Will Silver do Nickel? Gold cup & handle takeoff?

News

|

Posted 09/03/2022

|

6965

The speed of deterioration of global markets is exceeding many expectations with a lot of attention turning to not just hard commodities but a looming food and energy crisis as two of the agricultural superpowers are locked in conflict and the worlds second largest energy producer the sanctioned protagonist. Fears of high inflation have turned to fear of hyper-inflation. Gold came within a whisker of printing and all time high at USD2064 last night as it continues its surge. Coming from a lower base silver has now risen from USD22 to now USD 25.75 over night, a 25% increase just this year.

Gold’s cup and handle formation we flagged back in January is looking more and more ‘perfect’ as a potential strong break out to the upside looks more and more likely.

Behind the technical scene there is also some apparent real pressures in the physical silver market that could present an even more bullish flag. Veteran metals analyst Ed Steer had this to say over the weekend:

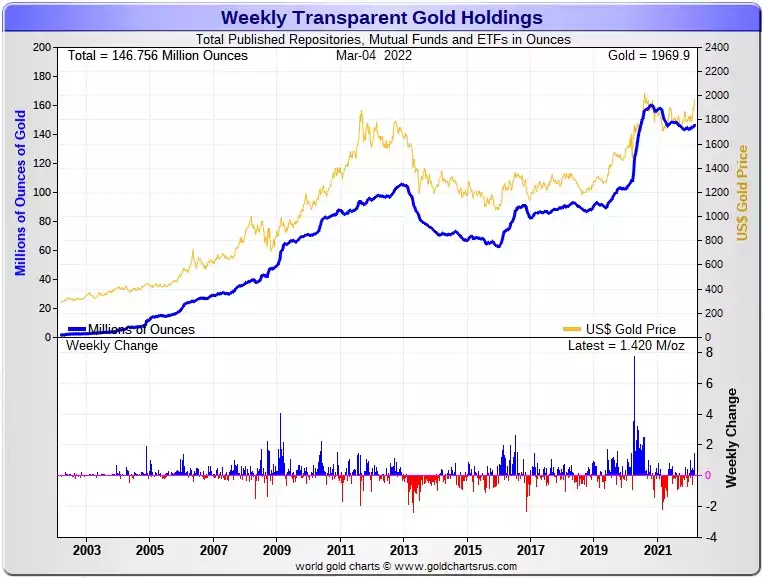

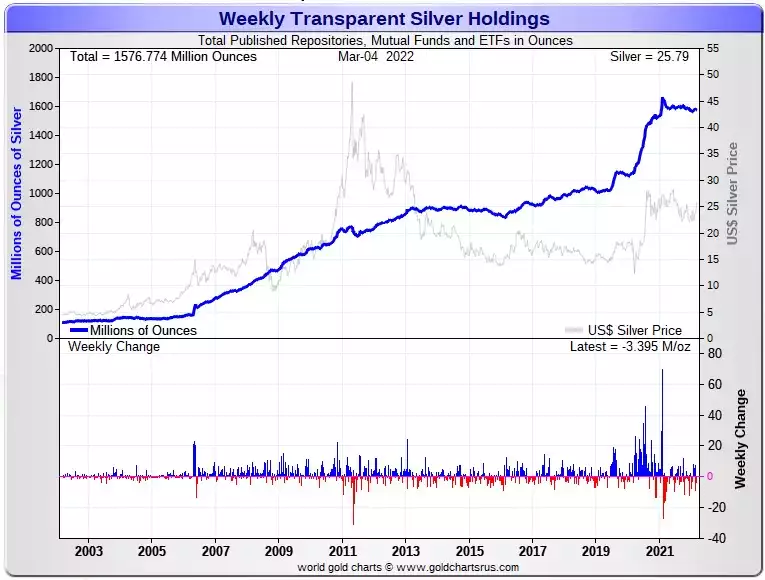

“Here are the usual two 20-year charts that show up in this space every Saturday. They show the total amount of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there was a net 1,420,000 troy ounces of gold added -- but a net 3,395,000 troy ounces of silver was removed...with all of that amount, plus more, being conversions of SLV shares for physical...along with the big withdrawal from Deutsche Bank yesterday, that I mentioned above.

“But in the overall, far more silver has been added to these various ETFs and mutual funds in last month, than has been withdrawn -- and even the withdrawals/exchange for physical in SLV are bullish as well.

And not to be forgotten is the fact that 20-25 million troy ounces of physical silver is owed to SLV, according to Ted [Butler, COMEX silver analysis specialist].

The physical shortage situation in silver continues to creep along -- and the shrinking price spread differentials in silver since First Notice day is further proof that the physical silver noose is drawing ever tighter in the wholesale market.

Now that silver has broken above its 200-day moving average, ETF and mutual fund demand has exploded -- and retail demand continues to be incandescent.

Something's gotta give sooner or later.”

The charts above are as amazing for the movements Steer outlines behind the scenes as they are for the disconnect on demand versus price for silver when you compare it to gold. It is no wonder we still have a sky high Gold Silver Ratio of nearly 77…

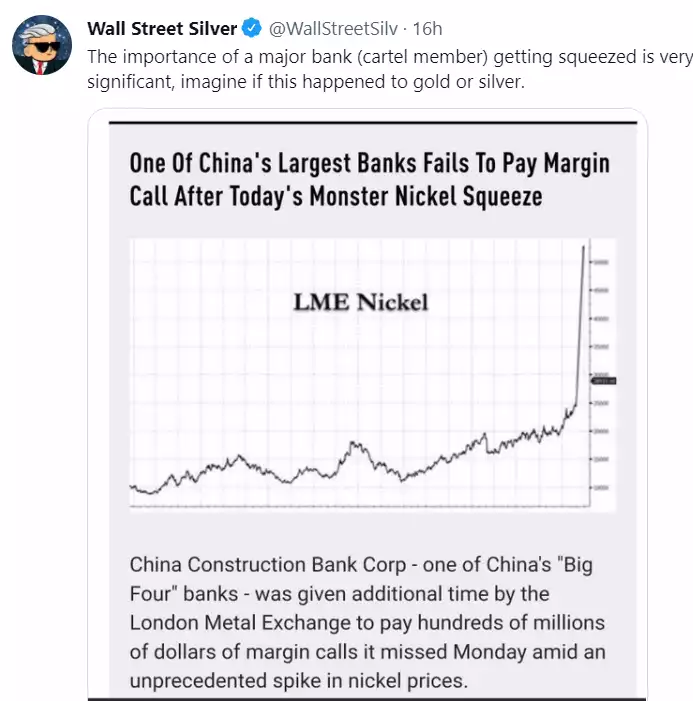

Don’t forget the massive short positions the bullion banks hold on silver on COMEX. Russia is a massive producer and is now cut off. This is a similar story to Nickel yesterday where it spiked on Russian forces in the market. From the AFR:

“The price of nickel traded in London rocketed as much as 90 per cent to a record high as fears of a Russian supply shock left buyers of its high-quality output exposed to a short-term squeeze in one of the wildest sessions in living memory.

The metal, which is a key component in lithium-ion batteries and stainless steel, leapt to nearly $US55,000 a tonne, surging past the previous record of $US51,800 reached in 2007. It settled at $US50,925 a tonne, up 76 per cent, marking the largest single day gain for nickel in the three-month LME contract’s history.

The explosive move was triggered by reports that holders of Russian metal physically stored in LME warehouses had relinquished their holdings, causing liquidity to swiftly deteriorate as sellers rushed to the sidelines. This forced investors with short positions to buy back positions, adding to the mood of chaos.”

When a relatively small market is so grotesquely exposed to derivative markets as nickel was and as silver most certainly is…. things can break and those who own the physical metal win.