Why S&P500 could fall 35%

News

|

Posted 31/08/2016

|

4589

The word ‘unprecedented’ gets thrown around more and more when describing the current global financial environment. Whether its interest rates (5000 year lows), bond yields ($13.5t of which are now negative), debt levels (at all time highs), and now share prices, it is a world of new ‘unchartered territory’. When one travels to such places, one normally buys insurance…

So let’s look at another recent phenomenon. We have written extensively (most recent summary here) about sky high PE valuations and the like as shares hit new highs on investors looking for some kind of yield in this near zero yield world… and hang the risk associated with equities. The graph below goes back to 1980 but the 3 instances of the S&P500 yielding higher than a 10 year Treasury bond that you can see on that chart (the GFC, just after the ensuing recession, and now), are the only such instances since 1958!

10 year Treasury yields are pretty much considered the ‘risk free rate’ in investing. This then raises the matter of the equity risk premium (ERP), or according to Investopedia:

“Equity risk premium, also referred to as simply equity premium, is the excess return that investing in the stock market provides over a risk-free rate, such as the return from government treasury bonds. This excess return compensates investors for taking on the relatively higher risk of equity investing.”

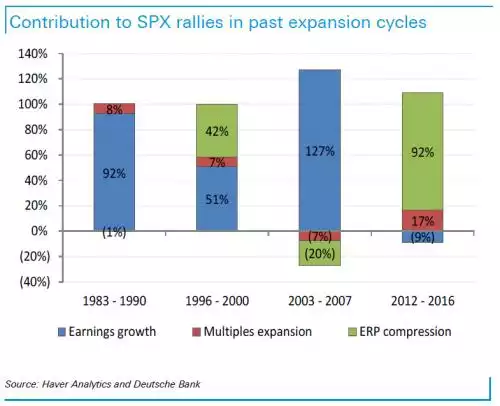

So it may come as a ‘shock’ to you that the equity rally we are witnessing now is pretty well entirely driven by ERP compression. The analysis pictured below by Deutsche Bank shows how fundamentals of earnings growth have completely disappeared and it is all about chasing yield beyond fundamentals and hence risk. This reinforces our message that central banks are the main drivers of this market through suppression of yields through ZIRP and QE. Herein lies their rates dilemma.. Need to raise rates to say everything is find and try and reign in this out of control bubble…. Do so by even 0.25% and the bubble could pop immediately.

Zerohedge did the math:

“In turn, this means that every push higher in yield, whether orchestrated by central banks, or due to exogenous events like a "taper tantrum" risks upsetting this precariously compressed ERP "spring", leading to a violent market crash. Because if the ERP is responsible for 92% of the S&P500 move since 2012, or just over 800 points, that would suggest that central bank policies are directly responsible for approximately 40% of the "value" in the market, and any moves to undo this support could result in crash that wipes out said ERP contribution, leaving the S&P500 somewhere in the vicinity of 1,400.” That is 1,400 from its current 2,170…