What CBDC’s Mean To Your Wealth

News

|

Posted 29/09/2020

|

9118

A CBDC is a Central Bank Digital Currency. It is a digital form of fiat currency which the government or central bank has established. The Bank of England, for example, has referred to CBDC’s as a “digital banknote” instead of a physical banknote.

Currently, there are two types of central bank money as indicated by liabilities of a central banks balance sheet. One is physical banknotes in circulation and the other being cash reserves held in commercial banks. Once a central bank introduces a CBDC, it provides an alternative to consumers to holding physical banknotes.

This means that a CBDC could potentially provide a new payment infrastructure that can bring more options to the consumer – primarily for e-commerce, where credit cards are usually the only option for payments.

There are many different ways a CBDC can be designed, each way needing the policymakers to carefully evaluate their pros and cons. A few of the factors that will need to be considered are:

- Operation

- Wholesale vs Retail

- Central bank-managed vs synthetic

- Economics

- Interest-bearing vs non-interest earing

- Deposit limit vs no deposit limit

- Technology

- Centralised vs DLT-based (Decentralised Ledger Technology)

- Programmability

- Privacy

- Token-based vs account-based

- Privacy-preserving vs non-privacy-preserving

- Transaction throughput

- Settlement finality

- Storage and custody

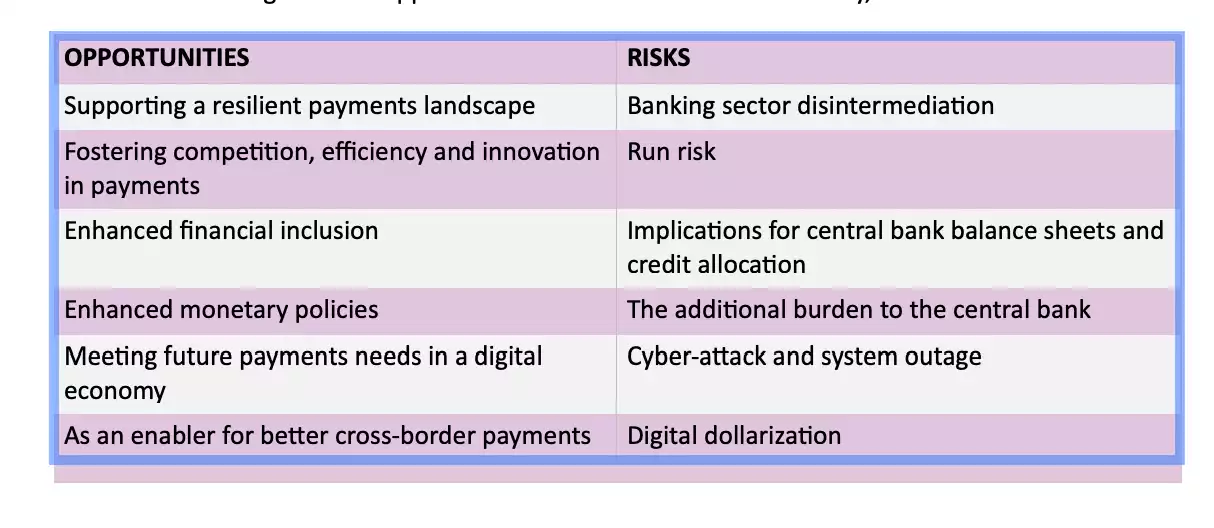

- Lending activities

The benefits of CBDC's are clear but central banks have been cautious to implement them. Why is this the case? Along with the opportunities it will create for the economy, it also has associated risks:

There is a multifaceted range of factors driving the shift to a cashless or "less-cash" society in countries across the world. Regional analysis exposes key changes in the forces driving us towards a cashless society. In western countries, convenience has emerged as the primary force driving a natural evolution towards a cashless system (which has been accelerated by the pandemic), supported by lower transaction costs that make contactless payments just as competitive as cash transactions.

A CBDC would potentially improve the safety and efficiency of both retail and large-value payment systems. On the retail side, the focus is on how a digital currency can improve the efficiency of making payments—for example, at the point of sale (POS), online and peer-to-peer (P2P) – making payments cheaper and quicker than already existing infrastructure.

The benefits of a CBDC also extend to wholesale and interbank payments. For example, it could improve and facilitate faster settlements and extended upon settlement hours. The current model for cross-border payments relies upon CBs operating the RTGS infrastructure within which commercial interbank obligations must settle. There is a list of limitations to this system. The primary restraint is that there are time lags for cross-jurisdictional payments, during which counterparties are exposed to credit and settlement risk from their correspondents.

A CBDC could also support the elimination of low-value coins through the distribution of e-change. Back in 2017, The Bank of Korea rolled out a coinless society trial, enabling customers to deposit their change onto prepaid cards instead of taking small change from their purchases. This also has cost-saving benefits as the country spent 53.7 billion Won ($AU60.5m) on producing coins in 2016 alone.

In a cashless society, it would be envisaged that there would be no coins or notes available to individuals and that all money would be exchanged in a digital format. It is not imagined that there will be a move to ban notes and coins but as the number of digital transactions increases and the withdrawal of cash from ATMs declines (a steady and constant shift towards cashless). Already the world is moving towards this – with cash transactions becoming less popular, ATM withdrawals becoming less commonplace, and the government banning large cash transactions.

It is a certainty that the government will attempt to regulate any cryptocurrency that may revolutionise the payment system. It may be found that a digital currency with Central Bank backing may be a credible alternative. The central bank's incentive to regulate and create a digital currency is so that they can steer the ship and remain competitive with other nations. You wouldn’t want to risk being left behind in this financial revolution.

So what effects would CBDC’s have on interest rates? Will this change anything?

CBDC holdings may strengthen the pass-through of the policy rate to money and lending markets. If CBDC's are interest-bearing and can be held without limits, this could affect holdings by institutional investors of other liquid, low-risk instruments (such as short-term government bills and repos backed by sovereign collateral). The CBDC interest rate would help to establish a hard floor under money market rates. An interest-bearing CBDC could make monetary policy more effective as the pass-through of interest rate changes by the CB would be more direct. If a CBDC offers a direct alternative for deposits, banks would have less ability to independently set deposit interest rates.

The overall effects of CBDC on the term structure of interest rates are very hard to predict and will depend on many factors. To attract demand, short-term government paper and overnight repos with treasury collateral would likely need to provide some yield pickup compared to CBDC. This would lead to the short end of the sovereign yield curve being above the CBDC rate

Following the financial crisis of 2008–09, several Central Banks set modestly negative policy interest rates to move aggregate demand toward potential output. It has been suggested, that the effective lower bound (ELB) on interest rates of zero has prevented the real interest rate from falling to the equilibrium negative level required to remedy the persistent shortfall in aggregate demand. This ELB exists because depositors can withdraw interest-bearing assets and choose instead to hold physical cash thereby avoid negative interest rates. Holding large amounts of cash does generate costs in terms of storing cash against security risks and the difficulty in making large payments. This cost, or negative yield, of holding cash generates the lower bound on (negative) interest rates.

It has been suggested that replacing physical banknotes with a CBDC would remove the ELB on policy interest rates, permitting the CB to implement negative policy interest rates if that were warranted by economic circumstances. Reducing the ELB can be achieved through increasing the cost or feasibility of storing cash as a method of avoiding negative interest rates. CBs could achieve this by eliminating banknotes which would lead to greater issues in terms of financial exclusion. The alternative is to remove large-denomination notes or ban larger cash transaction to increase the frictions related to holding and storing cash. The UK has to a great extent implemented this tactic by making the largest denomination note available to be £50 and Australia banning large cash transactions. Banks in Australia are beginning to move towards not accepting large cash deposits or cheques. Friction.

With a changing payments landscape, Central Banks have recognised that they too need to develop to aid this transition and incorporate new technology to stay with the times. If a private e-money issuer was to control the majority of payments in a country and there was a clear move away from the fiat currency, the CB would lose power and its ability to implement monetary policy. Against this backdrop, Central Banks are trying to understand the financial and economic impact of introducing their own digital currency.

Introducing CBDC would have a seismic effect on the banking system. A wholesale CBDC provides citizens with an alternative and safer means of storing money, thereby reducing the deposits held with commercial banks. The greater competition for deposits may lead to higher deposit rates for depositors at the commercial bank and new innovation to encourage saving and borrowing.

The impacts of a CBDC will be influenced by the availability and design of the CBDC, the form of which is open to many different options. The CBDC implementation will also be impacted by the regulatory regime introduced by the CB to support commercial banks. At this stage, many countries are in an exploratory stage. Each CB will need to consider the impact that they wish a CBDC to have; on monetary policy which will be determined by whether or not the CBDC bears interest, the personal and commercial implications and the viability of implementation using existing technology.

So, what does all this mean for our crypto investments?

In all likelihood, this digital currency will be connected in some way to an existing fiat currency or take the Libra approach of being backed by multiple currencies. The CBDC could theoretically even have a mix of crypto backing the currency. Stable coins are a rapidly growing segment of the crypto marketplace, and a CBDC is a natural extension of that existing trend. Specifically, as the blockchain and crypto experience more closely replicates that of the traditional banking experience, the easier it will be to expand the user base.

Building on this connection, it would be reasonable to forecast that a CBDC would have lower price volatility than some of the other options currently available. Reduced volatility, and the backstop of a central government or central bank, might also reassure individuals and merchants that have been hesitant to accept or use crypto to date.

The concept of a CBDC might seem like a new idea or something that will require large amounts of incremental investment, but that is an incomplete view of the situation. Digital currencies and virtual currencies exist and are used by millions of people daily via e-commerce and peer-to-peer platforms. In other words, the infrastructure for a widely used and accepted digital currency already exists, and could serve as a model for future CBDC initiatives.

Announcements by several global credit card companies seeking to, in essence, convert existing fiat currencies to blockchain-enabled digital versions reinforce the idea that the infrastructure for wider CBDC development already exists.

Viewed through the lens of a crypto purist, the idea of a CBDC might seem like a betrayal of the essence of what blockchain and crypto were supposed to represent. Acknowledging that, it is also important to keep in mind that the true potential of blockchain and crypto will not be realised until it achieves mass-market adoption. Numerous obstacles continue to stall wider usage; technical complexity, unfamiliar user interfaces, regulatory ambiguity, and concerns over how to disclose, report and insure crypto assets.

CBDCs might not have been the original idea of blockchain and crypto, but the continued development of them is good news for blockchain and crypto adoption.

It's important to remember that Central Banks love to print money and it's almost a certainty that they will create a digital currency without a supply limit. Much to the contrary, crypto-assets such as bitcoin have a hard supply limit. Even as the world moves all finances to the digital space, it's going to be even more prevalent to own inflation hedging assets such as bitcoin, precious metals including gold and silver-backed cryptos such as our AUS and AGS tokens.

This all of course also reinforces the clear government objective of removing cash from our transactions. Precious metals and decentralised large cap cryptocurrencies like Bitcoin and Ethereum become the logical place to hold ‘cash’ in an increasingly digital and centralised world.