Why This is Not a 1980’s Bull Market

News

|

Posted 15/11/2016

|

5594

Some readers may have seen articles comparing now to 1980 as Reagan (another ‘right wing’ wild card) began his administration on a similar platform of fiscal stimulus to Trump. The ensuing years saw shares soar and a protracted bear market for gold.

If you are heavy shares it’s a wonderful story that you would quickly adopt as fact as it suits your narrative or bias. It’s also a nice story as it is one of hope when hope seemed to disappear for a few hours as Trump looked to become the next President. But short of a new right wing president who wants to unleash fiscal stimulus to make America great again, the story falls flat on facts. Real Investment Advice just penned this great article that we summarise below if you are short on time.

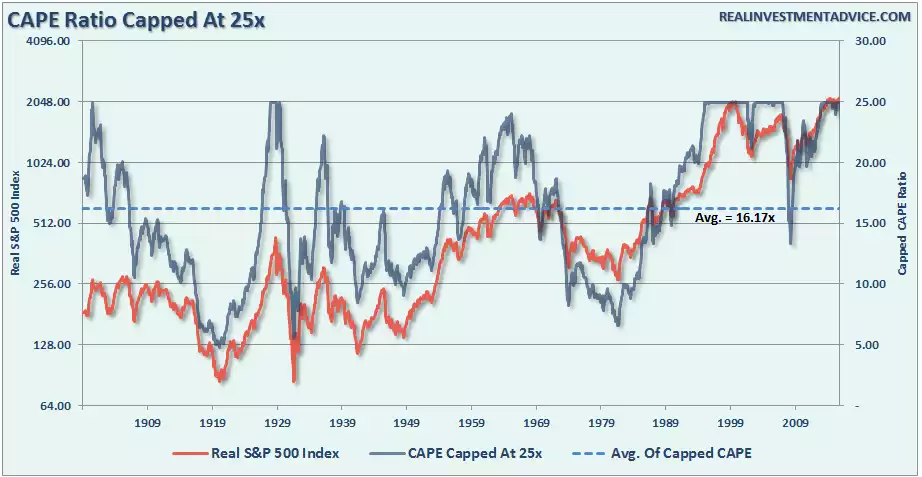

For a start we are starting at near record high share valuations not lows:

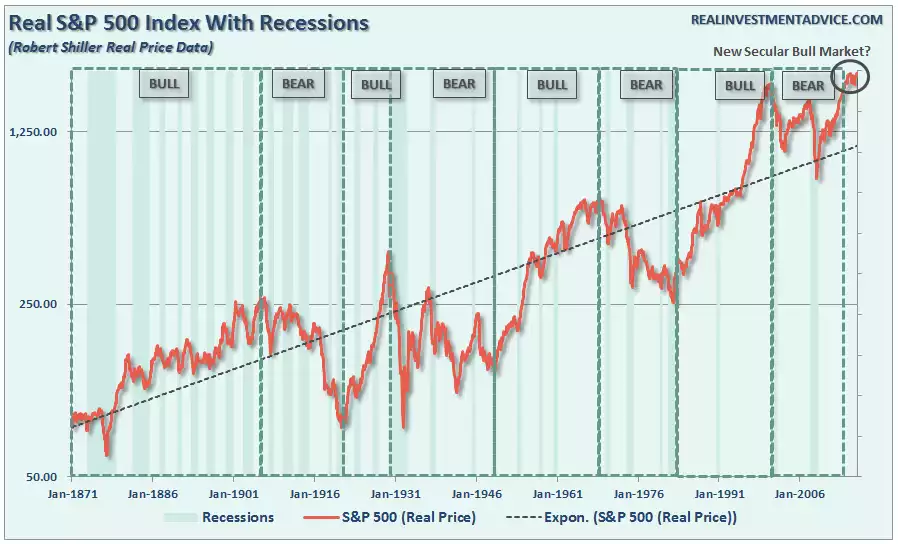

Secondly, in terms of normal secular bull and bear markets we are clearly due one last big fall before the next secular bull could be called in:

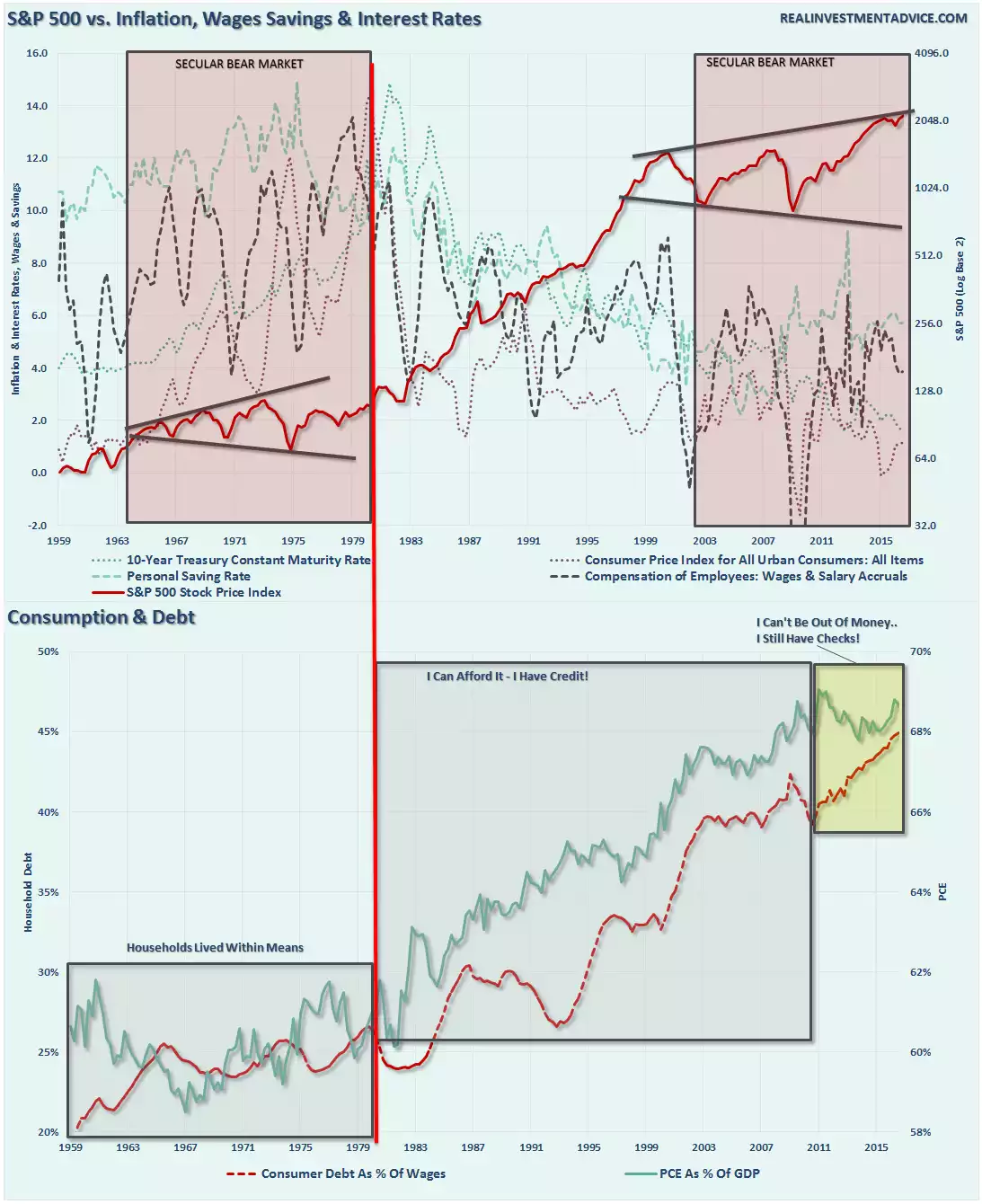

Thirdly we have a completely different macro economic and demographic environment set up. As they say:

“the ability to have a “1982-2000 affair” is highly improbable. The 1982-2000 secular bull market cycle was driven primarily by a multiple expansion process with a beginning valuation level of 5-7x earnings and a dividend yield of 6%. Interest rates and inflation were at extremely high levels and were at the beginning of a 30-year decline which would increase profitability as production and interest rate costs fell. Lastly, the consumer was at the beginning of a period of a leverage ramp up which spurred consumption levels to almost 70% of GDP. With inflation and interest rates currently at low levels, and consumers already heavily levered relative to historical norms, the drivers that led to the secular bull market in of the 80-90’s simply do not exist today.” Or in pictures…

They conclude beautifully and devoid of the emotion, bias and (ironic) ‘hope’ underpinning much of what you will read lately:

“While being a “stark raving bull” going into 2017 is certainly fashionable currently; as investors, we should place our faith, and hard earned savings, into the reality of the underlying fundamentals. It is entirely conceivable the current momentum driven markets, fueled by ongoing Central Bank interventions combined with optimism over the potential for economic reforms under the new administration, could certainly drift higher in the months to come. However, the reality is that the current underlying demographic trends, economic realities, and market fundamentals do not provide the base to support current price levels much less the entrance into a secular bull market akin to that of the 80’s and 90’s.

Of course, with virtual entirety of Wall Street being extremely bullish on the markets and economy going into 2017, along with bullish sentiment at extremely high levels, it certainly brings to mind Bob Farrell’s Rule #9 which states:

“When all experts agree – something else is bound to happen.”

There are simply too many things we “don’t know that we don’t know.” For that reason alone, 2017 could well turn out to be an interesting year for all the wrong reasons.”