“Buy This Dip” – Tocqueville

News

|

Posted 11/10/2019

|

11694

The Tocqueville Gold Strategy Investor Letters are a widely and highly regarded quarterly which we often share verbatim. The latest, the Q319 version, urges their readers to buy this correction in the gold price and outlines why. Authored by John Hathaway, it is a succinct summary of where we are now.

“Buy This Dip

Following a strong first eight months of the year, the precious-metals complex may be in the process of offering investors one final chance to enter on attractive terms before lurking systemic risks erupt into breakaway price action. Year-to-date through September 30, 2019, gold prices rose 14.8% but fell 5.2% from peak levels in late August. Standard technical analysis suggests that bullion prices may revisit the 200-day moving average currently at $1,360, which is down 7.6% from the month-end close of $1,472 to shatter investor confidence that was just beginning to find some legs following a six-year nuclear winter of non-performance. This would make sense, based on excessively bullish sentiment, overbought RSI’s, Fibonacci retracements, head-and-shoulders breakdown, and the rest of the usual array of technical analysis.

Myopic attention to trading conventions aside, there is a much bigger picture on which to focus. Systemic risks have yet to trigger an appropriate market response, but those risks seem to be advancing from a simmer to a low boil. Question: What, where, and when is the tipping point? Answer: Timing is always devilishly complicated; still, warning signs and red flags proliferate. The debris field of mishaps, sudden policy shifts, dubious explanations, and ambiguous to bad economic data seems to expand daily. The bigger picture suggests to us that the established financial order may be on track for destinations unknown.

Warning #1: The global economy appears headed for recession. If so, the US fiscal deficit for 2020 could exceed expectations by 30%-50%. That would not do wonders for the greenback’s credit rating. A trade deal with China, should one be achieved, seems more likely to reveal American weakness and lack credibility with investors than to be the miracle cure-all for economic doldrums. Business investment, supposedly paralyzed over trade uncertainty, will most likely remain in suspension pending the outcome of the 2020 US election, which now appears to contain high risk of tax-code changes that would far outweigh uncertainties over any China deal. Consumer spending, the vaunted backbone of US economic strength, appears to be wilting.

Warning #2: Monetary policy looks to be in disarray. Emergency repo facilities, recently launched to contain unruly short-term rates, give off more than a whiff of smoke. Unconvincing explanations of technicalities and timing belie the fact that a growing federal deficit may be crowding private borrowing, even while demand for private credit slumps along with economic activity. The Fed balance sheet, supposedly in shrinkage a year ago, is now set to grow “organically.” Political badgering for still-lower rates and even more accommodation may be in contravention of the laws of supply and demand. Lower nominal yields risk undercutting demand for “safe” short-term US issuance because skinny rates don’t cover currency hedging costs.

Warning #3: Negative nominal yields on $15, $16, or $17 trillion of global sovereign debt (does the precise number really matter?) suggest potential for capital losses that will dwarf those of the 2008 toxic mortgage crisis. Who is buying this stuff? The official sector, banks, and, sadly, regulated entities such as pension funds stand to lose when interest rates rise.

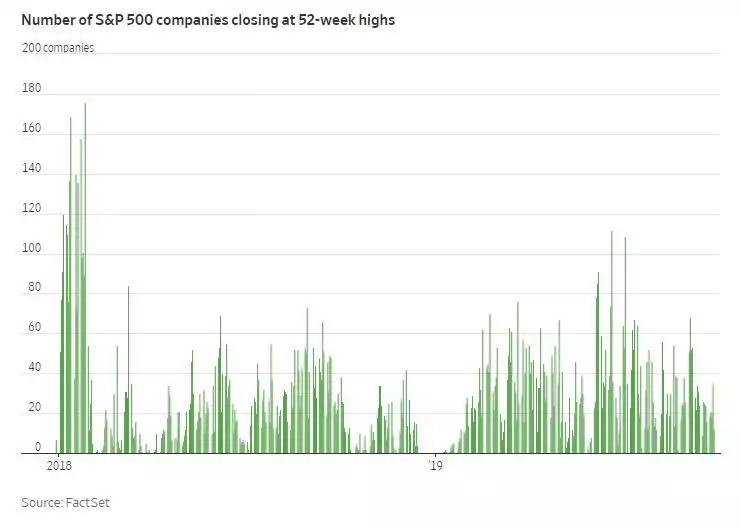

Warning #4: Market breadth continues to narrow, while averages hover near all-time highs, disguising underlying across-the-board weakness. This scenario echoes the “nifty fifties” saga of the 1970’s. Then, major institutions continued to buy a handful, 50 or so, of popular large-cap growth stocks identified by Morgan Guaranty, such as Polaroid, Eastman Kodak, Simplicity Pattern, and Digital Equipment. The battle cry of the day was to invest in “growth at any price” for companies that were deemed to be “one-decision” or “desert-island” stocks that could be held forever, because no matter how overpriced, investors would ultimately be bailed out by steady growth. Many of them crashed, along with the market averages during the recession of 1974-75. More than a few simply disappeared.

Fewer Stocks Are Participating in the Rally

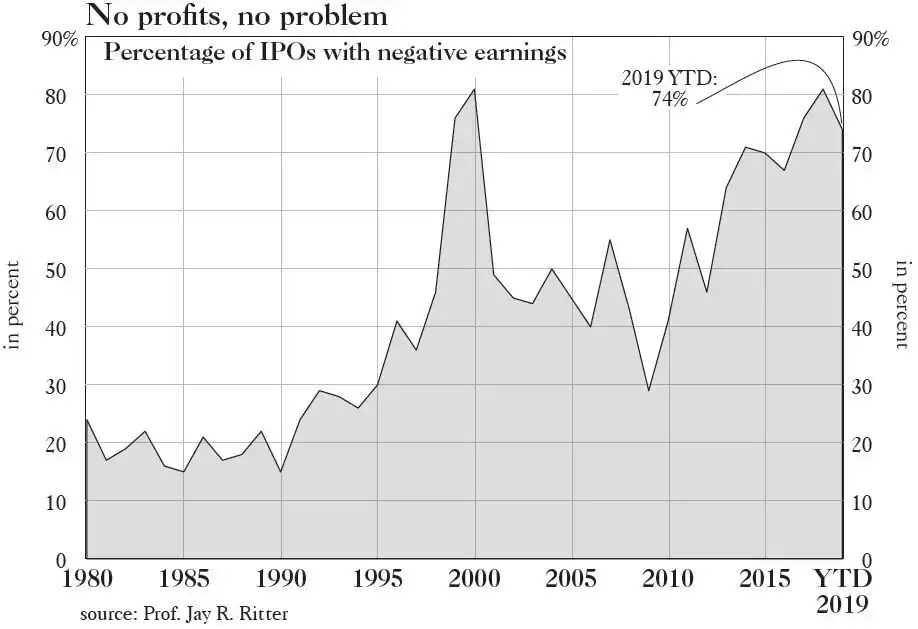

Warning #5: The percentage of IPOs with negative earnings year to date is 74%, a level previously scaled only by the 81% of 2018 and in the 2000 prelude to the dot-com crash:

Warning #6: Important investment luminaries – Ray Dalio of Bridgewater, who predicts a “coming paradigm shift,” and Rick Rieder, Blackrock CIO of Global Fixed Income, who recently discussed implications of a possible “monetary policy endgame” (to name only two of many), are turning to gold as a strategic solution. In our conversations with numerous investment professionals on the topic, we generally find that an understanding the investment case for gold does not translate into action on behalf of their clients. Why? Gold has become the third rail of investment ideas and represents career risk for any investment manager who fails to beat benchmarks because of metal exposure. For that reason, gold is episodically underweighted by professional managers and retail investors of all stripes ranging from high net worth to “moms and pops”. Antipathy to the investment theme seems to stem from possibility of success that could undercut mainstream thinking. If you underperform because of gold exposure, you could lose your job. On the other hand, if you lose money in FAANG stocks or other crowd favorites, you are safe from criticism. In our opinion, investor revulsion is a perfect setup for a powerful bull market.

Warning #7: The fractious US political climate cannot be ignored in the calculus for gold. If it worsens leading into the 2020 presidential election, we believe partisan discord could destabilize financial markets and further dampen economic activity. Think Watergate.

Conclusion

Since 2011, gold has lagged both equities and fixed income, which trade at all-time highs in terms of price and valuation. In our view, the secular forces that caused this to happen are near exhaustion. The piling-on of ever more public- and private-sector debt, encouraged and enabled by central banks, appears to have reached the point of diminishing returns. In contrast, gold and related mining shares represent value, substantial upside, and an asymmetric risk proposition. Gold appears set to outperform financial assets.

Policymakers seem to be in a head-scratching mode. Despite record low interest rates and massive fiscal deficits, the traditional prescriptions to juice growth, the global economy seems to be slipping into recession. We could be at the threshold of even larger deficits and more radical monetary initiatives. Neither populist leaders nor their constituents will stand for belt-tightening or fiscal prudence.

Gold’s breakout from a six-year base in June of this year may have signaled a secular turning point for interest rates, inflation and hard assets in general. It seems quite plausible to us that it is gold’s turn to climb to record highs against the US dollar. It is already advancing in every currency, the definition of a gold bull market, and has summited to record highs against the AUD, CAD, EUR, GBP, and Yen. Famed non-gold bug economist David Rosenberg (Gluskin Sheff) recently stated that $3000 gold would not come as a surprise. It would certainly not surprise us.

In the weeks ahead, according to conventional technical analysis, the precious-metals complex may be due for a well-deserved rest, considering the torrid first eight months of 2019. We would guess another four to six weeks before an important bottom. However, we suggest that investors keep their eye on the big picture and take advantage of any possible near-term weakness to build exposure. This is a dip that needs to be bought.”