“Sell Everything” v Buying Gold & Silver

News

|

Posted 13/01/2016

|

6657

RBS (Royal Bank of Scotland) yesterday advised clients to brace for a “cataclysmic year” and to “Sell everything except high quality bonds. This is about return of capital, not return on capital. In a crowded hall, exit doors are small.”…. “China has set off a major correction and it is going to snowball. Equities and credit have become very dangerous, and we have hardly even begun to retrace the ‘Goldilocks love-in’ of the last two years,”

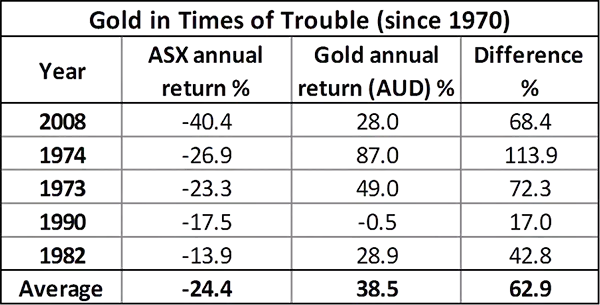

Let’s be clear, we are not advisors, we just present facts and ask the salient questions. RBS and some others may think gold and silver will go down with the rest when this next crisis hits. But let’s look at this a bit closer… RBS suggest holding bonds (debt instruments) in what is largely speculated to be a debt/credit instigated crisis….go figure. They may, like some others, think the scale and scope of the ensuing liquidity squeeze will see “everything” sold in the mad panic. That well may be the case on some significant scale but we can’t escape the fact that there are (in the order of) $295 trillion of financial ‘paper’ assets around the world (shares, ETFs, bonds, etc). When or just before that market collapses, a significant proportion of it will still be liquid and still be looking for a safe haven home. Throughout history physical gold and silver have been that tried and tested home. The total tradeable gold market is estimated at $1.5 trillion. RBS talk of the “small exit doors”, but it is the small size of the gold ‘room’ on the other side that means even a modest amount of that massive $295t trying to get into that little $1.5t space should only have one impact on price. It’s the law of supply and demand. Gold rising 3.1% (US spot, in AUD it was up 9.3%) this year whilst sharemarkets around the world saw double digit, record breaking losses is case in point, but only in part. The real action hasn’t started yet. We include the following very telling table again as a reminder of the past.

Speaking of supply and demand RBS also predict $16 oil (which dropped below $30 last night for the first time since 2003) and UBS have it at $20. The economic bellwether Dr Copper slipped to GFC lows last night of just $1.99. Incredible stuff. China’s woes indicate a similar continuing plight for iron ore. The outlook for Australia is getting dimmer. That means our dollar is likely to fall further (combined with likely continuing yuan devaluations) and that is music to precious metals holders’ ears.