An Extraordinary Week

News

|

Posted 03/05/2016

|

7715

This week is proving to be arduous for Australian investors. With so many decision influencing catalysts, even the experts appear indecisive or conflicted. Let us start with the increasing dissemination of concern surrounding the Australian property market. Last night saw the ABC’s Four Corners program to be the latest to report on the rising worry surrounding Australian property. The report focused in part on social issues born of the generational divide that high prices are seen to be creating and importantly again referenced accusations of predatory and fraudulent lending practices by our financial institutions. The latter observation was timely considering that earlier yesterday, Westpac’s half year report was released. It indicated weakness both in terms of their return on equity, their dividend and in terms of their bad debts. The fact that the bank was sold off by around 4% for the day illustrates the pressure that Westpac is under in investors’ eyes and Commsec is expecting all the major banks to be exposed in a similar way with ANZ and NAB half year results also due this week.

In a further warning, CommSec Advisory’s Blair Hannon suggested that Iron Ore levels are unsustainable at their current prices with a lot of speculative futures trading happening in China and indicated that BHP and RIO are currently artificially propping up the market; especially considering that the banks are falling. Cumulatively, this sees the Aussie market currently at its most volatile in about 7 years.

Furthermore, the RBA hands down its interest rates decision today with current pricing at about 58% in favour of a cut; much higher than it was prior to the release of our recent CPI deflation. The outcome of this decision will likely impact equity markets and investment decisions more broadly. Thereafter is the pre-election federal budget tonight with Scott Morrison expected to lift the second highest tax bracket to address bracket creep, favourably adjust medium business tax, introduce superannuation changes and unveil a suite of multinational tax avoidance measures. The calendar this week makes for a volatile investment environment and emphasises the role of sound portfolio allocations that perform well in uncertain circumstances.

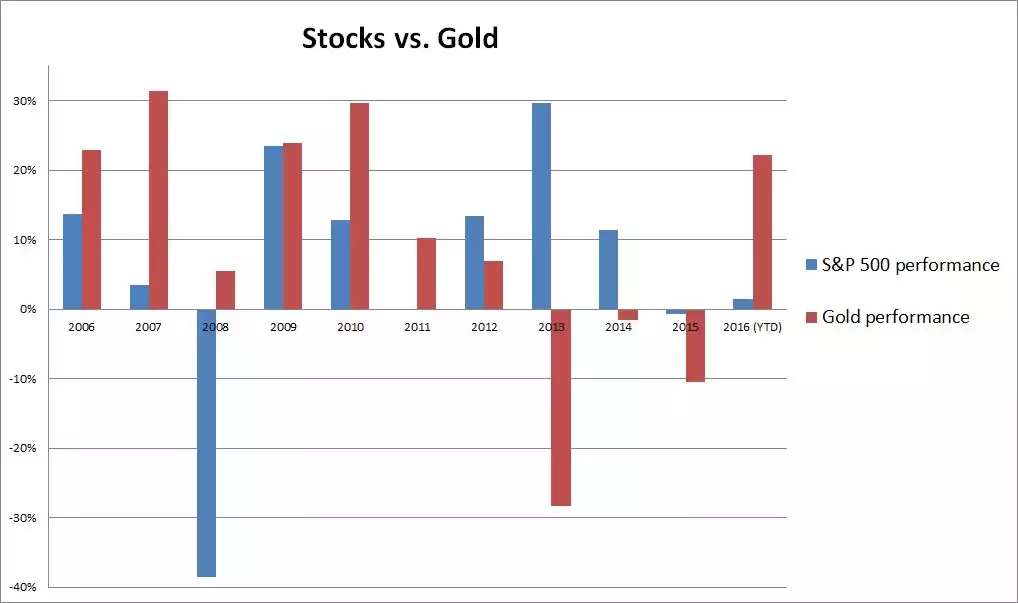

To speak of such an investment, we reported on gold touching $1270 prior to the long weekend and last night saw gold take out the $1300 mark. In a sign of the times, it is now not uncommon for main-stream news outlets to not only report on gold but to do so favourably. To illustrate, we finish with CNBC’s overnight assessment of gold’s performance this year. Going further than simply covering the metal’s circa 22% YTD rise, they draw a parallel between 2016 and 2007; the latter being the only other time in the last 36 years when gold has outperformed the S&P by 20% or more when the S&P was actually positive for the year. This is illustrated in the chart below. CNBC use this metric to conclude that gold as a bad-news-barometer is flagging warnings. In a comment that could easily be applied to the current Australian investment landscape, Max Wolf of Manhattan Venture Partners concludes that “fear about a lot of really negative news flow is probably driving people into gold”.