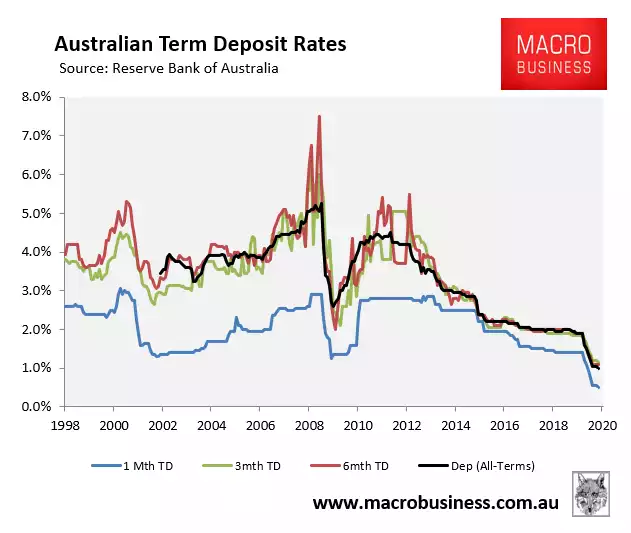

Even if you leave your money in a term deposit the returns are barely at or below 1% for short term:

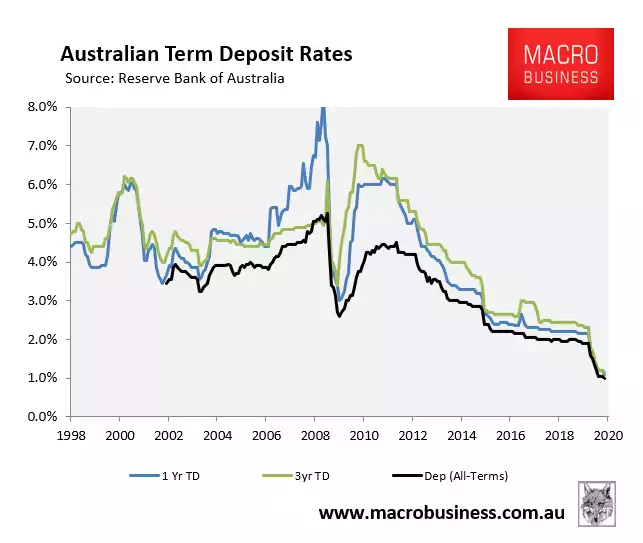

And barely above 1% for long term deposits…

So to be clear here; your return for the risk of being an unsecured creditor of an institution heavily exposed to an inflated Aussie property market, subject to bail in laws and potentially cash bans is around 1% before inflation, tax and fees. It is no wonder we at Ainslie are seeing so much big money getting out of banks and into the security of gold…

But we digress… The takeaway above is that the RBA is looking more and more under pressure to look to quantitative easing (QE) to desperately try and stave off a recession (we are already in a per capital one) whilst rates are already effectively near zero. They cannot sit idly by and watch the AUD rebound. This raises the spectre again of course of them relenting and joining the $13 trillion of negative interest rates around the world as well.

As your currency is increasingly debased, money, real money in the form of gold looks more and more compelling.