A Flattening Yield Curve & The Curious Case Of The Yen/Gold Pair

News

|

Posted 14/07/2017

|

8351

In an overnight interview, TF Metals Report owner and 27 year veteran of the securities space Craig Hemke has contributed some interesting observations to the economic narrative.

There are two particular takeaways of interest in Craig’s material. The first is the observed relationship between the COMEX gold price and the Dollar / Yen pair and his hypothesis that this may be the result of algorithmic linking of the metal market to the much larger foreign exchange market for the purpose of hedging.

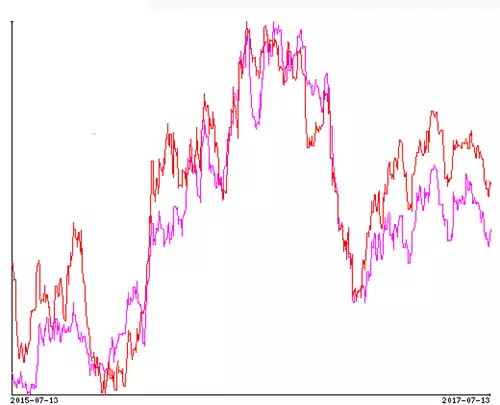

By plotting the inverse of the currency pair (the Yen / Dollar) and overlaying that with gold, a clear correlation which started to form in 2012 becomes evident as we’ll show below.

One of the suggestions behind this correlation is to allow the bullion banks, those that manage the physical metal supply at the wholesale level around the world and issue the derivatives contracts, to offload risk into the FOREX market. Craig explains that these derivative instruments which are tied to a physical commodity are inherently tremendously risky and indeed JP Morgan nearly had an extension event in 2011 (particularly during the last $10 short squeeze from $38 to $48 in the month of April) when they held a large short position and little physical silver behind it.

Because the banks recognise this risk they want to eliminate it. With such large positions however, it can be difficult to mitigate or hedge that risk by using only the gold market itself and it seems possible that the bullion banks have utilised computing algorithms to link gold prices with the USD/JPY pair.

The motivation to link by computer a currency pair to the gold contract price is to facilitate hedging of short gold exposure through the Yen and in utilising the near $6 Trillion a day FOREX market to do so there is “a near infinite pool where you can cover and hide your tracks on your hedges”.

We stress that this is a hypothesis (albeit an interesting one) yet the means and motive would appear to hold water. To explore this idea, we generated the following three plots this morning for comparison. They show one year historical data for the inverted USD / Yen pair and the gold price over the same period.

For further perspective, overlaying the two plots and expanding the time out to two years, an astounding correlation can be observed below. One can only speculate as to why this currency pair may have been selected if this hypothesis has merit but liquidity must be one of the considerations in this case. If nothing else, this concept adds weight to the importance of understanding risks in and limiting the amount of funds allocated to any speculative financial vehicle.

The second interesting takeaway point that we will cover from Craig’s interview is on the topic of recession indicators. The last three Federal Reserve rate increases in December, March & June have produced a 75 basis point increase in the shortest rate available, the Federal Funds rate or the so called “overnight rate”. This is the only rate that the FOMC has direct control over and during this time the long rates have actually gone down.

“The 30 year long bond double topped at 3.21% and now today it’s at approximately 2.9%”. These rate increases have hence had the effect of flattening the yield curve; a phenomenon well established as an accurate precursor to recession.

Craig explains that “the global central banks have printed so much cash and given all of it to the banks that the cash is now looking for a place to go. So it creates a put under the bond market, like a constant bid for bonds, at least on the long end, because everyone is desperately searching for yield”. He says the jawboning of threatening to unwind the balance sheet (which we discussed last week) is intended to frighten that bid and achieve a positively sloping yield curve in order to avoid this classic recession signal.

In closing, we’ll leave you with a tweet from Jim Rickards which would seem to put discussion of algorithmic trading and rate manipulation into stark perspective.