Why Shiller’s Worried

News

|

Posted 15/03/2017

|

4288

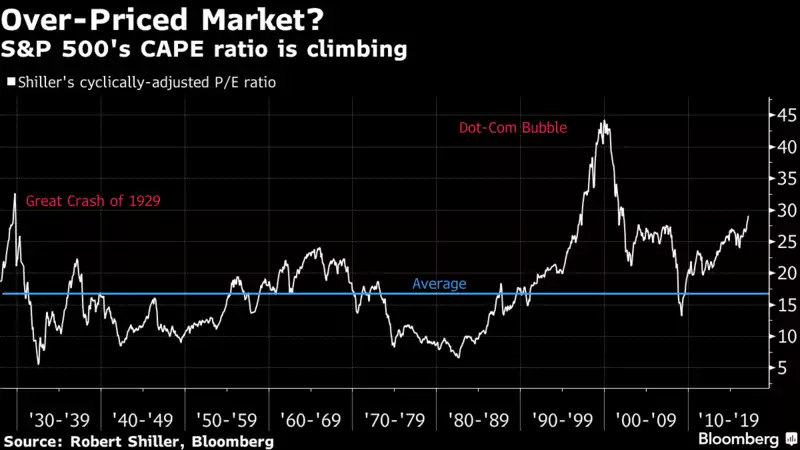

Nobel Prize winning economist Robert Shiller has warned about his concerns on the longevity of this Trump rally. The author of the widely respected CAPE Shiller share valuation for which he won his Nobel Prize points out that the current overvaluation is at levels seen before the Great Depression crash of 1929.

Whilst still below the record setting dot.com bubble of 2000 he makes the following comparison via Bloomberg:

“Back then, the Nobel Prize-winning economist says, traders were captivated by a “new era story” of technological transformation: The Internet had re-defined American business and made traditional gauges of equity-market value obsolete. Today, the game changer everyone’s buzzing about is political: Donald Trump and his bold plans to slash regulations, cut taxes and turbocharge economic growth with a trillion-dollar infrastructure boom.

“They’re both revolutionary eras,” says Shiller, who’s famous for his warnings about the dot-com mania and housing-market excesses that led to the global financial crisis. “This time a ‘Great Leader’ has appeared. The idea is, everything is different.”

For Shiller, the power of a new-era narrative helps answer one of the most hotly debated questions on Wall Street as stocks set one high after another this year: Why are traders so fixated on the upsides of a Trump presidency when the downside risks seem just as big? For all his pro-business promises, the former reality TV star’s confrontational foreign policy and haphazard management style have bred uncertainty -- the one thing investors are supposed to hate most.”

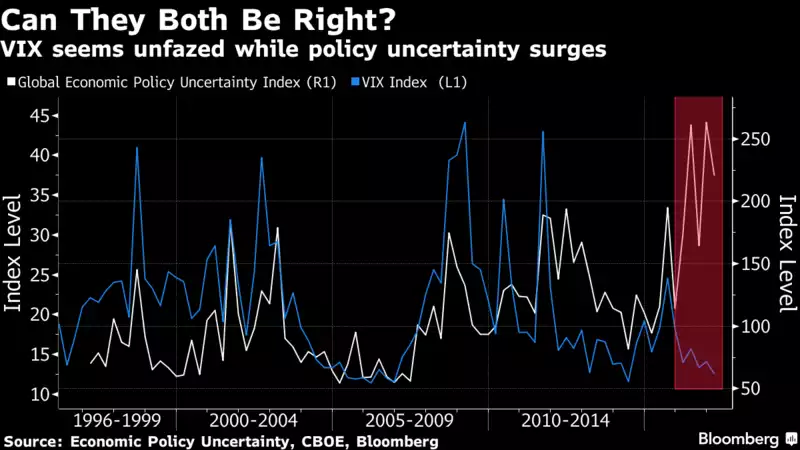

Indeed it is the seeming disconnect between global uncertainties and the volatility index that recently prompted banking giant Sociate Generale to call the following chart “the most worrying chart we know”. As you can see there is a very clear break in what has to date been a striking correlation between the two. In other words the market seems convinced ‘this time is different’… the 4 most expensive words in investment.

If you look at the ratio of the S&P500 Price Earnings ratio to the VIX it becomes even clearer. That ratio essentially measures the amount investors are willing to pay for a given level of market risk. Per the following graph from Bloomberg, that too hasn’t been higher in 23 years…

Let’s leave the final word to the Nobel laureate..

“The market is way over-priced," he says. "It’s not as intellectual as people would think, or as economists would have you believe."