2011 Silver Crash 4th birthday!

News

|

Posted 29/04/2015

|

7003

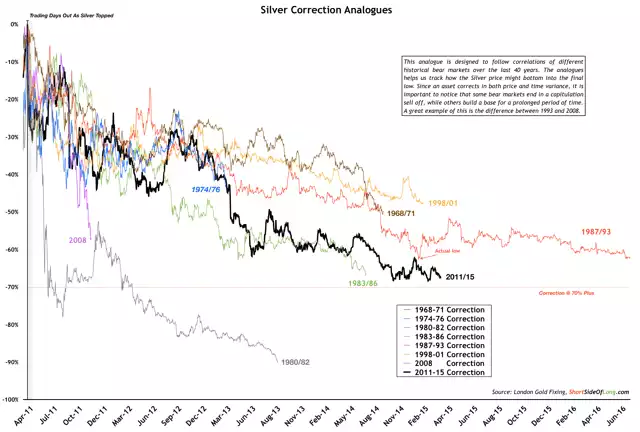

This week is one many longer term silver investors may not forget. This week 4 years ago saw silver reach an all time high of US$48 (A$44). It is also the same week 4 years ago that saw silver crash to US$35 (A$33)…$13 in 3 days. Awful stuff. But before we get the Kleenex out we should remind ourselves that this is the same silver price that started at around US$5 (A$6) at the start of the bull run from early 2000’s. For those who bought close to this peak though it is still painful but also demonstrates a good lesson in human behaviour. We people (some may say sheeple) tend to pile in when things are going great. Just look at the sharemarket at present. Global growth is sick, nearly all ‘overbought’ metrics are screaming, yet shares are on the up. On the other hand check out the graph below which shows all silver bear markets since it was open traded in the 60’s. Note the following:

- If you look closely, the 1987/93 bear run actually saw its low in 1991 which makes this current market (at 4 years) the longest USD bear run on record

- At 68% down from its April/May 2011 high this is the 2nd worst downtrend on record.

- Our Aussie dollar has shielded us from a bit of that 68% USD drop but we are still 52% down. We also arguably may have seen the bottom last November (A$17.91) as we are now up 16% on that low.

Why is this good news? Well for those who like buying low and selling high, for those contrarian investors, and for those employing Rothschild’s (a bloke who did ‘alright’ financially…) infamous quote of "The time to buy is when there's blood in the streets."… this graph may be screaming at you right now. For those who bought in early 2011, just remember any investment in precious metals should be a long term one. At 4 years in, and the rule of thumb of financial planning for a 7-10 year timeline, you have plenty of time to see your investment flourish still… And in Aussie dollar terms, the low may well be behind us already and you may take comfort in that, knowing it is only early days on the other side. Throw in a gold:silver ratio over 60% above its modern mean, pricing less than primary production costs, strong demand, and global financial markets strung out far in excess of that prior to the GFC and it looks like the buy of the century…