When Will ‘Real’ Win?

News

|

Posted 06/07/2015

|

4738

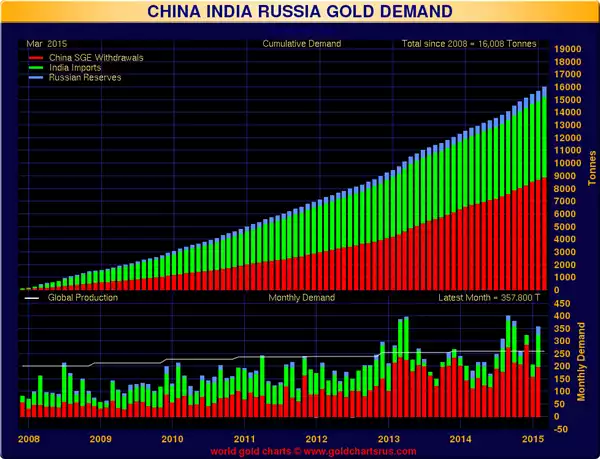

There continues to be a tug of war between ‘real’ gold & silver trade and ‘paper’ gold & silver trade. For a start the graph below shows very clearly that demand just from 3 of the BRICS countries exceeds global gold production (the grey line in the bottom graph). Secondly the latest Swiss import and export data shows an increase (not the decrease the press speculate) in gold demand by the East at 10% over last year. Gold leaves the vaults of London, goes to Swiss refiners who turn them in to the kilo bars the Chinese and Indians prefer, and then export them there. Hard evidence from the country that refines 2/3 of the world’s gold. Anecdotally too, demand in bullion stores like ours has increased dramatically of late. So why isn’t the price going up on all this physical demand? Without getting into speculative deliberate price suppression, part of the story may be the epic set up in futures contracts on COMEX as discussed here where Managed Money / Technical Funds are incredibly “short” at the moment, indeed an all time record in silver. But as analyst Ted Butler explains:

“The best setup is quantified by the largest managed money short position because these traders can’t possibly deliver metal to close out their short positions and, therefore, must buy back those shorted contracts at some point. The larger the technical fund short position more bullish because it guarantees larger future buying. This is not just a theory – there has never been an instance where the managed money traders have not bought back all or nearly all of recently added short contracts. It follows that the largest managed money short position in history would equate to most bullish setup ever.”

Real, “mother nature, fundamental supply and demand – whatever you like to call it must always ultimately prevail. It then comes down to whether you buy at the bottom or the top…