“One of the best investments for 2018”

News

|

Posted 15/01/2018

|

7320

Welcome to 2018! Many are calling this as an historic year for both traditional and the ‘new’ crypto markets. One thing is for sure… none of them really KNOW and that is why balance, now more than ever, is a prudent investment philosophy to employ.

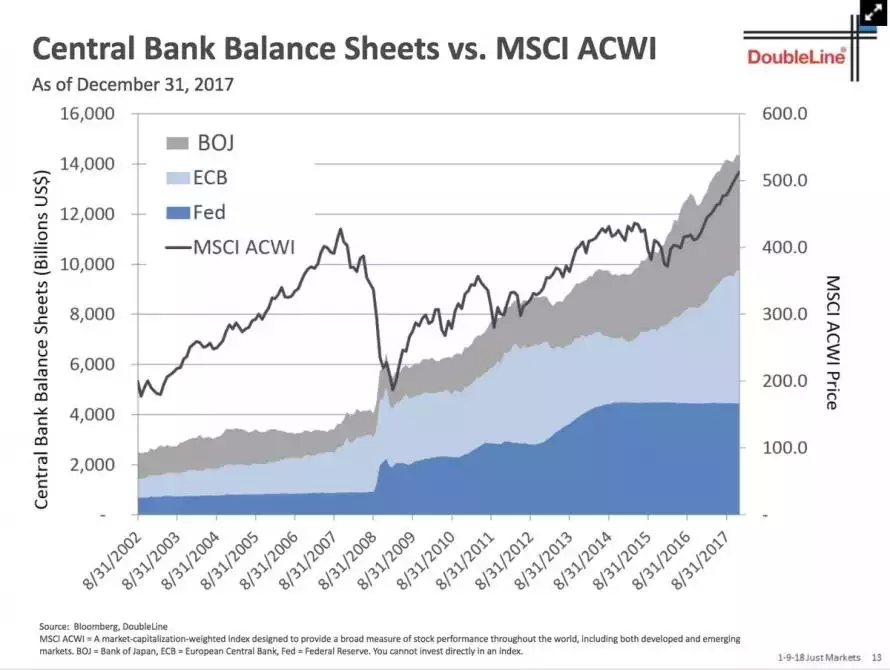

“Bond King”, billionaire and head of hedge fund DoubleLine, Jeffrey Gundlach, probably knows better than most and last week he gave an update presentation to investors. His view is that we are now in the “accelerating phase” for shares and 2018 will see the reversal of that as the catalyst for this extraordinary bull market, central bank stimulus, reverses. He’s calling a lower S&P500 and bond prices as yields rise. Per the chart below you can see (again) the correlation between central bank balance sheets and the global share index MSCI.

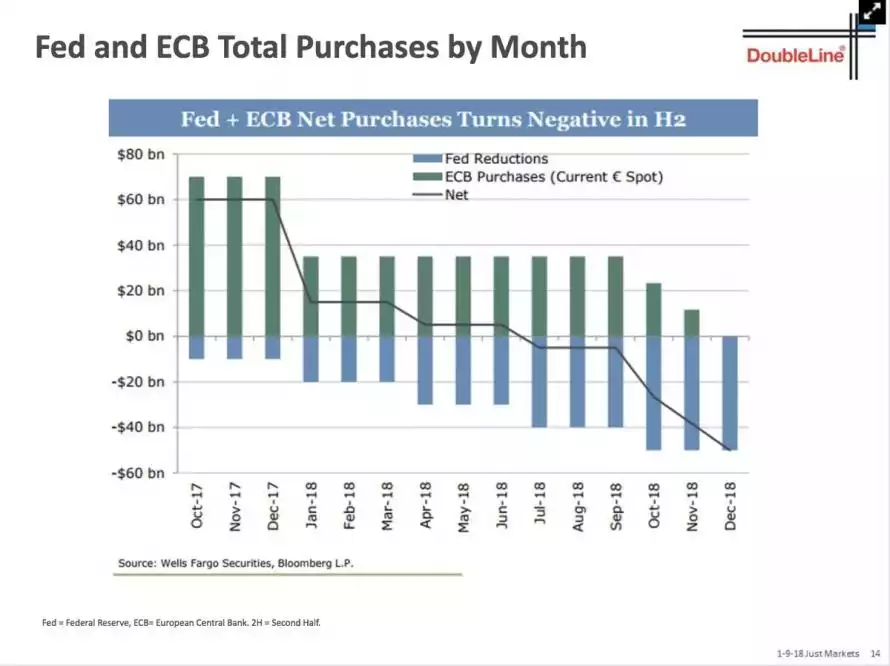

He believes the flagged shrinkage of central bank balance sheets by the US’s Fed and Euro’s ECB is not fully priced in and published the chart below showing that, come June this year, we reach what he calls the point of “shrinkage”…

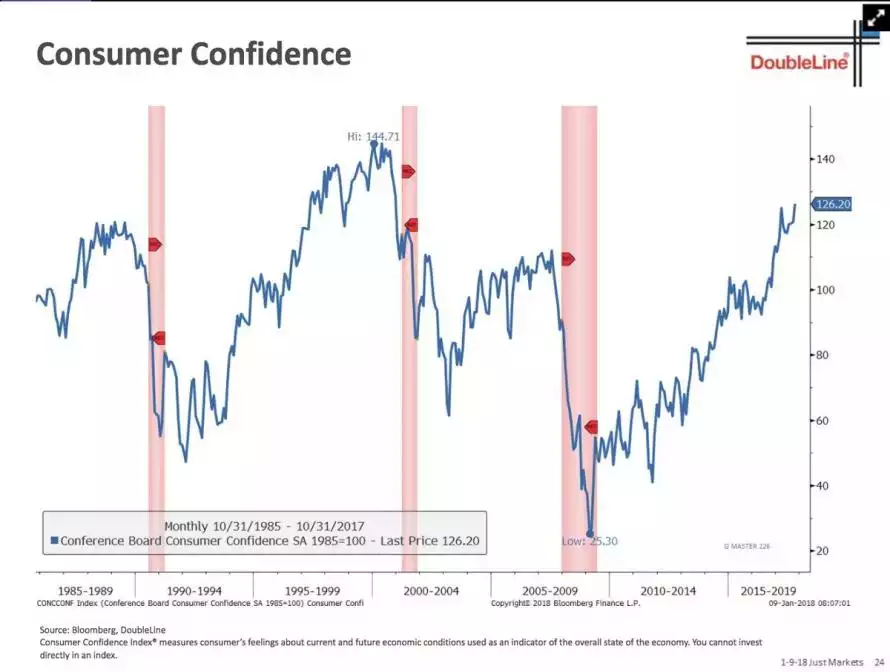

Consumer confidence is super high and surging, everything is clearly awesome and nothing could go wrong…(the red bands are previous recessions).

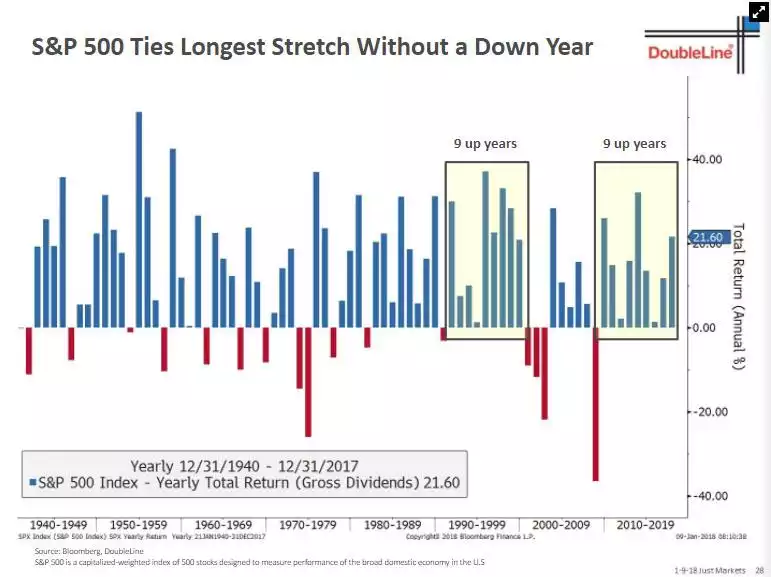

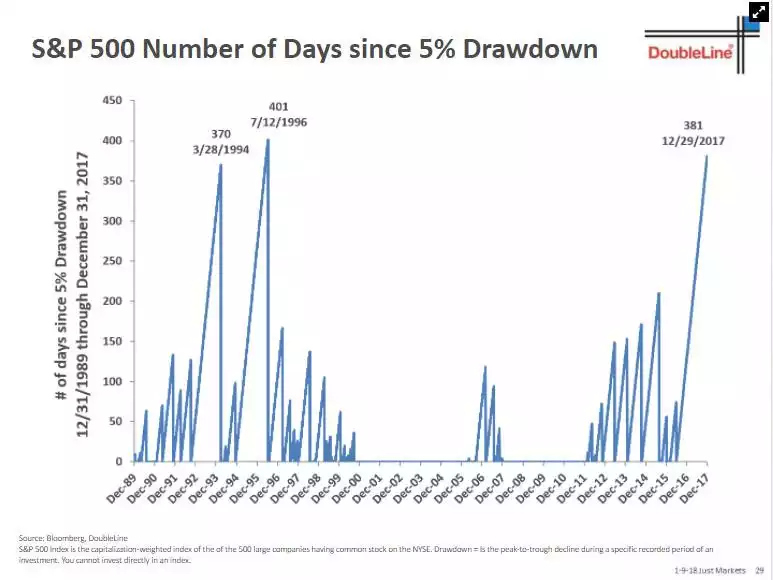

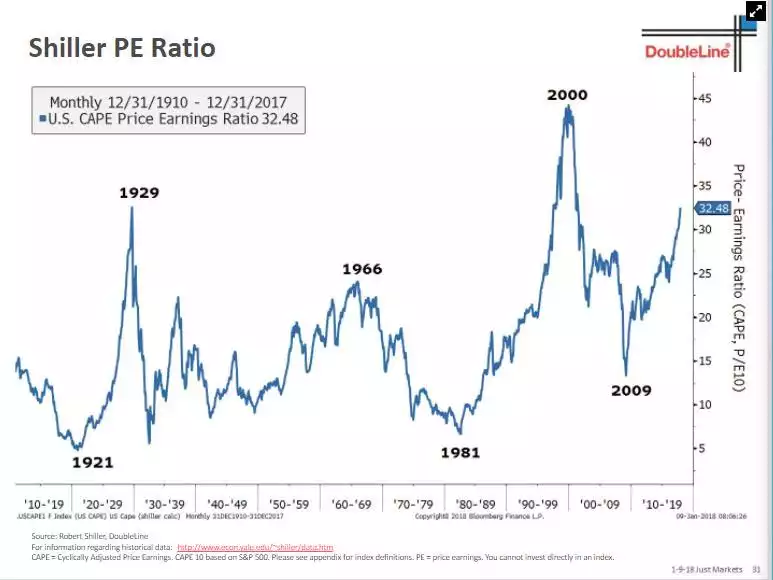

However he is not necessarily worried about a recession this year and seems to think we have a little more than 2018 to go for that. His concerns principally centre around shares and bonds, leaving room for gold to potentially enjoy the double whammy of a financial market correction and higher inflation. The charts below remind us just how low long this relaxed market has been pumping…

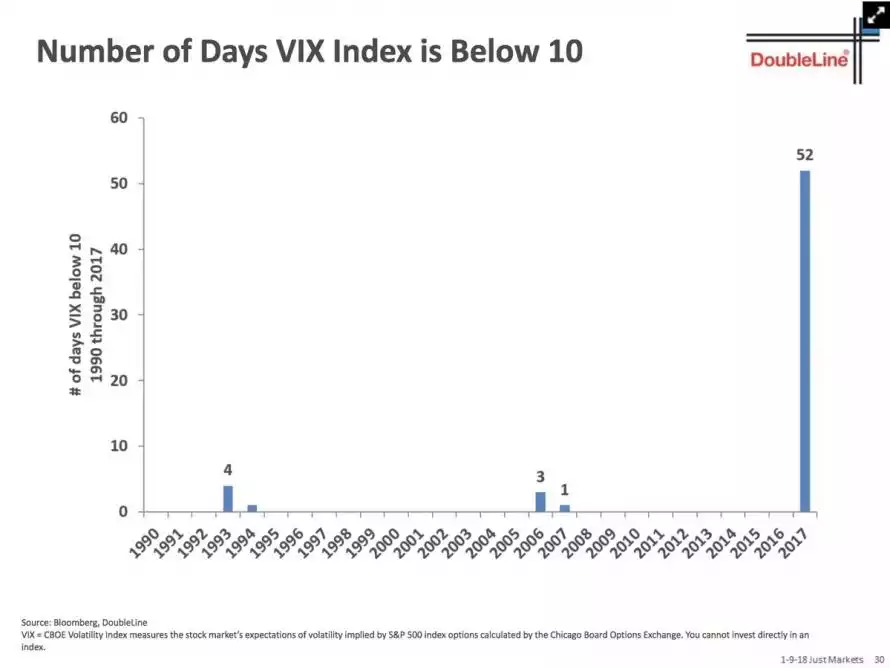

And the following quite extraordinary chart he borrowed from Citi showing the unprecedented number of VIX (volatility index) days with a sub-10 close in a rolling 6 month window.

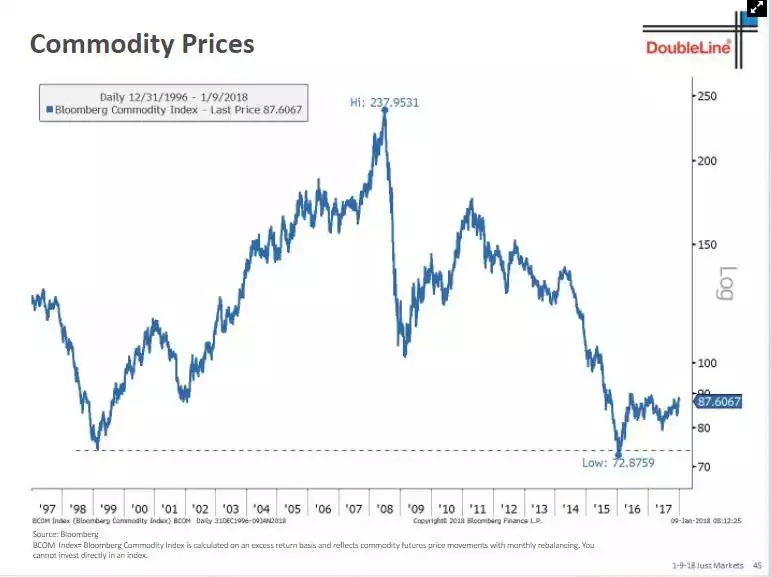

The third very supportive dynamic for gold this year is his very bullish view on the broader commodities complex coming off its lows. He stated "one of the best investments for 2018 will be commodities"...

On gold specifically, Gundlach has on a previous occasion said:

"gold remains the best investment amid fears of instability in the European Union and prolonged global stagnation, as well as concerns over the effectiveness of central bank policies…. Things are shaky and feeling dangerous…. I am not selling gold.”