Why 2022 Could Be An “economic inflection point”

News

|

Posted 22/12/2021

|

9242

Whilst there is growing consensus around strong inflation and the subsequent need for the Fed and other central banks to tighten monetary policy, respected analyst Raoul Pal has maintained his view throughout that the inflation will be somewhat transitory and a global slowdown is close.

Before you read on, if you missed our article on the demographic journey through history to get here, you need to read it now.

Pal has maintained for some time that the overwhelming macro forces of an aging and retiring ‘Boomer’ demographic and the impacts of technology on jobs and the cost of goods are largely deflationary. It’s a 10,000 ft view that has been tested this last year but he held strong to it despite burgeoning inflation and a ‘recovering’ economy.

With respect to paid subscribers of Macro Insiders we will share just a few of his charts and views.

“It feels as if we are right on the edge of a reversal in the growth narrative.

You see, the cure for higher prices is higher prices. In an indebted economy, higher prices destroy marginal demand in the economy. Again, I have been warning of this for a while.

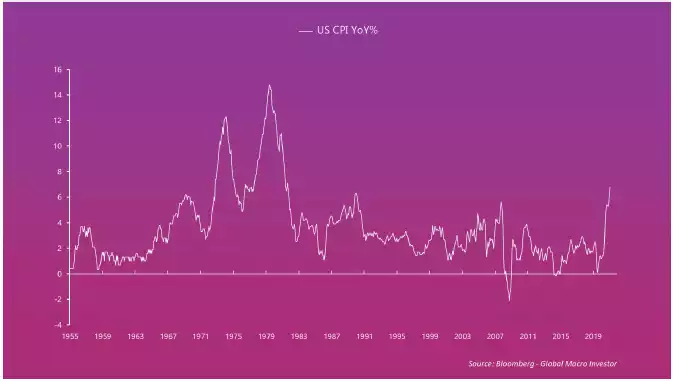

When prices are rising because of a supply shock, like this...

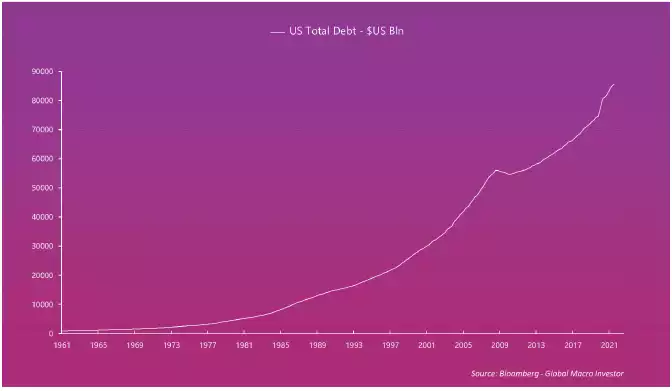

... and debt is this high...

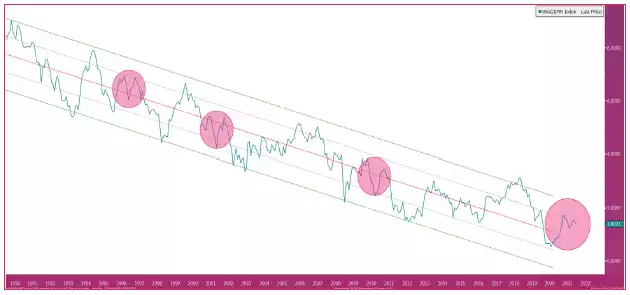

.. it tends to kill demand for other things as everyone’s input costs have increased and they have huge debts to service but revenues or wages haven’t risen as far. This is exactly why the Chart of Truth keeps working... it caps growth, inflation and thus yields over time...

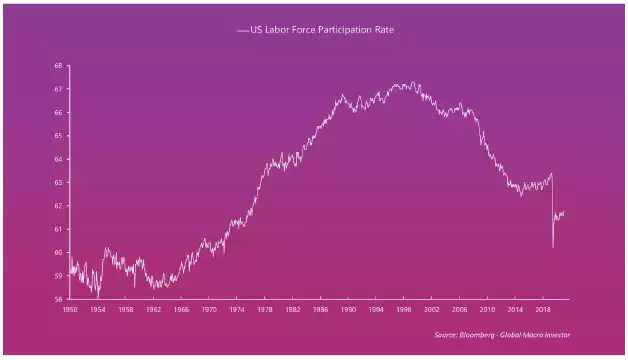

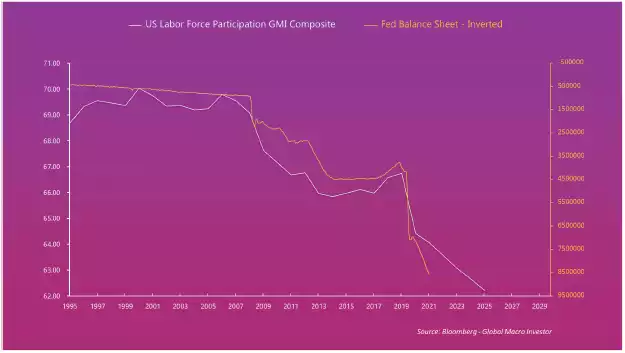

The other key factor is demographics, as I have also been discussing for years. The Labor Force Participation Rate is not going back up and that is a massive net reduction in demand...

And this suggests that CPI will mean revert and begin to fall as the really big cliff in retirees begins to weigh on demand...

And that is also the driver of the Fed Balance Sheet...

As opposed to a reduction or flattening of the balance sheet, demographics suggest that it expands another $1tn to $2tn over the next few years...

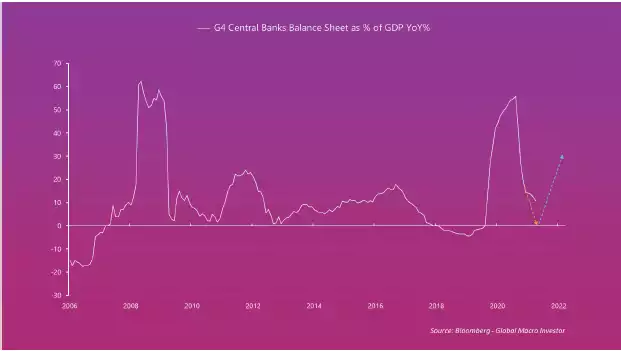

And this has all kicked off as the rate of change of the G4 Central Bank Balance Sheets is getting close to zero. The next phase in 2022 is more expansion...”

Pal goes on to outline the evidence to suggest that 2022 could be a wildly volatile year, an “economic inflection point” as the market responds to this, bouncing between this weakening economic setup, monetary tightening reversal into stimulus (again), and the response between protection against such volatility, increasing debt burdens and the TINA trades.

One word should be echoing in your wealth investing thesis and approach for the year ahead and that is BALANCE.