20% Drops in Property in ‘Crunch’

News

|

Posted 02/08/2018

|

10652

The warnings being sounded from a variety of economists and analysts around Australian property and the knock on effect to the banks and broader economy are sounding louder and louder. Ainslie’s are already seeing money from recent property settlements going into both precious metals and cryptocurrencies as people look to reallocated their exposure. We wrote about this just last week in Australia’s GFC.

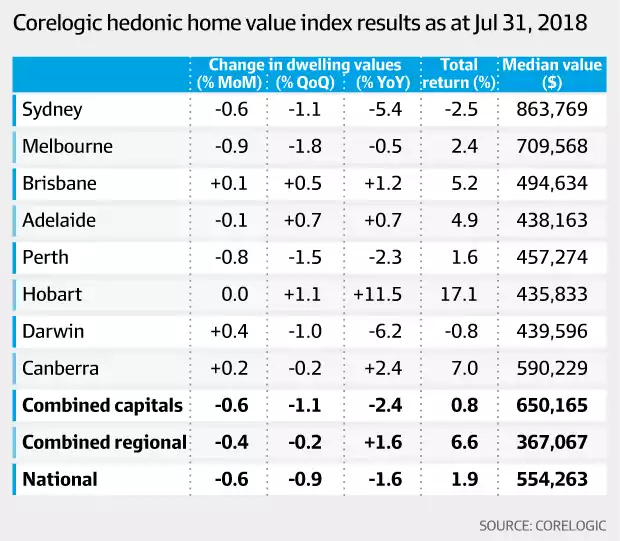

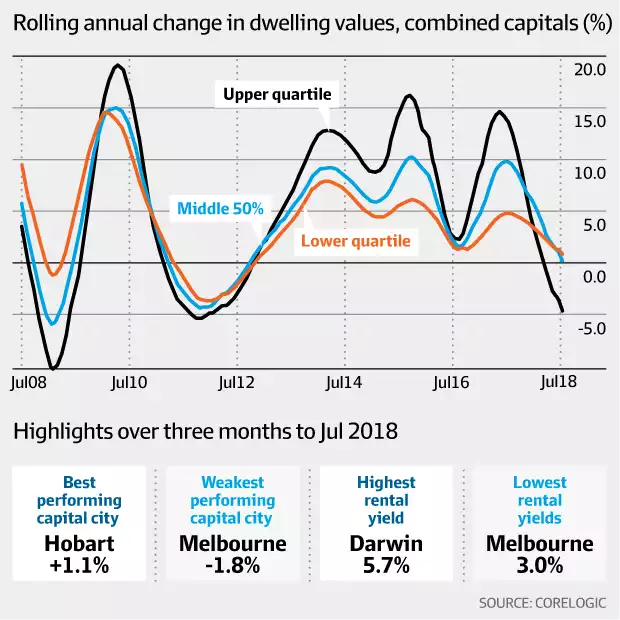

Today the Australian Financial Review covers the topic multiple times. Covering off the news earlier this week of the latest Corelogic Hedonic Home Value Index, which saw property prices drift lower, they covered a real estate agent in western Sydney citing numerous examples of forced sales at a loss exacerbated by rising vacancy rates and falling rents as well. Stating “We can't see any factors that may halt or reverse the housing markets trajectory of subtle declines over the second half of 2018", the following is Corelogic’s snapshot of the nation:

Corelogic also warned that the above declines have been driven by detached houses and we are likely to see falls accelerate when all the apartments under those cranes everywhere come on to the market later this year. Capital Economics’ Paul Dale wasn’t in the ‘subtle’ camp:

“Capital Economics warns the "worst is yet to come" and anticipates a faster decline in house prices than initially expected.

"The acceleration in the housing downturn in July should make the Reserve Bank and some other analysts sit up and take notice," Chief Australia & New Zealand Economist Paul Dales said.

"Our relatively bearish forecast that prices will gradually fall by 12 per cent from peak to trough is starting to look a bit optimistic."

"Most worrying is that prices will soon be falling at an even faster pace. The further decline in the number of home sales in March to a seven-year low was larger than the fall in the number of new listings. In other words, demand is deteriorating at a faster rate than supply is improving."”

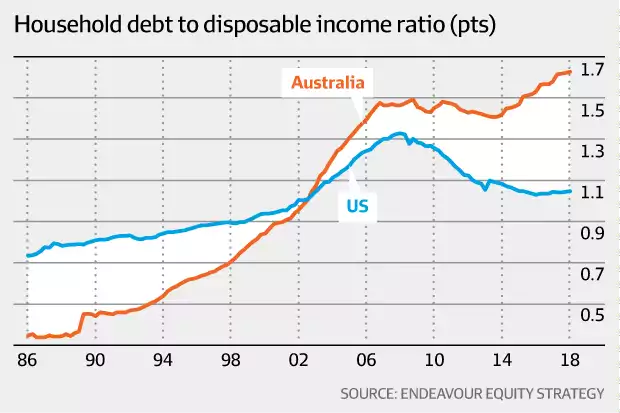

The AFR also ran the article today “Credit crunch could hit house prices by 20pc: Endeavour” and the opening paragraph “Sydney and Melbourne house prices could fall by 15 to 20 per cent in a repeat of the late 1980s and '90s, an independent equity research firm has argued, citing the "largest regulatory credit crunch in 30 years" as the cause for the slide in property values.”

Endeavour has established that 40% of all mortgages were “non-prime” on globally recognised income to debt metrics.

Endeavour warn about a knock-on effect of falling prices amid credit crackdowns post royal commission:

“A crackdown on the use of measures that understated borrower expenses, and overstated their borrowing capacity, would reduce loan values by up to 30 per cent and have a profound impact on property prices.” And “A fall in house prices would lead to a decline in building activity resulting in a "modest increase" in arrears as incomes tied to the sector fall. Meanwhile "lower house prices would reduce the ability for stressed borrowers to trade out or finance".”

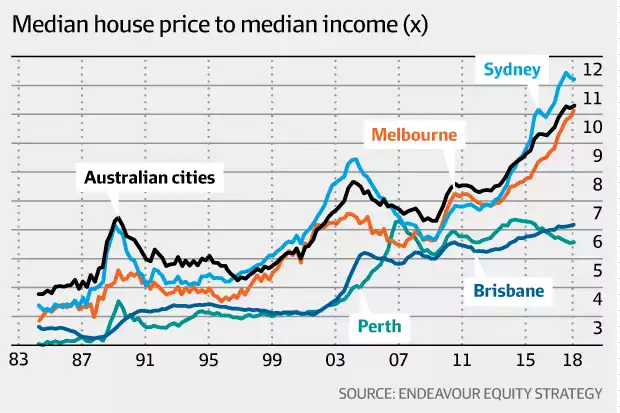

Before this is palmed off as just a Sydney and Melbourne problem, the following chart shows the effect of weighting with Australia aggregated in the black line.

When you consider our capital cities median price is around 11 times median income your gut should be telling you something is wrong. Looking at the above 2 charts you may be asking how could banks lend at such levels? Endeavour believe the Household Expenditure Measure (HEM) used by the banks to assess serviceability is “commercially conflicted” and boosts serviceability by 15-20%. Not surprisingly their outlook is rather concerning:

“"We see credit growth over the coming 12 to18 months as likely flat to negative, margins under pressure, heightened legal risks and bad debts set to increase as equity turns negative for a significant portion of leveraged home owners and investors."

The report said a sample of 420 Westpac mortgages, made public as part of the Hayne royal commission, supported its prior view that 40 per cent of all outstanding mortgage debt was "non-prime".

This was based on the "internationally accepted" measure of "non-prime" being a mortgage in which more than 40 per cent of income was being used to service interest payments on debt.

" 'Non-prime' mortgages areas have default rates three to five times higher in a downturn,"”

If you haven’t read our earlier article on the knock on effect to the broader Australian economy, you need to. Here it is again.