Why We Need a Market Crash

News

|

Posted 27/03/2017

|

5458

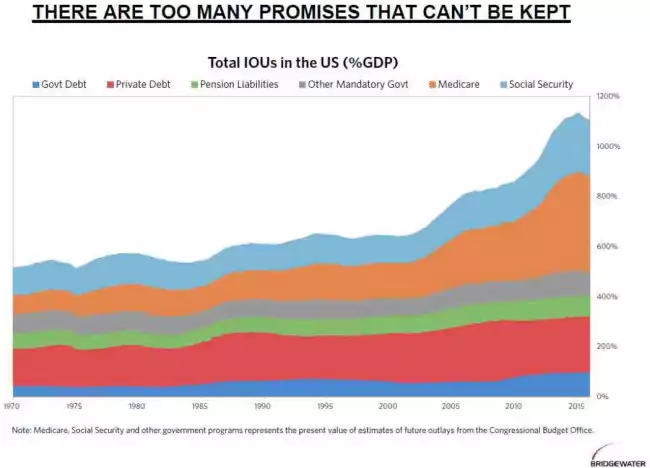

Following on from Friday’s article today we look beyond that headline $20 trillion and include very real US government liabilities that they don’t feel compelled to include on their balance sheet like any ‘business’ would under GAAP accounting rules. That number, according to www.usdebtclock.org (a must visit if you’ve never done so) is currently over $105 trillion. As we wrote mid last year Australia’s number, just in terms of unfunded pension liabilities (net of the Future Fund) was $143b at that time, and no doubt more now. As we wrote back then, if the US included those very real future payments of pensions, social security and medicare it would equate to nearly $1m per US citizen. Does that sound like something you can ‘trade out of’? The graph below, courtesy of Bridgewater (the world’s largest hedge fund), paints a very clear and (what should be) very concerning picture of consolidated US debt:

Chris Martenson of PeakProsperity explains:

“Money is not wealth; it is merely a claim on wealth. Debt is a claim on future money. The only way to have faith in our current monetary policies is if one believes that we can always grow our debts at roughly twice the rate of GDP -- forever. That is, compound the claims at twice the rate of income year after year from here on out.

At the national level, the US is already insolvent, meaning liabilities exceed assets. The US has been spending far above our means for decades and decades, amassing a tremendous amount of public and private debt (as well as entitlement promises) along the way. And, yes, even nations can go bankrupt.

The Austrian economist Ludwig von Mises said it best: “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Our current debts and other national liabilities now total more than 1,000%(!) of the nation's annual income, a.k.a GDP.

US economic growth began slowing due to its accelerating ‘too much debt’ problem back around 2000. Instead of allowing natural market forces to clear out the excessive debts, the Federal Reserve chose to go into overdrive to ‘remedy’ the problem. It's remedy? Drive interest rates to 0% to reduce the service burden of those debts, and print trillions of fresh dollars that in turn can fund new borrowing.

Of course, no true ‘solution’ for having too much debt involves piling up even more of it. That's like treating cancer with more cancer. Or alcoholism with more alcohol. But such has been the twisted logic of our central bankers.

The only path that history has shown works involves fiscal austerity and reducing debt. Or, as von Mises put it, "a voluntary abandonment of the credit expansion". But, that requires real political courage and a willingness from society to endure actual ‘pain’ in the form of living below its means to make up for the prior periods of living too lavishly. Don't expect that to happen anytime soon? Nether do we...

Returning to the chart above, it’s sufficient to know that no country, ever, in all of history, has ever dug out from such a mountain of excess claims. Never. Not once.

The only possible way we're avoiding crisis is if the economy suddenly returns to extremely rapid economic growth for an extremely long time. And that’s if AND ONLY IF during such a period of rapid growth, we use that windfall to pay down the debts and other associated IOU’s -- rather than as an excuse to once again look the other way because, hey, everything's awesome now!”

And finally:

“And just as happened in 2008, the accumulating instabilities within the system will reach a tipping point where they can no longer be suppressed. The deflation monster will escape from the box the central banks have been desperate to confine him within, and he will very quickly set about making up for lost time. A lot of wealth will get destroyed very quickly.”

“We not only need a market crash, but deserve one.”

i.e. we have enjoyed the excesses of this robbing from the future and put off the inevitable. The longer this goes on the bigger the crash in the end. History shows only one asset consistently survives such crashes.