Why are Precious Metals Under Fire?

News

|

Posted 12/08/2021

|

6855

Gold and Silver both took major hits late last week and early this week on high volumes. Moves like these are usually accompanied by earth-shattering macro news, shifting the tectonic plates of the global economy. To borrow from the cryptoverse: “why dump”?

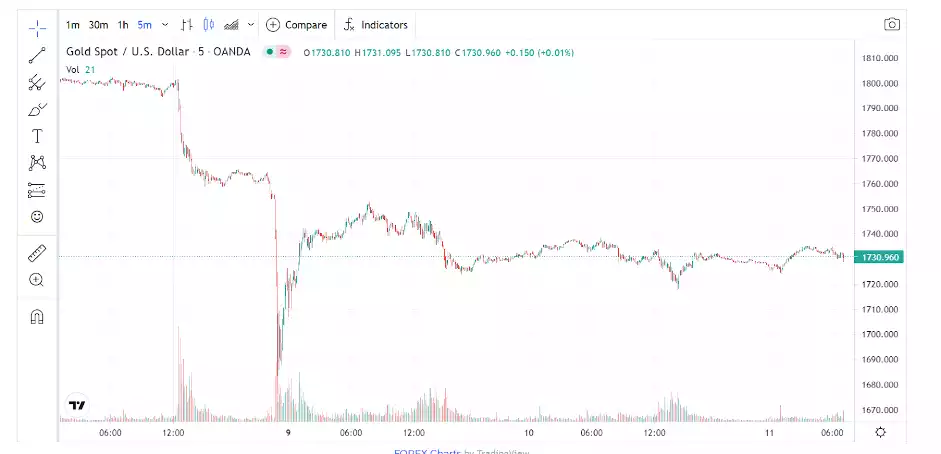

While the percentage based moves are small in comparison to crypto, the 5 minute chart does lend form to just how dramatic the moves have been over the last week:

Violent moves in gold, the $11 trillion behemoth-market, are unlikely to be caused by a rush of retail investors bringing their 1oz cast bars into their local bullion dealer.

The cause of that second flash crash was over $4b of COMEX gold contracts being dumped in an illiquid period of the market further triggering stop losses having breached the ‘death cross’ and support of US$1750. Whilst technically this may have been algo driven, this is not how one exits a position to minimise any loss. Indeed it wreaks of the big bank spoofing that has banks and their trading desk participants being fined and convicted in recent months. This can only be deliberate or, as the great Dwight Schrute said “otherwise, it's just malfeasance for malfeasance's sake.”

The waves of selling have abated for now and prices have stabilised around the $1730 mark and indeed rallying strongly to $1750 last night. These current levels are comfortably above the long-term, line-in-the-sand support levels at $1680.

Following the line across the page, investors can still scoop up gold for prices around the old highs of 2011-13.

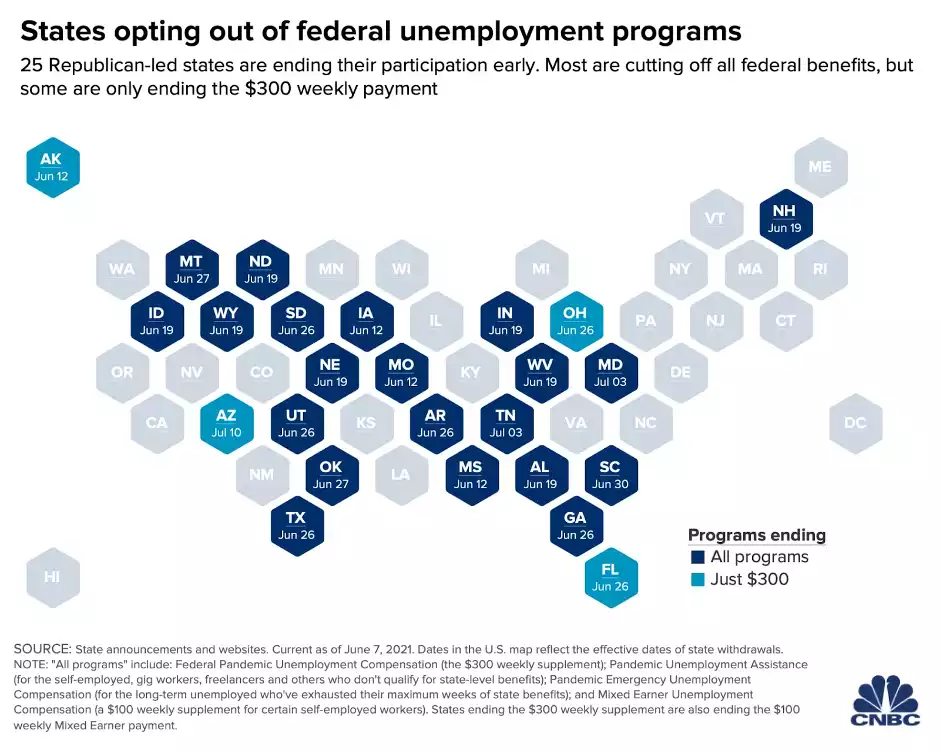

The initial major waves of selling were notionally on the back of better than expected Employment data coming out of the U.S. The U.S Labor Department reported on Friday that nonfarm payrolls increased by 943,000 jobs in July. What mainstream media hasn’t emphasised is that 25 states, all led by Republican governors, have been withdrawing from the Federal funding provided through the CAREs Act of March 2020. The program initially bumped up unemployment benefits by $600, now recipients are entitled to only $300 above what they were entitled to under state law. While the Federal program is only due to expire on 6 September, Republican governors have been withdrawing early in a bid to clear up labor shortages.

It may be going out on a bit of a limb, but reducing the incentives not to work may have encouraged people to go out and take some of the jobs that were waiting to be filled.

Precious metals holders need to ask themselves: if the global context hasn’t changed, if the fundamentals haven’t changed, if the value proposition in front of us hasn’t changed, if all that’s changed is the price; then that presents opportunity. Value investors have traditionally looked for price and value to diverge in emotional and reactive markets, and sought to trade the difference. When such opportunities to buy physical precious metals are presented on a silver platter from paper COMEX ‘anomalies’, well, all the sweeter.

Our business is arguably where the rubber hits the road. The reaction since that Sunday night smack down has been overwhelming…. People are BUYING the dip with gusto, our busiest week so far in months.

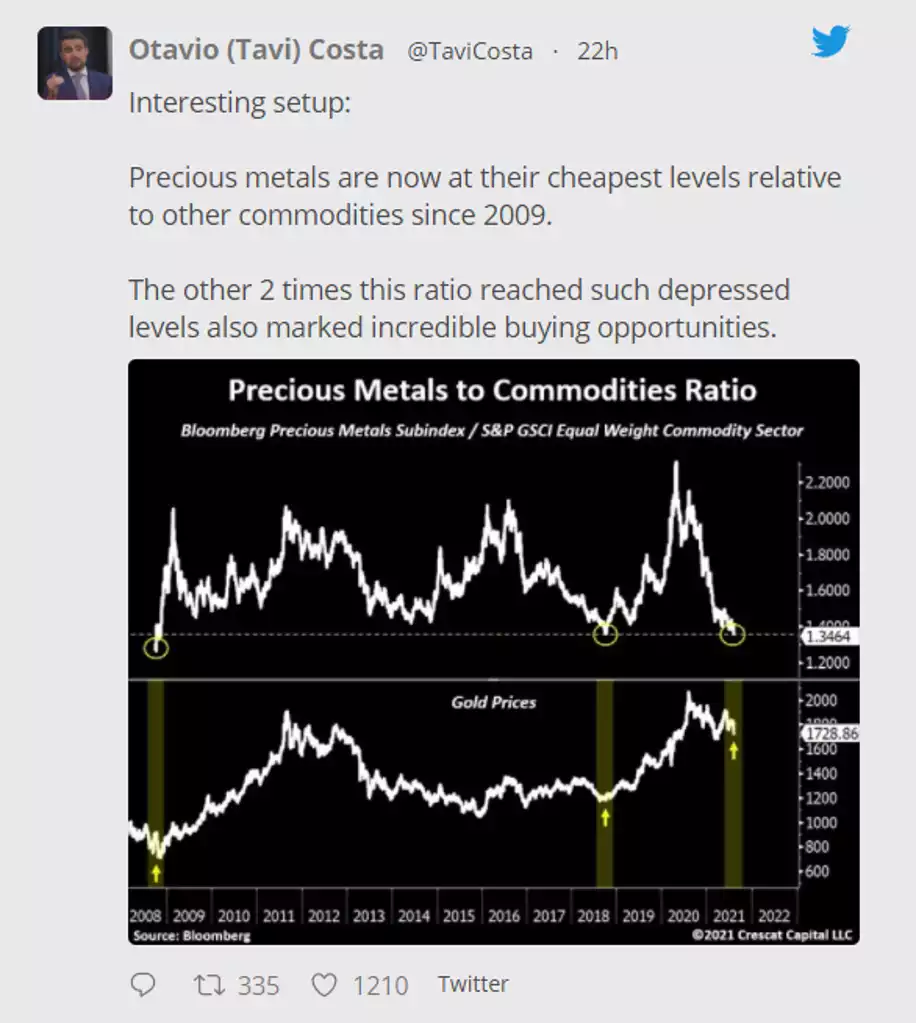

And finally, speaking of ‘context’…. In a macro set up where commodities look about to take off on sticker than ‘transitory’ inflation the implications for the numerator (gold) in the chart below simply can’t be ignored…