Another blow to recovery story

News

|

Posted 12/05/2015

|

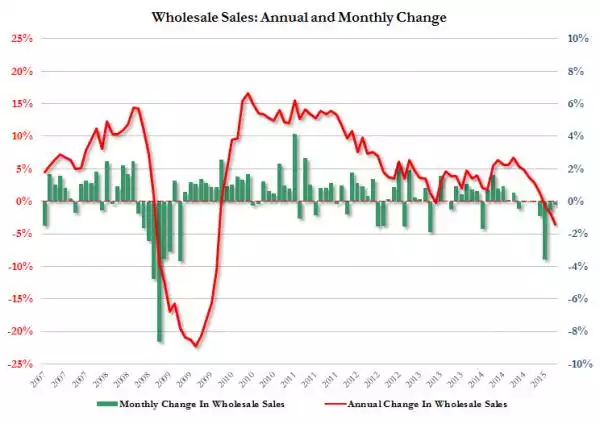

3813

Yesterday we discussed Friday’s US payrolls and last week Durable Goods Orders as key signs of the supposed Messiah of a global financial recovery, the USA, losing serious steam. In the Weekly Wrap on Friday we discussed the blow out in the US trade deficit which could well turn their already anaemic 0.2% Q1 GDP negative on its revision at the end of the month. One of the key points of the NFP payrolls data was the near, and persistently near zero (0.1%) wage growth. When combining this with the spate of poor retail numbers it should come as little surprise then that wholesale sales are plunging. The graph below puts this starkly into context against what happened before and during the GFC. This will all just likely mean more stimulus and higher share prices and by all means play that game, ‘don’t fight the Fed’ as they say, but logic dictates this is unsustainable and you need a hedge in your portfolio to protect you for what is shaping up to be the biggest crash of our lifetimes.