“Eye Popping” Corporate Bond Ratings Warning

News

|

Posted 22/10/2019

|

14820

Time and time again the warning signs of the corporate bond market being the potential catalyst for the popping of this bubble emerge. One of the key lessons from the GFC was the ratings agencies (ala Moodys, Standard & Poors, etc) having blatantly, arguably criminally, over rating the junk bundled debt CDO’s until it was too late. Whilst they got raked over the coals for this afterwards it appears old habits die hard and the Wall Street Journal just ran an article exposing similar practices at large again, this time in the corporate bonds market.

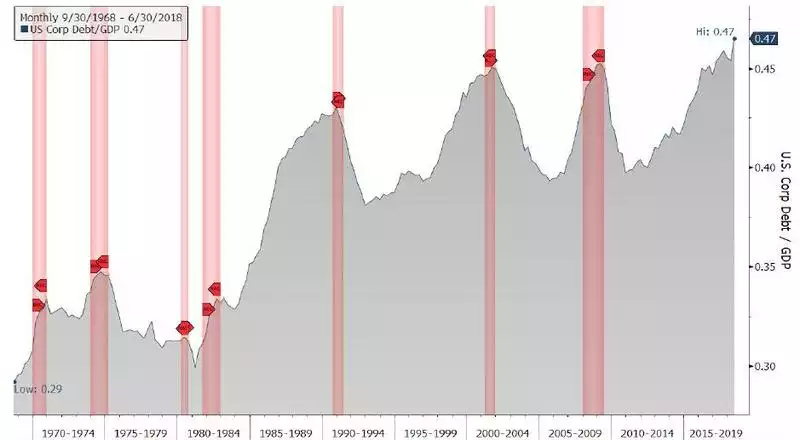

As a reminder from our last article on this, non financial corporate debt in the US has increased nearly $4 trillion (66%!) since the GFC to a record $10 trillion. In real terms against GDP that corporate debt is still a new record high:

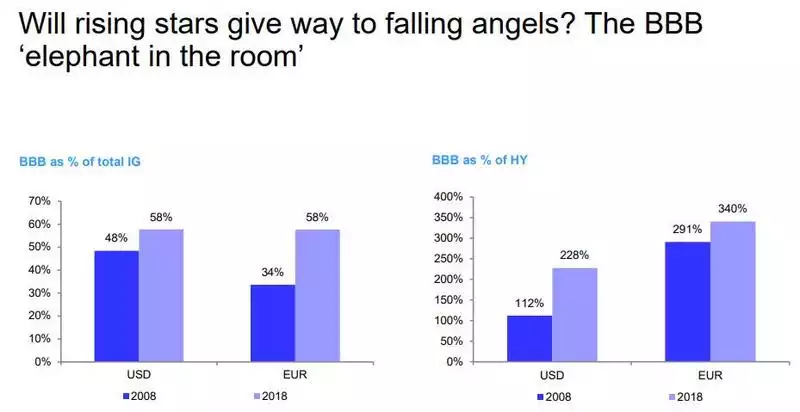

And yet the real danger is not so much the quantum but the quality, and it is the assessment of the quality that these ratings agencies have responsibility for. BBB is the lowest rating of an Investment Grade (IG) bond before it becomes Junk. The charts below illustrate the huge increase in BBB rated bonds both in the US and Europe. These lowest rated bonds account for nearly 60% of the entire IG market.

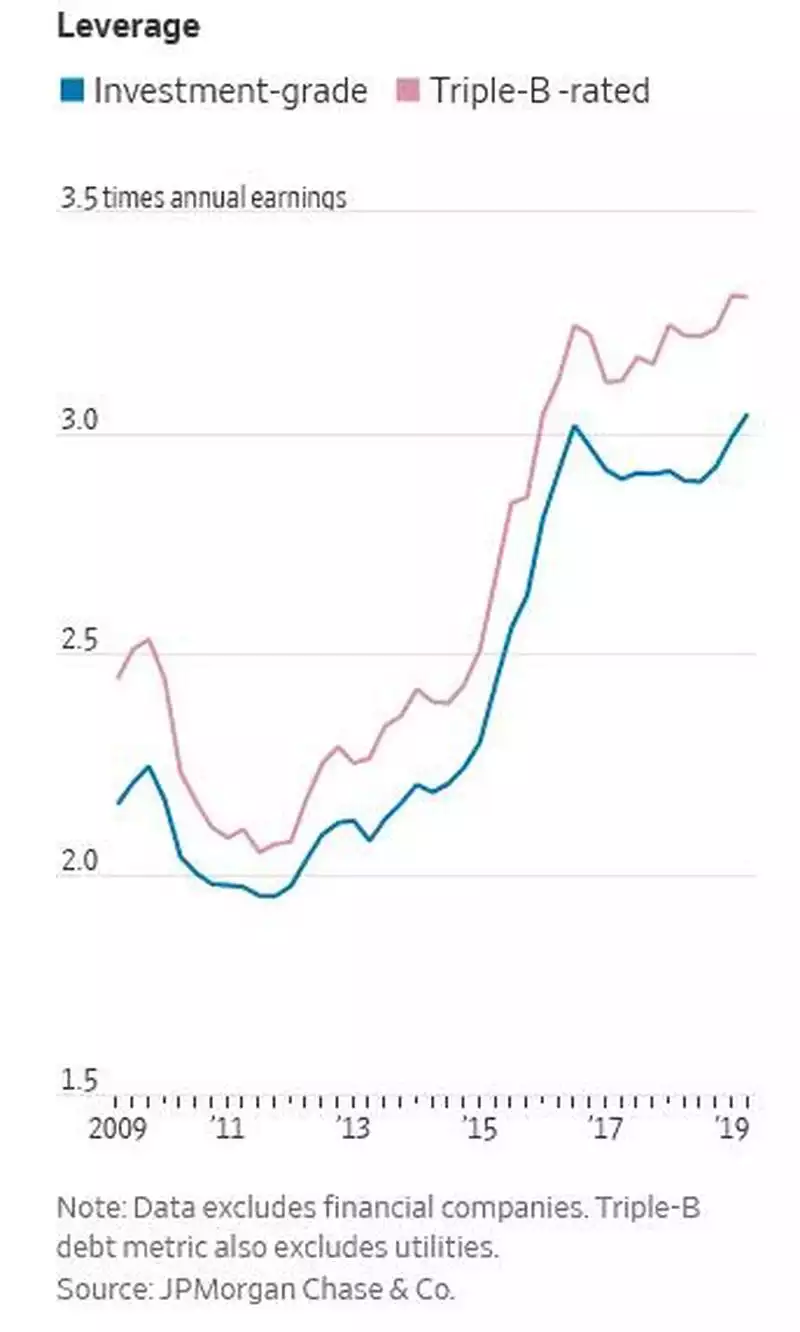

So yes the percentage of lowest quality bonds is huge but that tells only half the story. It’s the definition of quality that is the real concern, the responsibility of these ratings agencies, and the thrust of the WSJ article. Clearly, the amount of leverage is a critical factor in the quality of these bonds. We touched on this yesterday where we showed the highest spike in S&P500 company leverage since 2005 and with much of this used to buy back shares and inflate share prices. The chart below shows the “eye popping” increase in leverage since the GFC, some 50% higher for BBB….

From the WSJ:

“"It’s pretty eye-popping if you’ve been doing this for 20-plus years, to see how much more leverage a number of these companies can incur with the same credit rating," said Greg Haendel, a portfolio manager at Tortoise in Los Angeles overseeing about $1 billion in corporate bonds. “There’s definitely some ratings inflation."”

Of course a 50% increase in those leverages is hardly “some” but everyone knows now that the ratings agencies have become trapped in their own lie. To downgrade all this corporate debt to a more appropriate Junk rating would of course likely trigger a crash that everyone is trying to avoid. GFC redux.

Some analysts and concerned fund managers have not been quiet though, and have warned the SEC of the repercussions of this going unchecked. Again from the WSJ article:

“Last October, Adam Richmond, Morgan Stanley’s then head of U.S. credit strategy, testified at an SEC hearing that if leverage were the sole criteria for ratings, many triple-B rated companies wouldn’t qualify for such high grades. He warned that “downgrade activity could be heavy” once the economy inevitably weakens. The firm’s analysts wrote in a September report that investment-grade companies “have not de-levered significantly and are still getting credit for assumed earnings growth, integration of acquisitions, and other ‘plans’ to delever.”

JPMorgan raised similar concerns in a report it submitted to a bond-investor advisory committee at the SEC. In February, the committee created a new group to examine credit ratings and potentially recommend new regulations to boost oversight of the industry, according to people familiar with the group”

The sheer scale and implications of any action either way on this has everyone frozen. But like all the central bank stimulus, the longer this fixation to inflate the bubble further at all costs continues, the bigger the pop. At $10 trillion, the US corporate debt bubble absolutely dwarves the $1.5 trillion sub prime CDOs bubble.