Will Long-Term BTC Holders Surrender?

News

|

Posted 12/07/2022

|

8917

Bitcoin prices continue to consolidate around the US$20k range this week, as the market digests the extreme downside volatility of June. Prices traded higher, opening at a weekly low of $18,971, and peaking at $22,230.

With the market now down over 75% from the all-time-high, even the strongest and longest-term Bitcoin holders are feeling the pressure. Long-Term Holders and Miners are in the spotlight this week, as the market attempts to find a bottom amidst persistent macroeconomic uncertainty.

With the loss of the $30k price level, miners and long-term holders (LTHs) have come under extreme stress. We can look at their profitability on two fronts; their actualised losses (spending) and unrealised losses (coins held below cost basis) to get an idea of their ongoing capitulation.

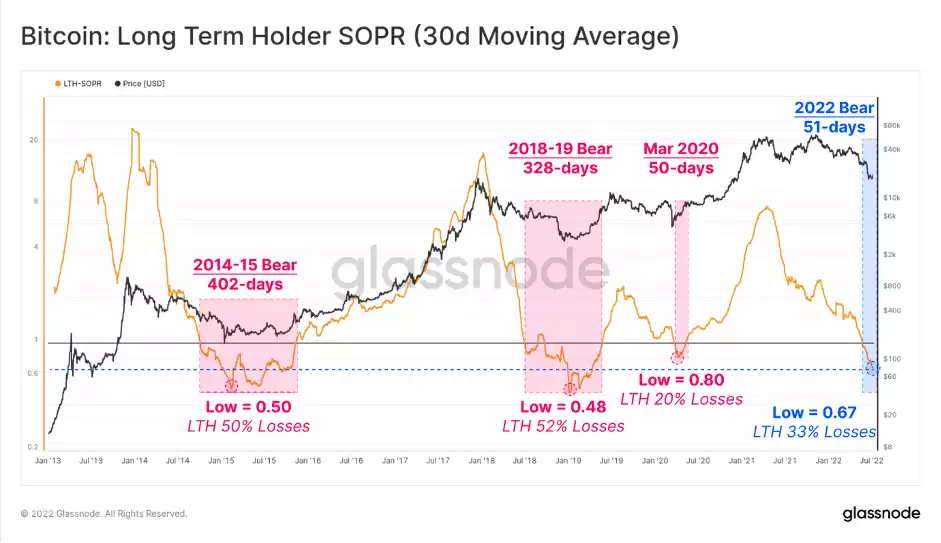

Long-Term Holder Spent Output Profit Ratio (LTH-SOPR) is a metric that indicates the profit ratio captured by LTHs (i.e. a value of 2.0 means LTHs are spending coins at a price that is 2x their cost basis). Therefore, when LTH-SOPR is less than one, these players realise losses or spend coins at a price below their cost basis.

LTH-SOPR is currently trading at 0.67, indicating the average LTH spending their coins is locking in a 33% loss.

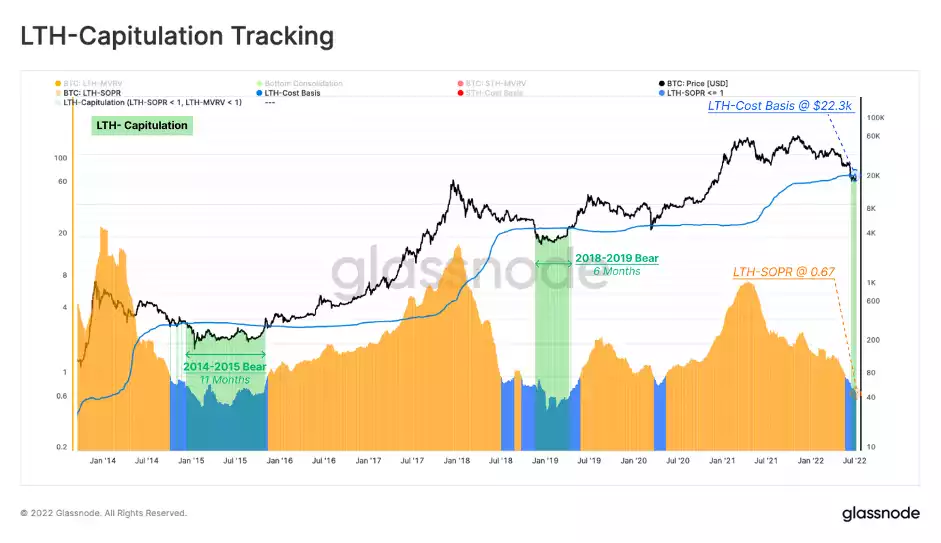

Long-Term Holder Cost Basis estimates the average price long-term holders paid for their coins. Hence, as the market value falls below the LTH-Cost Basis, this cohort can be considered to be in aggregate loss. Similarly, LTHs are currently underwater on average, holding an aggregate unrealised loss of -14%.

The following chart combines these concepts and shows intervals that satisfy both conditions (in green). These moments are where LTHs are both underwater on held coins, and locking in losses based on their spending. In combination, this indicates there is an increased probability that a LTH capitulation is underway.

With the current value of LTH-SOPR at 0.67 and the LTH-Cost Basis at $22.3k, it means LTHs are realising an average of -33% losses on each spent coin, despite spot prices only being ~6% below their cost basis. This signifies that LTHs who acquired coins at much higher are the primary spenders at the moment, and those who still hold coins from the 2017-20 cycle (or earlier) are largely sitting tight.

A consequence of capitulation events is an immediate redistribution of coins to new buyers, who are often classified as Short-Term Holders at first. Over time, however, the dominance of Long-Term Holders amongst the supply tends to increase, as fair-weather speculators are flushed from the market.

The bottom formation is often accompanied by LTHs shouldering an increasingly large proportion of the unrealised loss. In other words, for a bear market to reach an ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and with the highest conviction.

This is the result of two mechanisms:

- The exiting of entities with weak conviction (Short-Term Holders).

- The gradual transfer of coins to entities with strong conviction, who are relatively price-insensitive (Long-Term Holders)

In the depths of previous bear markets, the proportion of supply that was held by LTHs, and at a loss, reached above 34%. Meanwhile, the proportion held by STHs declined to just 3% to 4% of supply. At the moment, STHs still holds 16.2% of the supply in loss, suggesting that freshly redistributed coins must now go through the process of maturation in the hands of higher conviction holders.

The present market structure has many hallmarks of the later stage of a bear market, where the highest conviction cohorts, the long-term holders and the miners, are under tremendous pressure to surrender.