88 GSR in Context – Why Silver Looks Poised to Explode

News

|

Posted 16/08/2019

|

10745

So far this year gold is up 23% in Aussie dollar terms (19% in USD) and whilst silver has belatedly joined the party, it is lagging at ‘only’ 15%. 15% is also the amount the ASX200 is up in Australia (the S&P500 in the US is up around 13%). The question may be then, which has more upside? The Gold Silver Ratio is still stuck on 88:1 and whilst down from that 30 year high 94:1, it is still double that 100 year average of around 45:1. We have written extensively on the GSR, most recently here, and if you aren’t across it you should certainly read that article now.

There are some charts we’ve seen in the last couple of days we wish to share that further reinforce how out of step or undervalued silver appears right now, and the inherent potential based on supply and demand alone.

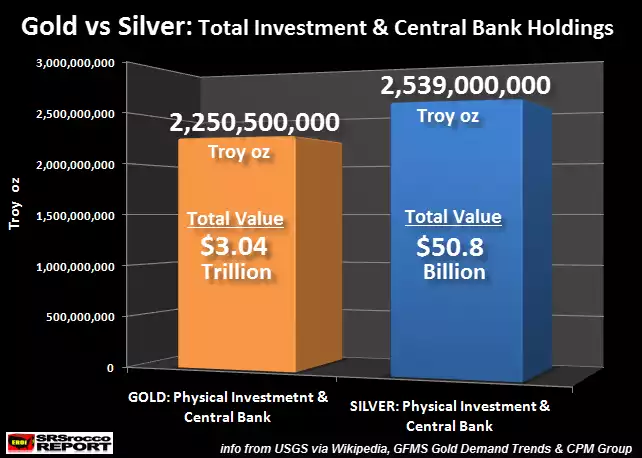

Firstly, as those who own and have to store it, silver is heavy and bulky compared to gold. Not coincidentally, about 88 times more so… When you look at the total weight and value of both metals in investment form and central bank holdings you can see not dissimilar weights but over $3 trillion in gold and $50.8 billion in silver. For context, the Aussie sharemarket shed $60 billion in just one day yesterday… Just consider that point for a moment.

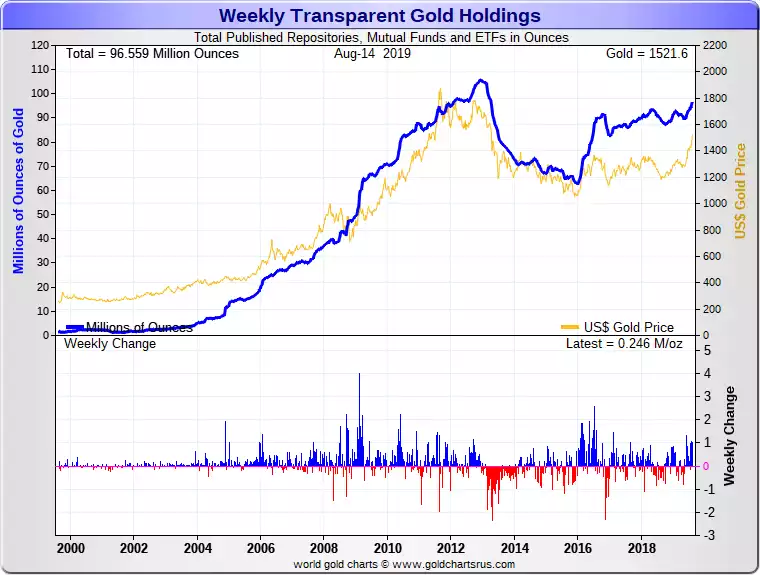

Secondly, and as you would expect with the market action in recent weeks, gold and silver have been piling into ETF, mutual funds and the like. The 2 charts below illustrate the extent of this against the price.

Firstly gold:

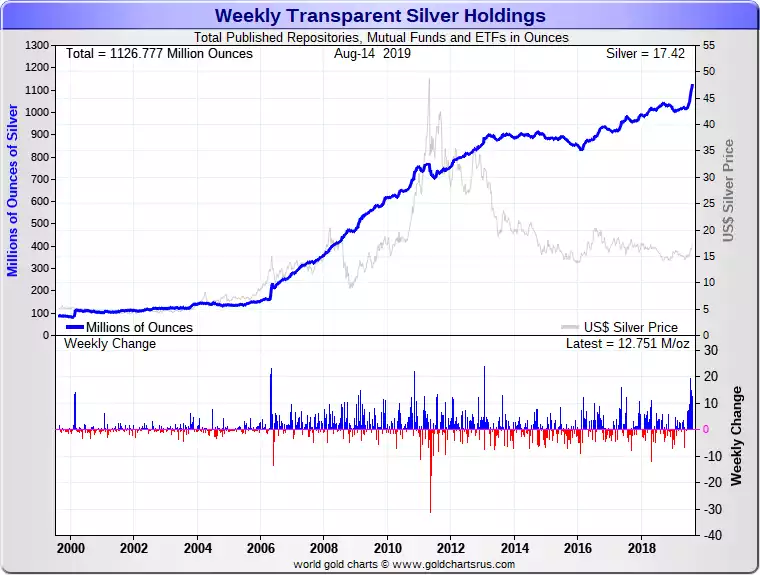

That makes sense yeah? Demand and price acting as you would expect when you have limited supply constraints. And now for Exhibit B, silver:

Yes there is a kick up now, but in the context of the silver that has flowed into these repositories since 2016, that ‘kick’ is very minor and the price appears to be a coiled spring.

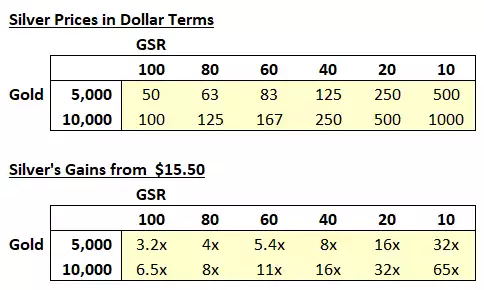

GlobalProTrader’s David Brady tweeted the following yesterday…

Done when silver was US$15.50 doesn’t really matter when we are at $17.30 now when you look at those numbers….

So at the point where both silver and the ASX200 are both up 15% it may be time to ask yourself which is potentially at the end of its price gains and which is just beginning.