Wall St Tanks as Silver Shines

News

|

Posted 05/12/2018

|

5954

It was another nightmare on Wall St last night with the Dow down 800 points (3.1%) and the NASDAQ even worse, down 3.8%. Conversely gold was up 0.9% and silver 1.3% despite a stronger USD.

There were a number of factors including the realisation that the rally on the positive signs of a truce on the US v China trade war was premature as the reality is far less certain, the US Treasury yield curve turning negative (inverting) for the first time since before the GFC, and the Brexit fiasco going from bad to worse.

Firstly, on the trade truce, there was confusion within the white house around the robustness of the 90 day timeline supposedly agreed between Trump and Xi, and of course Trump couldn’t help but fuel the fire by tweeting that he questioned “whether or not a REAL deal with China is actually possible” (his capitalisation) and then:

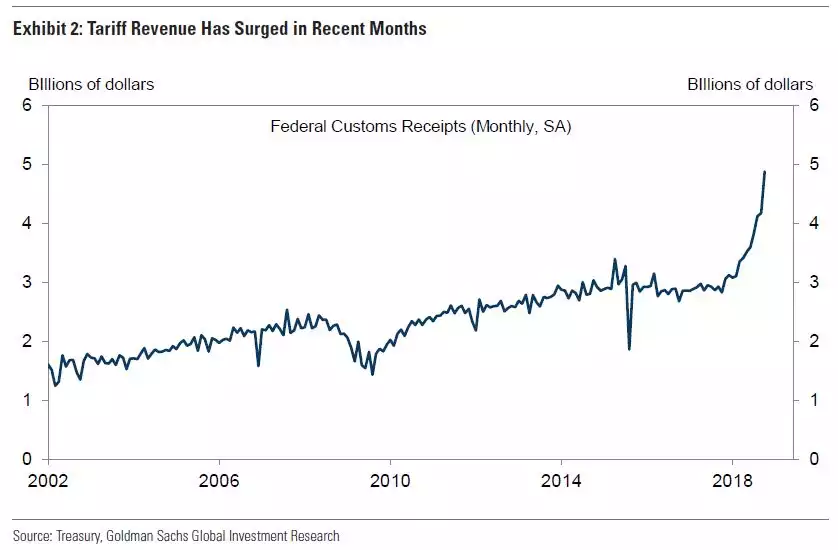

Check out just how many billions:

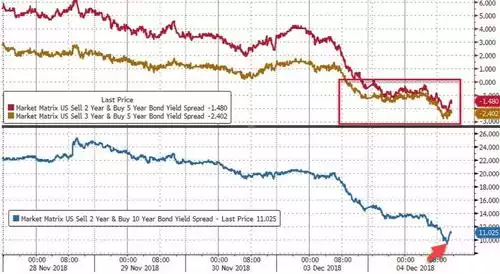

That fuelled a fire already burning with the inversion of the 2s5s (difference between 5yr and 2yr with negative meaning lower yield for 5 than 2) first, then the 3s5s, and the 2s10s (that considered most important as a recession bellwether) plunged to single digits.

That means a couple of things (and we last discussed this here). Fundamentally the market is saying that economic growth will be worse next year and the Fed will not only not hike but they are pricing in a cut to rates in 2020. Hardly supportive of such high equity market valuations and hence the correction last night.

The flat to inverted yield curve is also problematic for banks as we explained previously here. In essence it robs them of revenue at a time when they are already struggling. To wit:

- Global Systemically Important Banks are down 30% from 52-week highs.

- US Financials down 14.5% from 52-week highs.

- Goldman Sachs is down 33% from 52-week highs.

As a reminder, this is what has happened the last couple of times yields inverted…

Finally last night also saw the Theresa May / Brexit drama take a decidedly bad turn when she was found in contempt of parliament (an unprecedented event in the UK) and forced to handover her legal advice on the treaty she is trying to push through. She subsequently declared the choice before parliament is this deal, no deal, or risk of no Brexit at all. That essentially means her compromise deal, a hard Brexit (which would be very nasty) or essentially off to the polls for another referendum and the turmoil that would bring to the country. It’s a complete mess and the pound plummeted to an 18 month low.

And so whilst a stronger USD would normally weigh down on gold and silver, both rose amongst all of this as the market appears to see the need for a safe haven amongst all of this risk….