Yield Curve Sends a Warning

News

|

Posted 16/11/2017

|

6710

It was a rough night on Wall Street last night on the back of a raft of ‘everything is awesome’ shattering economic data. Another stronger than expected inflation print (CPI up 1.8%) saw gold and silver stronger and raised concerns of a December rate hike, but then we saw a post hurricane crash back to reality in retail sales (just 0.2%), the biggest drop in the Empire Fed survey in 7 months, and the 3rd straight month of declining real wages (a first in 5 years).

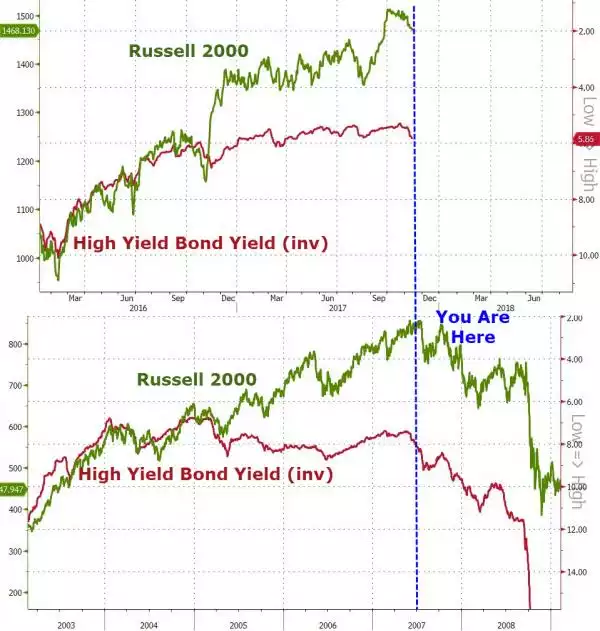

The S&P500 lost 0.55% which broke its 52 year record of the longest streak of sub 0.5% falls. We also saw the US Treasuries yield curve (explained here, and last discussed here) flatten to its lowest since the onset of the GFC in November 2007…

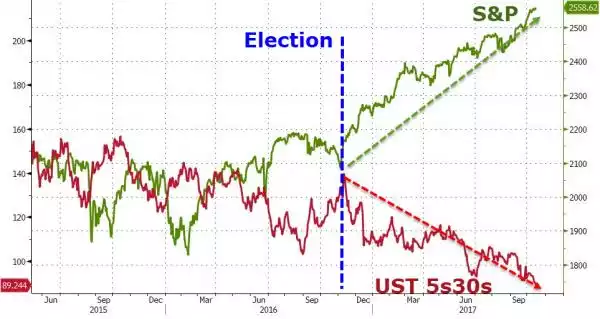

….and continuing the post ‘this time is different’ post Trump election anomaly:

Deutsche Bank has released their view on this and it highlights the absolutely precarious nature of the position the Fed (in particular, but central banks more generally) have put the market in and how very difficult it will be to manage us out without triggering a crash of epic proportions.

“The largest, and possibly, the only risk capable of resetting the vol higher is the tail risk associated with bear steepening of the curve and disorderly unwind of the bond trade. This is the risk that would be probably impossible to control, its trigger being either excessive deficit spending or inflation.

It is precisely the severity of this problem that prevents return of volatility. Current monetary policy is focused on the management of the underlying tail risk and the Fed transparency and gradual hikes are all about the reduced manoeuvring space that has remained after almost a decade of stimulus. Fed has an uncomfortable (and complicated) task in this context: Fed needs to raise rates in order to prevent rates rise. What must not be, cannot be: Inflation cannot be allowed to develop because it would be no way of avoiding dramatic rise in rates. If the Fed embarks on aggressive hikes in order to fight inflation, rates would rise. If the Fed stays behind the curve, the market would bear steepen the curve. Either way, the long rates go up.”

So watch these signs like we saw last night carefully around inflation, market ‘health’, and that all important yield curve’s response.

Below is an interesting (in that history is not always an accurate predictor of the future…) comparison of the current set up for the Russell 2000 (the small cap index, topical after our article this week) which shows how quickly that curve can steepen (noting it is an INVERSE of the curve illustrated) and the effects on financial markets…