“Real Assets” Never Been This Cheap

News

|

Posted 22/02/2017

|

7209

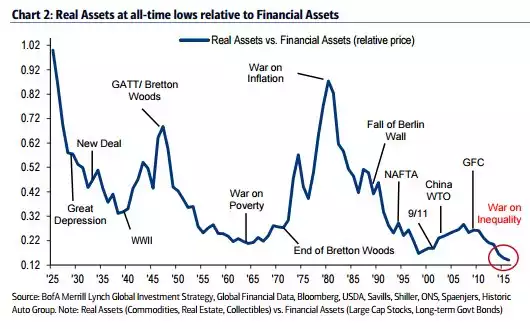

Our article yesterday outlined a world of financial assets inflated by years of unprecedented monetary stimulus that the author believes cannot survive without more stimulus. Gold and silver, on the other hand, are ‘real’ or ‘hard’ assets, not financial assets. The chart below maps nearly 100 years of the ratio between the two. Never before have real assets been so undervalued relative to financial assets.

Looking at the chart above you can see that the previous lows preceded the last 2 big rallies in gold and silver. The authors, BofA Merrill Lynch, when they released it in October last year (so it would now be even lower) had this to say:

“Policy, profit and positioning trends all argue for rotation from deflation to inflation, from ‘ZIRP [zero interest-rate policy ] winners’ to ‘ZIRP losers’, from Wall Street to Main Street. As part of this rotation we expect real assets to outperform financial assets,”

Since then Trump pulled off the unthinkable and the War on Inequality became a whole lot more real.

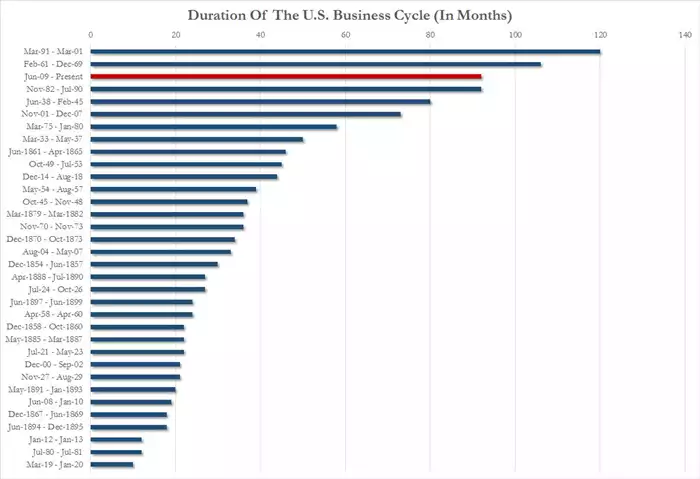

But how much longer can financial assets rally is the key question in that equation. The chart below puts into perspective the current cycle v previous…

What an extraordinary time we are living in now… We have as many headlines shouting there is still more to go in shares and property as those calling an imminent crash. A scan back of our daily article titles would have you think we are convinced the crash is imminent and you should run to gold as quick as you can. But as a seller of gold we’d like to think we go to more lengths than most to remind you that we simply don’t know! Our news articles just ensure you have your eyes wide open to the downside as human nature sees most people piling in to a bull market at the end. We preach balance in the absence of certainty.

We also implore you to step back and look at the multitude of charts, ratios and other metrics available to you now that tell you where we are historically. As long as you don’t fall into the trap of ‘this time is different’, this practice allows you to make an informed decision away from a self interested broker, real estate agent, or for that matter, a bullion dealer. Your gut will guide you or at least get you to ask the pertinent questions. The charts above must surely be one of those ‘step back and look’ opportunities.