Gold & Silver – the ‘each way bet’ right now?

News

|

Posted 16/04/2024

|

1406

The rout in U.S. shares continued overnight with the S&P500 down 1.2% (down 2.6% since Friday and finishing beneath its 50DMA for the first time in five months) and NASDAQ down 1.8% whilst bonds continued to fall (yields rising) and the USD strengthened even further, its biggest 4-day gain in a year and its highest since November 2023. Despite the usual inverse correlation with the USD, gold too surged another 1.7% back up to US$2385. The lower AUD saw Aussies enjoy a stronger 2% increase overnight with gold now at $3700/oz in AUD terms and silver at $44.90/oz. Obviously the rumblings of war are playing a big part in this, but the cause is rooted deeper.

The market’s obsession with Fed rate cuts continues. Last night saw a whipsaw with a much worse than expected NY Fed Manufacturing survey (-14.3 v -7.5 expected) but then a stronger retail sales print than expected (+0.7% v 0.3% exp). But this then got overwhelmed by an Israeli official saying a retaliation on Iran was “imminent”. The latter saw both gold and oil surge with the ‘black gold’ adding to inflation concerns.

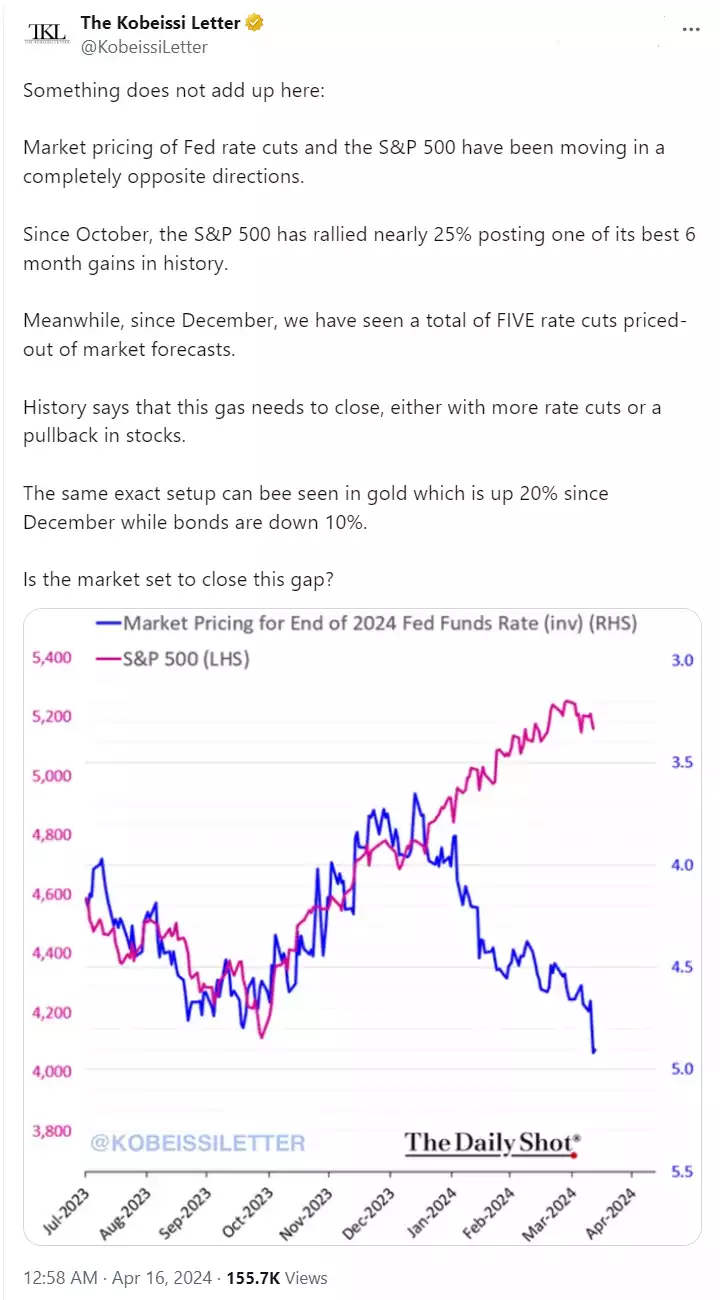

Whilst shares have come off robustly, there is still a huge disconnect between shares and rate expectations… (note typo of gas > gap)

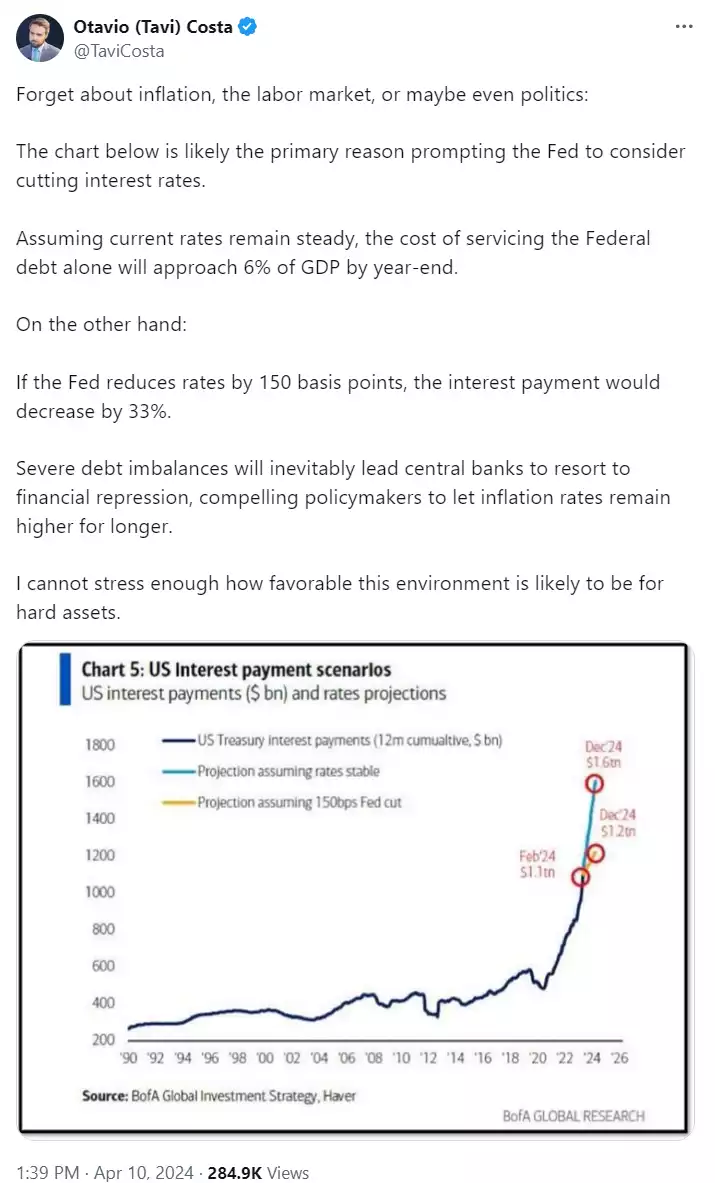

Whilst the case for tanking shares to close these ‘alligator jaws’ is strong, just as strong is the case for ‘they simply HAVE to cut rates’ as put forward by Crescat’s Tavi Costa in a recent tweet below:

And therein lies the very rare ‘each way bet’ that gold and silver present right now.

Sharemarkets crash amid the disconnect between rates/bonds and the market at the moment and gold’s normal safe haven, negative correlation comes to the fore and rises further as a chunk of the $300 trillion of financial assets tries to squeeze into the $2 trillion available gold market. You cannot expand the supply of gold and so that only leave price as the supply/price variable against surging demand.

Fed drops rates ‘prematurely’, and Global Liquidity surges, currency further debased, inflation untamed, stagflation ensues… gold surges as it most always does in such a macro setup. Throw in a war and it could be quite staggering.

A resurgent gold price then normally leads to a lagging but then spectacular silver rally. We have seen the Gold:Silver Ratio drop from mid 90’s to now (at time of writing) 82 indicating this could be starting now. A retracement of that ratio to the 30’s seen in 2011 would see a silver price of $123/oz even IF gold didn’t move another dollar higher, but they normally climb in tandem. For the mathematically challenged that is a 275% increase on the current price...