What Happens After the Fed Rate Rise?

News

|

Posted 20/03/2017

|

4898

So the Fed raises rates last week and gold surges… what gives? History is what.

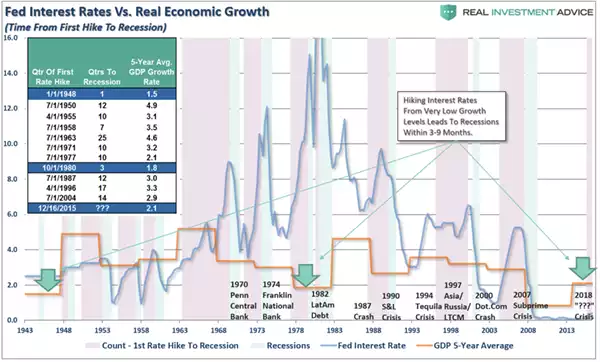

Any reader, or in particular listener to the Weekly Wrap, will know the US economy is hardly on an economic tear, it’s mild at best (the Atlanta Fed just revised down Q1 GDP estimate to just 0.9%...). The problem is that history shows that after previous rate hikes economic growth slows. The graph below shows that when this done in a low growth environment, as the US is currently experiencing, a recession has occurred within 3 to 9 months. For fun, try and spot when a rate hike has not preceded a recession or crash?

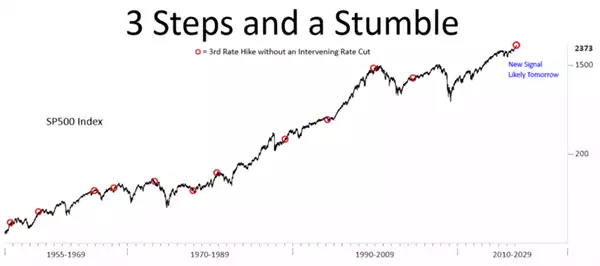

Last week Business Insider Australia ran an article titled “The Fed's 3rd rate hike could be bad for stocks” based on the ‘3 Steps and a Stumble’ adage familiar to many on Wall Street. This adage came about from the historic phenomenon of shares selling off after the 3rd rate hike in a cycle (as a reminder that happened last week…). From that article, and referring to the graph below:

““The S&P 500 has endured significantly below average results from 1 to 12 months after 3rd rate hikes in 11 events back to 1955,” they wrote in a note on Tuesday. “Six (more than half) of those hikes occurred within a year of a major cyclical top for stocks (1955, 1965, 1968, 1973, 1980, 1999).”

The only exception was in 2004, when stocks continued to rally for another three years before the Great Recession [GFC].

“Hikes are generally bad for stocks, somewhat bad for the US dollar, and bullish for 10-year yields and commodities [gold & silver],” Leveroni and Tian said.

“Will rate hikes derail stocks this time around? In a general sense, yes. Is there a deterministic formula or trigger for precisely when? Probably not.””…. You just need to be ready.