‘Greenspan Put’ Safety Net is Gone

News

|

Posted 23/10/2017

|

9544

Peter Schiff is renowned for some famous and very public calls on financial events. Most recently he was very vocal about the impending GFC in 2006 and 2007 before that crisis unfolded. Whilst there were a few, like now, that were sounding warnings just because markets were high, Peter was quite specific about the cause and effect… and he was bang on.

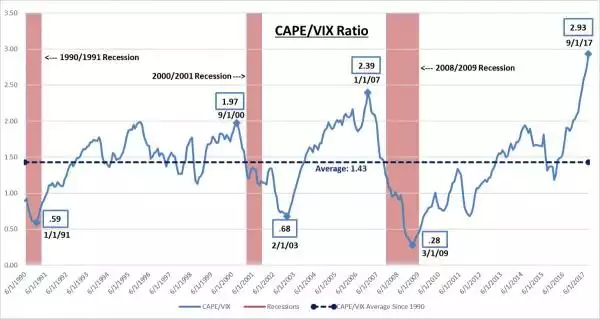

As we have written many times, this current market is notable for not just the high valuations on any number of measures, but it’s coincidence with incredibly low volatility (via the VIX). Indeed that relationship, as outlined by Schiff, is at an ALL TIME high.

“This means that the gap between how expensive stocks have become and how little this increase concerns investors has never been wider. But history has shown that bad things can happen after periods in which fear takes a back seat.”

Take a look at the following chart:

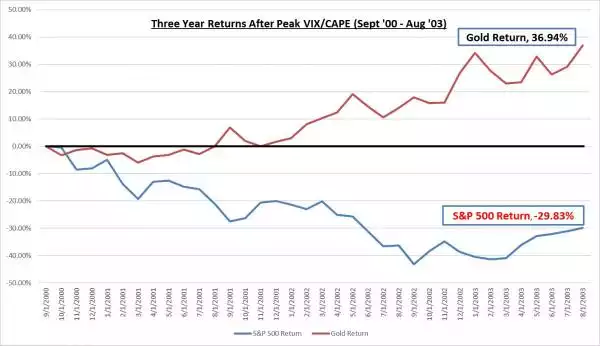

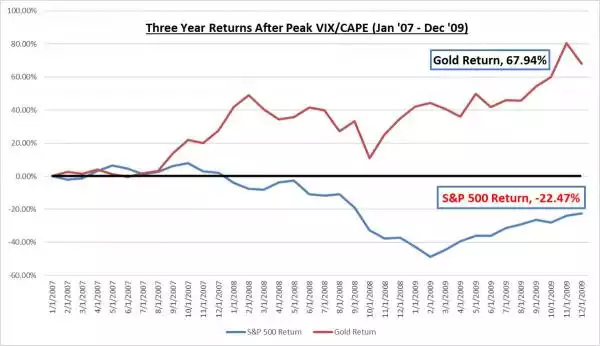

The reason? Schiff puts it squarely down to the undying belief by the market that the Fed will step in should there be any large market correction, just as they have done the last few times. Sharemarkets used to be widely understood as being risky and hence the VIX would (logically) rise alongside valuations. However after the 1987 crash we saw the now famous Greenspan Put where he said the Fed was at “its readiness to serve as a source of liquidity to support the economic and financial system” and lowered rates and flooded the market with cheaper money. That safety net was reinforced after the dot com crash when they slashed rates from 6% to 1% and then again after the GFC when they cut rates from 5% to nearly 0% PLUS launched the unprecedented Quantitative Easing program that saw them print $4.5t. Despite that stimulus the haul out of the crash for shares was slow. The charts below show what happened from each of the peaks of the chart above for shares and gold:

Those who sold their gold at its peak and bought underpriced shares have had a wonderful run since. In Australia, those who hung on to their shares have still not seen the pre GFC peak again.

But in essence all of the above is known by most people, it’s a history lesson. Where Schiff adds his views on going forward, and in the context of the biggest bubble in val v vix EVER, and the fact the Fed still has rates at just 1.25% and a $4.5 trillion balance sheet already from the last round of QE, is this:

“It should be clear to anyone that since the 1990s the Fed has inflated three stock market bubbles. As each of the prior two popped, the Fed inflated larger ones to mitigate the damage. The tendency to cushion the downside and to then provide enough extra liquidity to send stock prices back to new highs seems to have emboldened investors to downplay the risks and focus on the potential gains. This has been particularly true given that the Fed’s low interest rate policies have caused traditionally conservative bond investors to seek higher returns in stocks. Without the Fed’s safety net, many of these investors perhaps would not be willing to walk this high wire.

But investors may be over-estimating the Fed's ability to blow up another bubble if the current one pops. Since this one is so large, the amount of stimulus required to inflate a larger one may produce the monetary equivalent of an overdose. It may be impossible to revive the markets without killing the dollar in the process. The currency crisis the Fed might unleash might prove more destructive to the economy than the repeat financial crisis it's hoping to avoid.

We believe the writing is clearly on the wall and all investors need do is read it. It’s not written in Sanskrit or Hieroglyphics, but about as plainly as the gods of finance can make it. Should the current mother-of-all bubbles pop, for investors and the Fed it won’t be third time’s the charm, but three strikes and you’re out.”

We’ve written a bit of late on the global loss of faith in the USD. What we think Schiff is saying is that the sheer amount of debasement (through printing so much more) of that currency that would be required to reflate the next crash would ultimately see any semblance of faith in it evaporate. A fiat currency is based on nothing but faith and the promise of a government and market bulls can only be so blind as to the real value of their financial assets.