Weight of Debt v Hope

News

|

Posted 26/05/2016

|

4755

We speak often of debt being the core catalyst for the world’s next financial crisis, as indeed, it was for the last in 2008/09. As the world learned (and seemingly shrugged its shoulders) in 2014 from the McKinsey report, we have not learned from the GFC but instead doubled down, adding 40% or $57 trillion of debt in the years since to try and reflate the system. A chunk of that debt has been companies borrowing to buy their own shares to prop up their share price. But at some stage the sheer weight of that debt becomes too much. As usual Vern Gowdie says it nicely:

“Global debt has reached the stage where it’s now counterproductive. Debt, once the fuel of economic growth, is now a lead weight. Never before in the recorded history of money has there been a cumulative debt pile (measured as a percentage of GDP) as large as there is today. Every recorded period of excessive debt accumulation has ended in a crisis.”

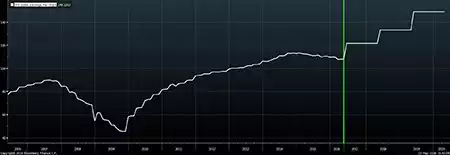

If you take that weight analogy and apply it to the chart below of US company earnings it makes a lot of sense. You can see the gradual decline in earnings under the weight of that debt. The really sad thing is (for those believers going ‘all in’ on shares) is that the projected earnings, to the right of the green line, are so easily and unquestioningly believed by some. This is investment by ‘hope’ not logic.

It’s also a little instructive on the discussion above. The only time such fast growth in earnings occurred before was in the debt and easy money fuelled rebound of 2009. That was both after a crash and in response to new fresh debt. What we have now is the pattern of before the crash under the weight of all that accumulated, and no longer fresh, debt. The evidence just keeps on building, day by day, measure by measure….