“Wile E. Coyote” Moment is Close

News

|

Posted 28/01/2021

|

9832

Maybe one of the best visual analogies you will see around current financial markets came via Raoul Pal recently writing for GMI’s Macro Insiders talking to Road Runner’s infamous coyote running off the cliff, legs still spinning…

“Risk on” is the current trade, made with reckless abandon, legs-a-spinning, with no fundamental support beneath it. Pal writes to the escalation of COVID at a rate that will make things much much worse before any benefit of vaccines can impact it, and more particularly the serious economic impact this will have. Just yesterday we saw the figures of 100,000 deaths in the UK, 2m worldwide, and 100m cases worldwide. GMI’s models, excellent to date, are forecasting 200m cases by the end of April and 4m deaths. Such is the exponential nature of this virus. Whether you ‘believe in it’ or not doesn’t matter, the economic impact on the government responses is what we are talking to today. From Pal:

“There will be no choice but for Biden to try and impose much stricter measures in the US and force as much of the country as possible into lockdown. He fought the election on this and he needs to buy time for the vaccine to be rolled out or the virus will accelerate with the new UK strain.

In case you didn’t get what I’m saying, or skim-read it, let me reiterate:

Our estimates show that in the NEXT THREE MONTHS the world is probably going to DOUBLE the number of deaths from Covid accumulated during the entire last TWELVE MONTHS!”

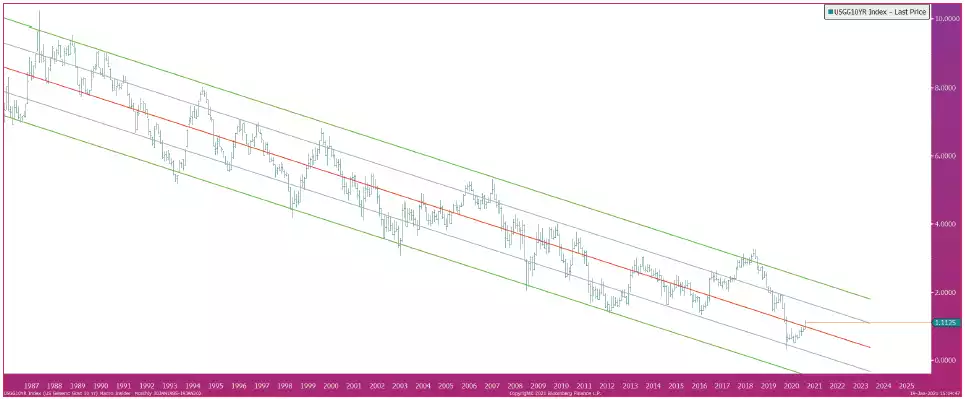

Out of respect to paid subscribers we will look at just two of the key indicators he is seeing as signs of a major correction / crash coming up. First, the “Chart of Truth” as he calls the 10 year Treasuries yields has clearly not bottomed in the regression channel, which it does in every cycle after a top. That tells us rates are headed to zero and of course real rates even more negative (we discussed gold’s correlation here). So whilst we have been seeing yields rising in this risk-on market, history and the ‘smartest market’, the bond market, is telling us this won’t last.

However even the guy who made that amazing bond market call in the last cycle and calls them the ‘financial truth’ is more concerned by one thing:

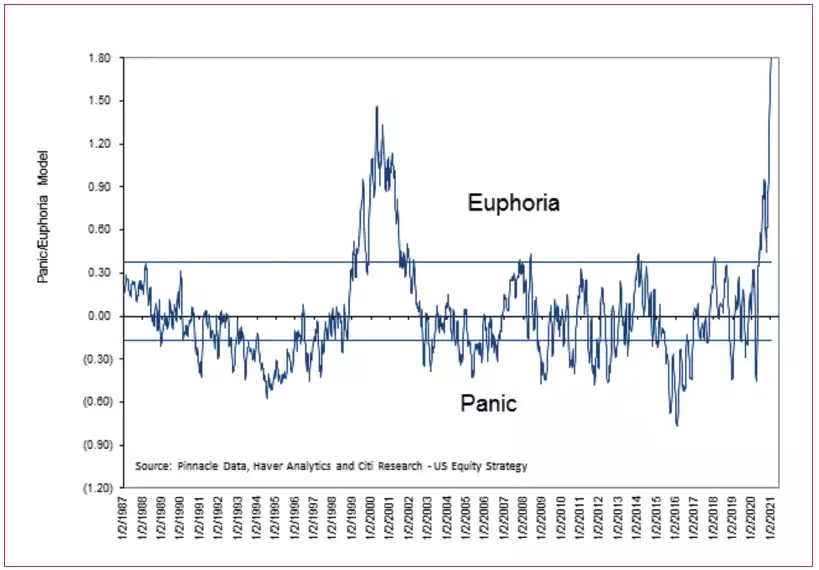

“But the thing that really worries me, is not the bond market but the equity market, which is now in clear bubble territory. Euphoria is all-time record highs...”

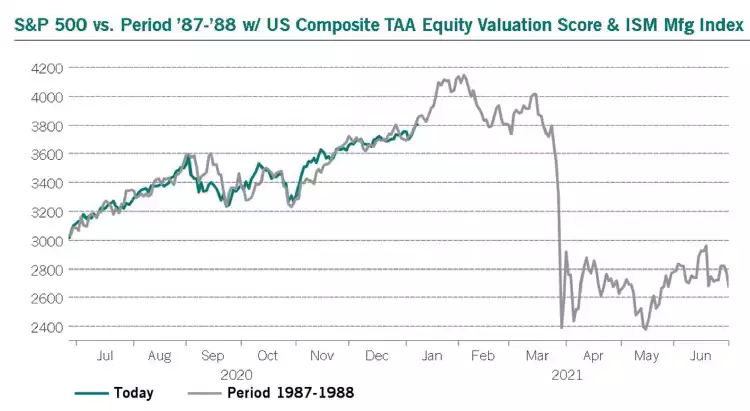

What is clear however is that even one of the greatest minds like Pal can’t pick the top. He is torn between a further final surge, when comparing to 1987, and an imminent crash. The following chart compares now to the behaviour before the 1987 crash:

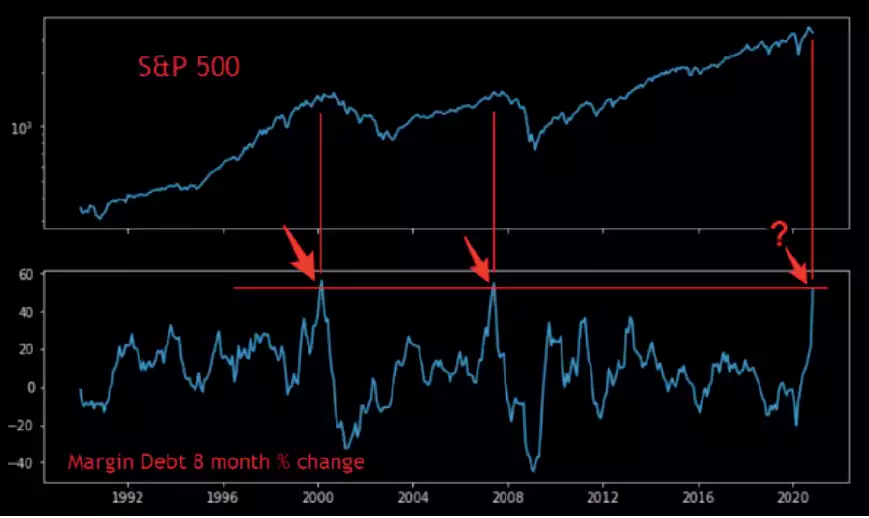

So ‘all in’ are markets that we have Mutual Funds carrying the lowest level of cash in all history and not surprisingly margin debt is at all time highs.

“I’m getting very concerned that the stock and bond market are about to have a Wile E. Coyote moment where the market reverses the positions rapidly. I’m not sure if the big move comes yet or in a few weeks, but it feels like it’s coming. The 1987 parallel suggests it might come after a new push higher.

I just don’t know.”

So what does all this mean for markets and gold?

“Well, the Fed step in to print and the government steps up the urgency of massive fiscal stimulus. Bond yields will fall in that scenario (low growth plus Fed buying) and the Fed will likely pin them lower with yield curve control.

That much printing will cause gold to rise again (falling bond yields help massively) ...”

“Gold is in a channel, which I expect to break to the upside in due course...”

“And a new high in Gold would be a MASSIVE break of the largest bullish cup-and-handle pattern in Gold’s history... this would create a mega trend for Gold...”

In conclusion he writes:

“Remember:

• If I’m right and we have another deflation and growth scare, the answer is more printing and BTC and Gold go up.

• If I’m wrong and we have inflation, the outcome will be BTC and Gold rising.

But overall, I think the deflation scare is more powerful, even if Gold and BTC get hit in a liquidation for a short period.

Investors know that the outcome for a liquidation event is much higher prices in Gold and BTC and with institutions on the bid, the chances of a sharp hit like in March is much, much lower than people realise.”

To clarify his last point, in March last year we saw gold, silver Bitcoin, indeed everything bar the USD get liquidated as the surprise and unknown event of COVID saw essentially all markets crash as everyone went to cash in fear. Simplistically, COVID was an ‘unknown unknown’ (to channel Rumsfeld’s famous analogy). This next event is most certainly a known unknown, and indeed arguably a known known with unknown timing. Any broad liquidation event hitting precious metals and crypto will likely be very short lived as the big money will go to gold, silver and Bitcoin quickly in the knowledge of what the implications are, spelt out above.

Whilst ‘blind Freddy’ can see this set up, markets have a habit of being wilfully blind on a narrative of ‘this time is different’. It never is.

Read into it as you want, but last night 2 of the better minds out there Tweeted the warning below…