When Everyone is Relaxed

News

|

Posted 03/05/2017

|

5011

Yesterday the RBA kept our cash rate at 1.5% and voiced confidence that Australia’s economic fortunes had turned, in line of course with a broader global improving economy. That probably sounds a little at odds with our article yesterday…. But it is exactly in line with market wide sentiment. Everything, it seems, is awesome again.

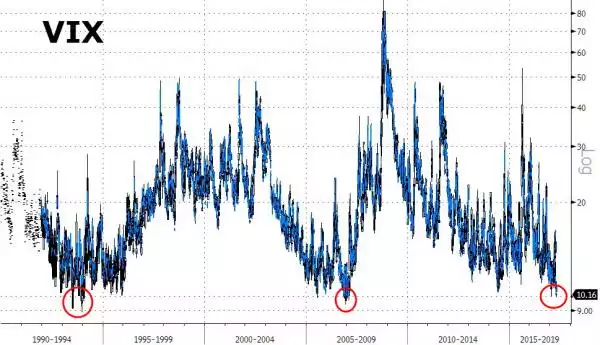

Evidence? Well late last week the volatility index hit a decade low 9 handle…

That’s good yeah? Not usually. ConvergEx's Nicholas Colas studied the data and found “The takeaway from these examples is clear: in the unusual instances (just 0.13% of the days since 1990) when the VIX closes below 10, one year forward returns have all been negative. In one case (2007 into 2008) the following year was terrible. In the other case (1994 into 1995) it was great – up 37.2%.”

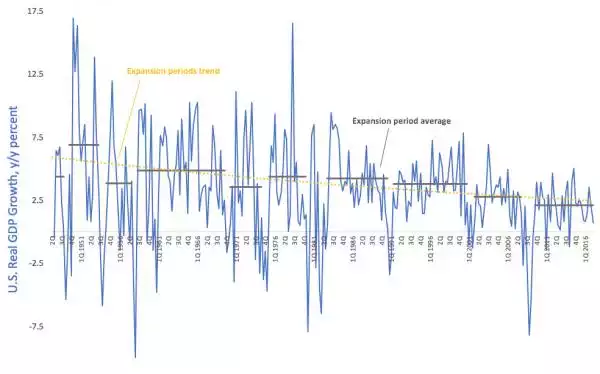

This in the same week we saw the first print for the US 1st quarter GDP come in at just 0.69%, the 13th lowest in 70 years, and cementing a trend of declining long term growth is the US:

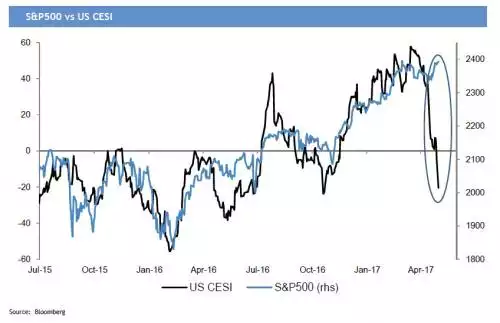

We also saw the Citigroup Economic Surprise Index (CESI) continue to plummet, making it the first in JP Morgan’s recent 6 “Red Flags” to start to exit the sharemarket. The last time we saw this happen (though not as dramatically), around August 2016, the Dow dropped 1000 points:

What also happened around August 2016 is Bank of America’s “Sell Side Indicator” (its proprietary “Everything’s Awesome” measure of Wall Street’s bullishness on shares) rose to 53.5, its highest since August 2016….

There are endless examples (including all the valuations we’ve shared with you) that illustrate the group think bullishness despite the weak fundamentals. That our own Central Bank is jumping on board should be more of a warning, that banks are raising rates regardless, another. The US Fed meets this week as global markets hit a collective high but US CPI came in weaker. We should (in theory) hear the continued hawkish (all is awesome, lets raise rates) tone. Watch what happens with gold if they start to jawbone the market with dovish (real or perceived) comments… At some stage reality will need to be acknowledged or force itself unexpectedly on the market.