Venezuela Pays Debt With Real Money

News

|

Posted 26/02/2016

|

6324

This week Venezuela is in the media again. The troubled South American country is drawing upon its real money reserves (gold) to pay its cash obligations. News just released states that according to the Swiss Federal Customs Administration, $1.3 billion in gold bars was shipped from Venezuela in mid-January which happened to be just weeks before two debts payments fall due. One such payment of $1.5 billion is due today.

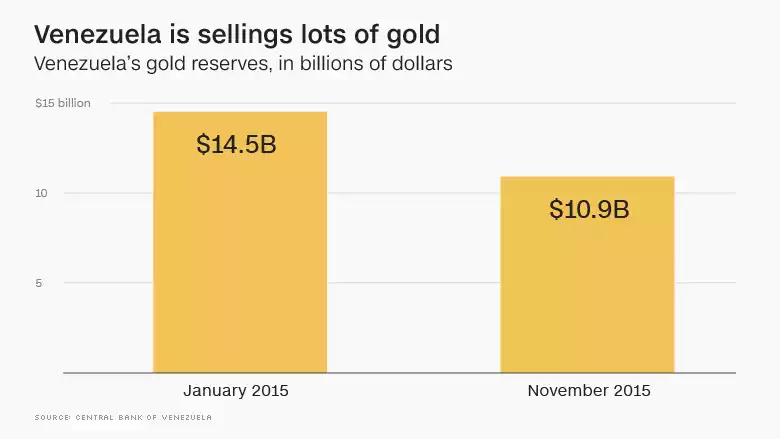

The need for this stems from the country’s battles on a number of fronts including runaway (triple digit) inflation (the IMF predicts 720% this year in the Bolivar) and the maintenance of its heavy social obligations in the face of the oil price carnage that has damaged its balance sheet. Approximately 95% of Venezuela’s revenue is derived from crude. Venezuela is drawing upon its gold reserves to bridge the cash shortfall and just this week, data was released on its total reserves including gold holdings of $10.9B as the chart below from the CBV indicates.

The shipment to Switzerland is a little unusual and follows the repatriation of Venezuela’s gold roughly 4 years ago by president, Hugo Chavez. The Swiss involvement is speculated to either be for the purposes of verification and sale or for use as collateral in gold swap deals for the procurement of cash.

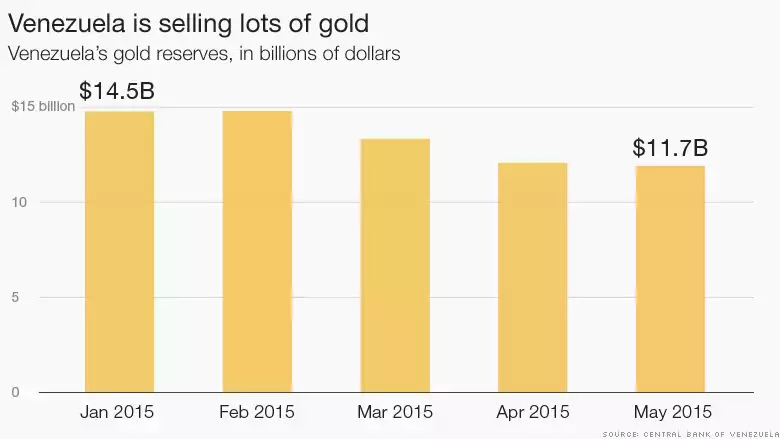

This most recent drop in gold reserves occurs within a climate of central bank gold accumulation which speaks to the desperation of the situation in Venezuela. This gold reduction is actually the most recent move in a continuing trend for Venezuela with articles late last year identifying similar behaviour as the country’s economy crumbles (see chart below). Predictions of a default by Venezuela are now prolific (possibly in the last quarter of this year when $5 billion in debt is due) if China (one of the popular sources of finance) is unable or unwilling to assist.

Developments in Venezuela’s environment of hyper-inflation and financial stress continue to prove gold’s relevance as a modern financial tool. Other recent examples are also available and Philip Haslam’s post-GFC (2014) book “When money destroys nations” as a study of Zimbabwe’s hyper-inflation is one excellent example of the value of hard assets to the investor. One of the numerous anecdotes contained within includes the wide-spread purchasing of motor vehicles (despite the lack of fuel to drive them) in a desperate attempt to acquire anything physical instead of holding cash. Whether talking about the scale of nations or individuals, the principals of sound money remain equally virtuous.