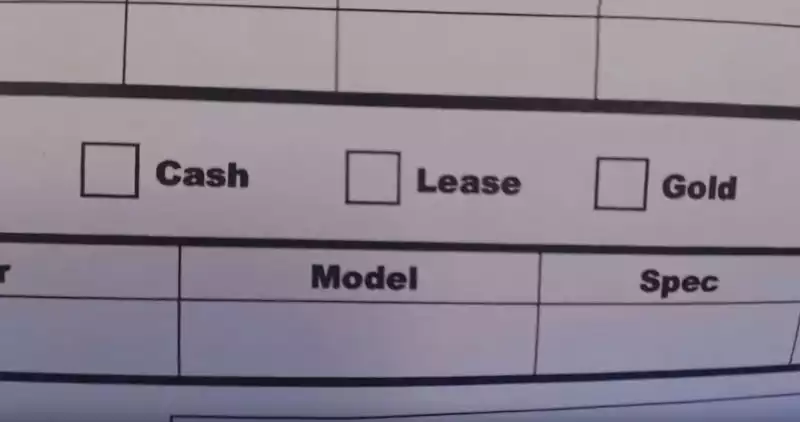

Will That Be Cash, Lease, Gold or Silver?

News

|

Posted 09/08/2016

|

5296

For something a little different, today we present a brief but interesting story sourced from Greg Hunter’s USA watchdog, a program that presents alternative news wrap-ups and hosts interviews with a variety of well known economic experts, traders and commentators. Recently, a member of the USA watchdog community presented news of a fascinating development at his employer which was shared on the channel. Wishing to keep his identity and that of his employer anonymous, the contributor submitted the following.

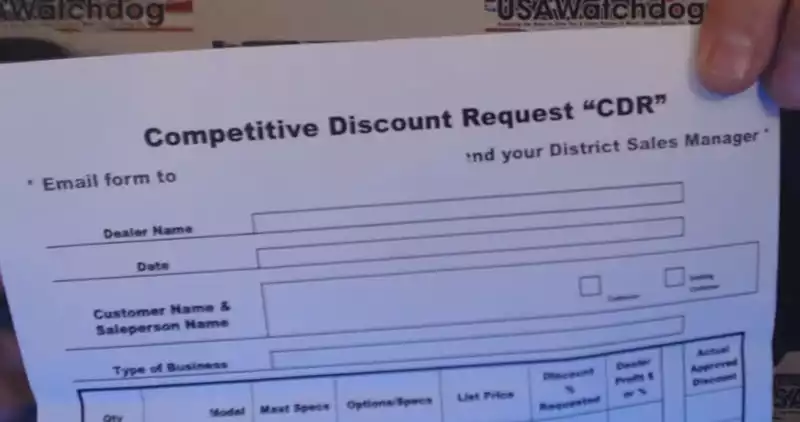

"I sell forklifts here in the US and just received a confidential form that shows our forklift company has just changed policy to accept gold and silver for payment options. Cash and lease were the only options in the past”. Although the company was not named, it was said to be a major market participant that conducts business internationally. A redacted version of the “Competitive Discount Request” form was presented as pictured below with the accepted payment options shown to be cash, lease, gold and silver as pictured subsequently. Furthermore, it was clarified that payment must be in physical form which illustrates the worthlessness of contracts or ETF shares such as GLD or SLV in any real commodity exchange.

Although (or perhaps because) this information is the result of “grass roots” reporting, it does suggest that companies may be showing signs of nervousness with regards to accepting paper payments, whether that be for reasons related to exchange rates or for more systemic considerations. This would not be without precedent with Patrick Byrne, CEO of online retail giant Overstock.com openly stating in late 2015 that the company was stockpiling gold and silver coins to safeguard employee entitlements in preparation for another financial crisis. A similar approach to personal finances would seem to be a prudent move.