Accumulation Behaviour in BTC Strengthens

News

|

Posted 31/05/2022

|

6419

In the aftermath of the sell-off in early May, a noteworthy shift in accumulation trends for BTC is underway. The Bitcoin HODLer class remain the only ones left; however, their accumulation behaviour signals a doubling down as prices correct below US$30k.

Bitcoin prices continued to consolidate this week, after initial signs of a potential decoupling between digital asset markets and traditional equity markets.

After the LUNA motivated sell-off event earlier in the month, there has been a distinct behavioural change in Bitcoin on-chain accumulation trends. In particular, entities with balances < 100 BTC, and those with >10k BTC have been significant accumulators. The remaining wallet cohorts have also transitioned from net distributors, to neutral. This reflects a notable shift in behaviour compared to the Feb to mid-May period which was intermittent accumulation and distribution, reflecting uncertainty and a rotating capital.

However, on-chain activity remains extremely soft, with a notable lack of new interest in the asset outside the existing HODLer base. That said, the HODLers who remain, appear to be willing to double down as prices fall, and remain unwilling to spend coins, even if held at a loss.

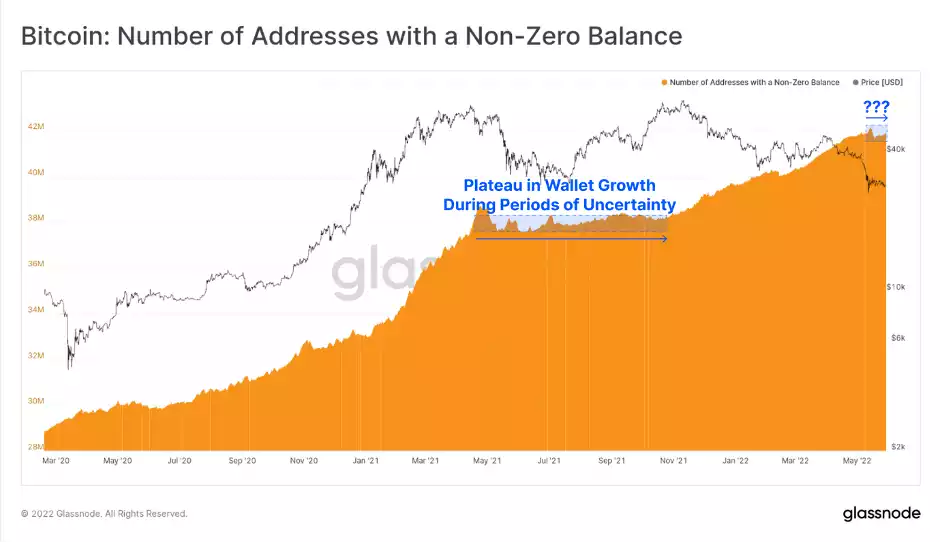

After the May 2021 sell-off, we witnessed a modest 'purge' of wallets, as investors completely emptied their coin holdings. This was followed by a four-month-long plateau in wallet growth as uncertainty crept into investor psychology, and marginal buyers were flushed out of the market by the drawdown.

As we can see in the chart below, the poor price performance of late has put wallet growth on a near term pause, although not on the same scale as in May 2021.

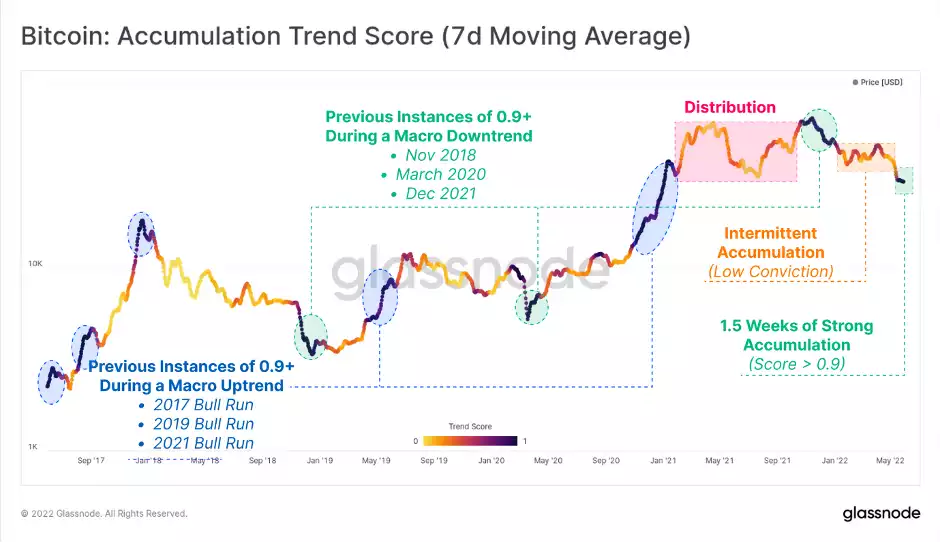

The Accumulation Trend Score has seen a noteworthy shift in behaviour. For almost 2-weeks, it has returned a near-perfect score above 0.9. This indicates that existing entities on the network are adding significantly to their holdings. This is a clear break from the intermittent scores returned during the Jan-April consolidation range (orange) which can reasonably be classified as relatively low conviction accumulation.

Previous instances of sustained high accumulation trend scores fall into two buckets:

- High scores during a bull-run (blue) - which usually occur near tops as the smart money distribute their balance, but are matched with an even larger influx of less experienced new buyers.

- High scores during bearish trends (green) - which generally trigger after very significant corrections in price, as investor psychology shifts from uncertainty, to value accumulation. A notable exception is the post ATH period of Dec 2021 where 'the dip' turned out to not be THE dip, and many of these coins were redistributed lower at a loss.

The plateauing on-chain activity for Bitcoin has been in effect since September 2021, and as yet, there are few signs of this changing course. What this indicates is that the HODLer class, the Bitcoin buyers of last resort, and the only ones that remain. This can also be observed in the unwillingness to spend held supply, even if it is now held at a loss.

Alongside a majority of Long-Term Holders an increasingly large volume of BTC appears HODLed and acquired at these lower prices. This trend, unless disrupted, can be expected to propel Long-Term Holder supply above its ATH over the coming months.

Keeping both eyes on the macro environment in which Bitcoin remains within, there are signals of decoupling between digital assets and equities. Whether renewed correlation returns remains to be seen, and so does the ultimate direction of markets in reaction to monetary tightening. Risks of significant scale remain, however, so does the population of price-insensitive Bitcoin HODLers.