AUD, currency wars, & “that” US rate hike…

News

|

Posted 04/02/2015

|

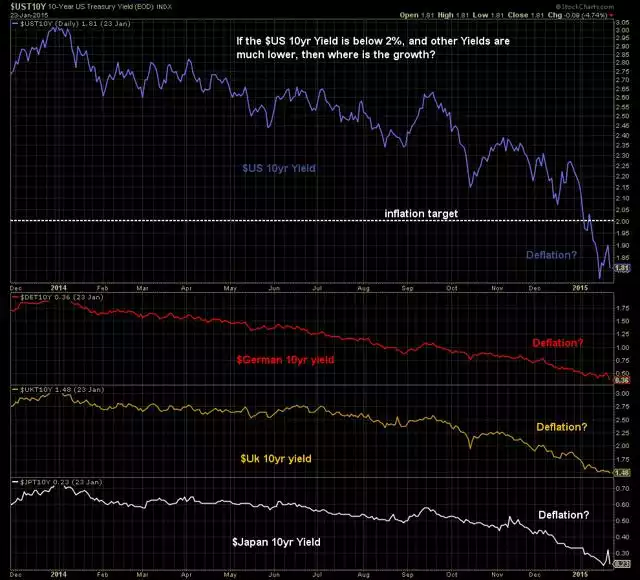

4226

Yesterday Australia’s central bank (RBA) lowered the interest rate for the first time since August 2013 to a new record low of 2.25%. We are rejoining the global currency war – trying to deflate our dollar to compete globally with all the non USD currencies doing the same. And boy did it work with the AUD plummetting vertically by over 1.7% to just 76.26c, its lowest since July 2009. But last night we saw that completely reversed and it’s back to 77.8c as this is penned. The fact remains that in a deflationary world racing to zero we still look attractive. The graph below tells the sad story of the global economy as bond yields around the world continue to fall as investors look for ‘safe havens’ ahead of concerns of economic turmoil (Euro, Grexit, Ukraine/Russa, China growth, Japan spiral, commodity plunge and in the US the VIX volatility index breaching the 22 resistance line 4 times since QE3 ended last year alone, etc etc ). Aussie 10 year government bonds are now 2.37%, US 10 year Treasuries hit a 2 year low of just 1.64% this week while German and Japanese bonds are yielding below 0.5%, and as we know gold and silver have been some of the best performers across all asset classes this year. With deflationary pressures everywhere it seems laughable that expectations remain of a US rate hike soon, despite the Fed’s “patience” mantra. The second graph below shows the inflation rate trend in the US, clearly well below their 2% target. Its hard to imagine in this environment that the next print will be any stronger, yields higher, and the time for raising rates nigh. This also of course means the lack of yield from precious metals is almost meaningless in a world where after tax bond or savings yields are almost zero without the capital gain opportunity gold and silver now present.