4.2% US CPI – What it Means for Gold

News

|

Posted 13/05/2021

|

9303

Amid all the speculation around inflation, last night the rubber hit the road with the release of the latest official US CPI figures. In the context of the US Fed seeking an ‘average’ sustainable 2% inflation rate, the CPI print came in at a blistering hot 4.2% sending shockwaves through markets. The April figure of 0.8% was the biggest jump since 2008 and the other key metric of Core Prices (which exclude food and energy) rose 0.9% the biggest increase since 1995. Importantly too, the current CPI ‘basket’ (which arguably is adjusted to suit) excludes home prices as it used to, now only rent. Rent, which accounts for a mighty third of the index has ‘only’ gone up 2%. House prices in the US have risen around 18% in the last 12 months!

It was a night of red amongst nearly all assets other than the USD. Shares had their worst night since the beginning of the year and even assets that usually benefit from such a print like gold and silver came off, albeit the lower AUD off the stronger USD saw pretty much no change for AUD metals from yesterday. Crypto too saw falls over night.

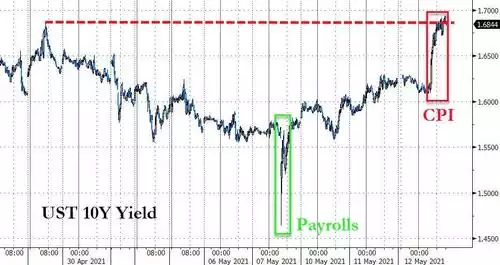

US Treasuries were also dumped which saw yields spike, the 10yr almost kissing 1.7%, a long way from when they plummeted to 1.47% after the disastrous employment figures last Friday night. Such a spike in yields would normally see gold weakness, but it has largely shrugged it off. You can see in the chart below the last peak at the end of March which is when gold bottomed. So why not this time? Because the key factor for gold is REAL rates, not nominal yields, not the Fed Funds Rate.

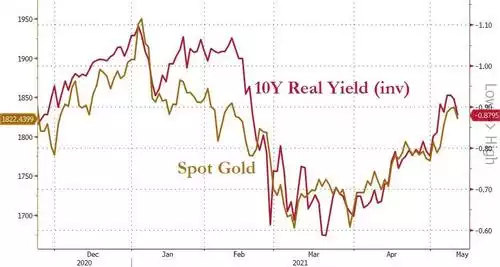

Gold peaked last August at US$2063 and not coincidentally, the 10 year Treasury yield sat around 0.5%, an historic low. From there, the recovery and reflation narrative saw US Treasury yields march higher and gold relentlessly fall to just US$1686 at the end of March with US 10yr yields at over 1.7%. Real rates are the difference between nominal rates and inflation. Inflation was largely a fear not an actuality. Last night was potentially instructive on the ‘turn’ being in. You can see below the remarkable correlation between the gold price and real rates:

What is making this even more interesting, at a time when shares are still at near record highs despite the falls this week, is the real prospect of stagflation rather than just inflation. Stagflation is high inflation but lower economic growth, it’s the abysmal double whammy. Fresh after the appalling jobs data the chart below is screaming stagflation as a real prospect:

Now you may well be saying, yes well bond yields will just keep going up, it’s a two-way equation. Maybe. However as we repeatedly remind you, to get to where we are the world has amassed a record amount of debt. The delicate (impossible?) task before the central banks is to orchestrate sustained inflation to inflate that debt away BUT without allowing the interest payable on it (via rising nominal rates) to get out of hand and quite simply not be able to service it and default.

Whilst the CPI print is 4.2%, the Fed prefers the PCE Deflator (Personal Consumption Expenditure Deflator which is a measure of inflation based on changes in personal consumption) measure which is still sitting at 1.6%, comfortably below the 2% ‘target’ and hence they will continue to maintain their easy money program. That same program buys Treasuries strategically to try and keep the ‘natural’ bond market yields low. You can see what’s happening then yeah?

The PCE Deflator is still at large and arguably more reliant on the velocity of all this new cash in the system which is still largely absent as people have been saving. That will inevitably change and there will be no heading back, the ‘transitory’ inflation narrative will be dead.

Let us leave you with a current reminder from data last night of the enormity of all the new ‘money’ being poured into the system and again ask yourself how this will not lead to rampant inflation…

For the US fiscal year to date for the 7 months to the end of April, the US government collected $2.14 trillion in taxes and other income, and spent $4.075 trillion. 90% more. And that is before Biden’s latest stimulus measures. What could possibly go wrong…

Precious metals are real money. Never before in our generation has that been more important.