“The dollar is our currency, but it’s your problem”

News

|

Posted 29/03/2021

|

9021

As we sit here amongst the highest global debt pile in history there as yet appears no solution in sight. We often remind readers there are just 3 ways to deal with such a pile of debt… 1. Pay it off with increased economic growth and taxes, 2. Inflate it away with increased inflation, or 3. Default.

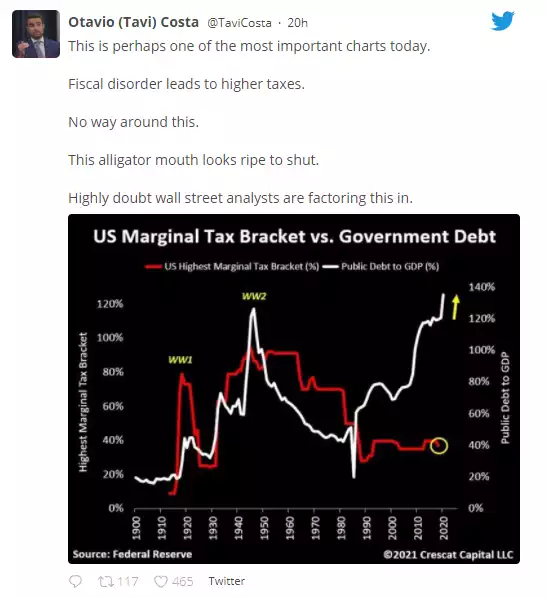

Such is the sheer magnitude of the debt and such is the low economic growth and fundamental demographic and technological changes afoot that option 1. is nigh-on impossible. That is from a growth perspective and modern politics means that tax hikes large enough to make a dent are unlikely and their likely flow on effects disastrous regardless anyway… On the latter point, Crescat’s Otavio Costa tweeted about the historic anomaly before us…

You will see above the last time debt got to these levels was to pay for World War 2. The difference of course is they put taxes up accordingly and the post war period heralded a boom in the economy as the world rebuilt. However as much as growth helped, it was the debasement of the US dollar that really did the trick with the final kicker of course being the massive inflation blow-off of the 70’s that saw rates in the mid and high teens. At the completion of WWII, the debt to GDP rate was 118% compared to the current 130%. By 1981 that debt to GDP reached just 31%. And yet the official CPI figures show that the basket of goods worth $1 in 1946, took $5.16 to buy at the end of 1981. Put simply the USD lost 81% thanks to the inflationary actions of the Fed and US Treasury.

When the world saw this playing out, and the USD was backed by gold, not surprisingly they started taking the gold in lieu of the debased dollars. To stop this flow, President Nixon ended the convertibility of the USD for gold (and hence the gold standard) in 1971. The USD officially went full Fiat, backed by nothing but the promise of the US Government. In a brief but insightful quip by the then US Treasury Secretary John Connally to the G-10 in Rome in 1971, he arrogantly said to the world’s leaders:

“The dollar is our currency, but it’s your problem”

From that time to 1980 gold surged from the pegged $35 to its ‘natural’ $800.

And so here we are in 2021. We have the uber dovish Mr Powell in charge of the Fed and his equally uber dovish Fed predecessor, Ms Yellen, now the US Treasury Secretary in a Democrat administration. What a double act…

The problem is we don’t have the sort of economic setup of a post war economy. That era saw a hard end to something that required enormous rebuilding. Now we have (and another Qld lockdown announced as this is written) wave after wave of COVID lockdowns and broader effects. Even a ‘full recovery’ would take us back to what was a weak economy and people are forgetting base effects when looking at strong GDP prints (big % on small base is still relatively small). On top of this we have the opposite demographic setup (aging population now, not booming), and we have a digital disruption era that is removing not adding jobs, expedited by the life changing habits and outcomes of COVID. With the advent of QE and the (lack of) tax income depicted in the above chart, we also have the ‘stimulus’ actions from both Fed and US Treasury actually ADDING MORE DEBT to fix a debt problem.

And so going back to those 3 means of reducing debt above…. Rampant inflation = gold wins. Default = gold wins. If you think we are going to ‘grow’ our way out of this…. Well, best of luck.