Why Crypto Bubble Talk is Premature

News

|

Posted 04/12/2017

|

7055

On Friday the U.S. Commodity Futures Trading Commission (CFTC) announced that CME and CBOE Futures Exchanges were approved to trade bitcoin futures. We reported in early November when the CME announced their intentions and now it is official. CME announced it will start on 18 December. Predictably bitcoin (and other large cap cryptos) surged on the news.

As JP Morgan noted:

“With bitcoin reaching the $10000 mark this week (Figure 1) partly fuelled by the prospective launch of bitcoin futures contracts by established exchanges such as CME and CBOE, the question that arises is about whether a new asset class is emerging, potentially competing with other more traditional asset classes. The prospective launch of bitcoin futures contracts by established exchanges in particular has the potential to add legitimacy and thus increase the appeal of the cryptocurrency market to both retail and institutional investors.”

This latest price surge and growing awareness prompted endless articles over the weekend and as usual the responses were polarised. Whilst the word bubble is often used it often misses the point of this not being an established market. As J P Morgan noted above this is “a new asset class”. To see such price action in long established markets or assets classes like share markets or indeed gold would be alarming and quite justifiably raise questions of why this time is different.

We often remind people of the famous quote that the 4 most expensive words in investment are ‘this time is different’. However that is in relation to (and almost by definition) markets with long established behaviours and bases of price. The US sharemarket has seen earnings almost stagnant compared to the meteoric rise in prices. That means all the price gains are on multiples (and as we’ve often reported at near record highs) rather than earnings, or ‘real’ growth. History has demonstrated time and again that only ever ends one way…

However bitcoin and other large cap cryptos are arguably still in the ‘discovery’ or ‘early adoption’ phase. There is no previous time or behaviour to be different to, there are no rules on what fair value is.

In other words what we might be observing now is the initial establishment of what becomes a normal base. That however needs context to be able to assess, so let’s do that courtesy of J P Morgan again:

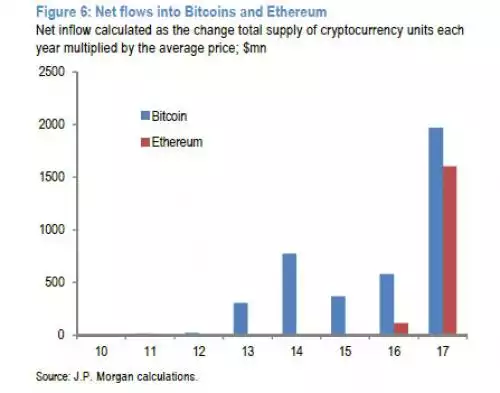

"The net flow into cryptocurrencies is very much a function of coin creation which is controlled by computer algorithms and in the case of bitcoin is diminishing over time. Figure 6 shows the net amount of money invested every year since 2009. The cumulative amount has totalled around $6bn since 2009, well below the current market cap of $300bn."

$6b, in the global market context, is still incredibly small. If you compare that to year to date flows into global shares/equities of $283b and bonds of $346b, you soon get the context. Gold is a little harder to quantify but if we were on track for another approx. 2000t demand this year that would like something like $90b as well… $6b is tiny but that $6b has seen the market cap rise to nearly $330b. Just stop and consider what happens if even a small percentage of the $300 trillion in financial assets in the world tries to get into that little $330b ($0.3 trillion) space.

This is not a new concept to regular readers because the story is the same for gold and silver. Gold equates to around 0.5% and silver 0.012% of global financial assets. When the heard move in, and you can’t simply create more of either gold, silver or bitcoin, there is only one variable in the supply / demand / price equation…..