Vaccines don’t cure debt

News

|

Posted 20/11/2020

|

7062

Findings from the IIF (Institute of International Finance) and a warning from the IMF (International Monetary Fund) bring the hope trade off the back of vaccines starkly into contrast as the world sinks under debt.

Speaking at the close of the Bloomberg New Economy Forum Kristalina Georgieva, managing director of the International Monetary Fund, said she was going to urge the world’s richest nations at the G20 meeting this weekend to continue their support for economies racked by the pandemic, despite the promising vaccine news in recent weeks.

“A second wave of infections is slowing down the recovery; it is losing momentum,” Georgieva said. “It is so important that we don’t pull back until we see the health crisis in the rear-view mirror.”

So in other words, more stimulus, more debt, more debasement of currencies until well after this pandemic goes away.

Topically the IIF just released its latest quarterly Global Debt Monitor report which unsurprisingly reported a yet again new all time high global debt pile. From the report:

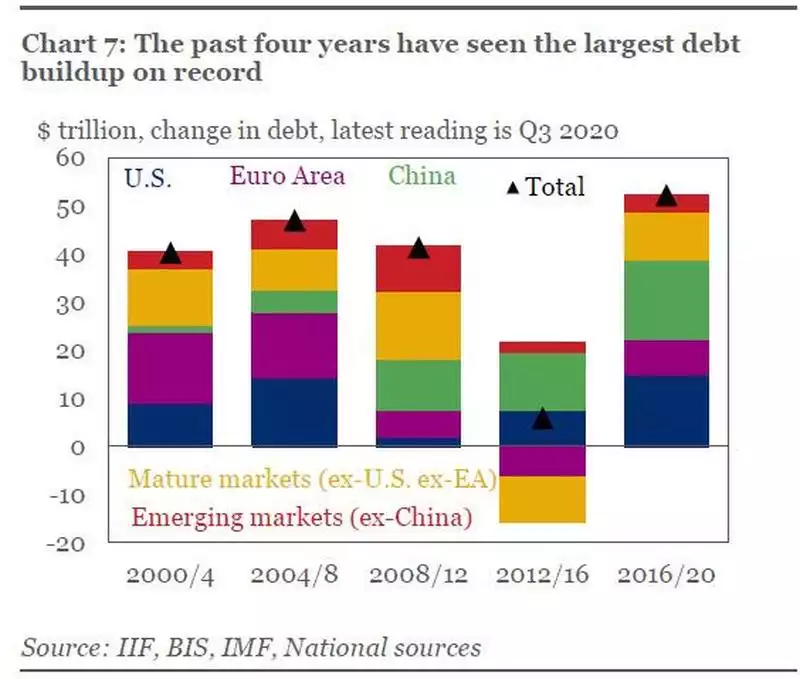

"The pace of global debt accumulation has been unprecedented since 2016, increasing by over $52 trillion. While some $15 trillion of this surge has been recorded in 2020 amid the COVID-19 pandemic, the debt build-up over the past four years has far outstripped the $6 trillion rise over the previous four years and over earlier comparable periods,"

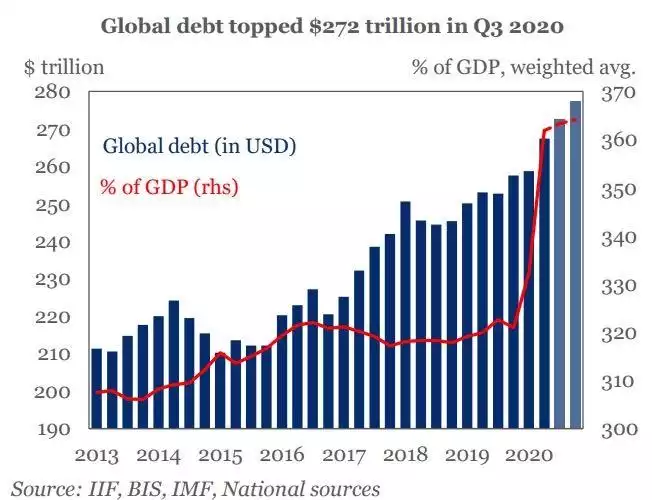

Strong rises in both government and corporate borrowing as the COVID-19 pandemic drags on has seen global debt increase by $15 trillion in the first three quarters of 2020 to more than US$272 trillion.

"With little sign of a slowdown in debt issuance, we estimate that global debt will smash through records to hit $277 trillion by the end of the year,"

"Following a record surge in global debt-to-GDP (from 320% to around 362% in the first-half of 2020), the rise in the third quarter of 2020 was more modest, at less than two percentage points—helped by the strong global recovery. We expect that the global debt-to-GDP ratio will reach some 365% of GDP in 2020."

Just look at the parabolic nature of the red line below…

However that relies on a continuation of the so called V shaped recovery prior to this second wave, which is exactly what the IMF alluded to and we discussed earlier this week. That “more modest” 2% could quickly unravel.

And so going forward? From the report:

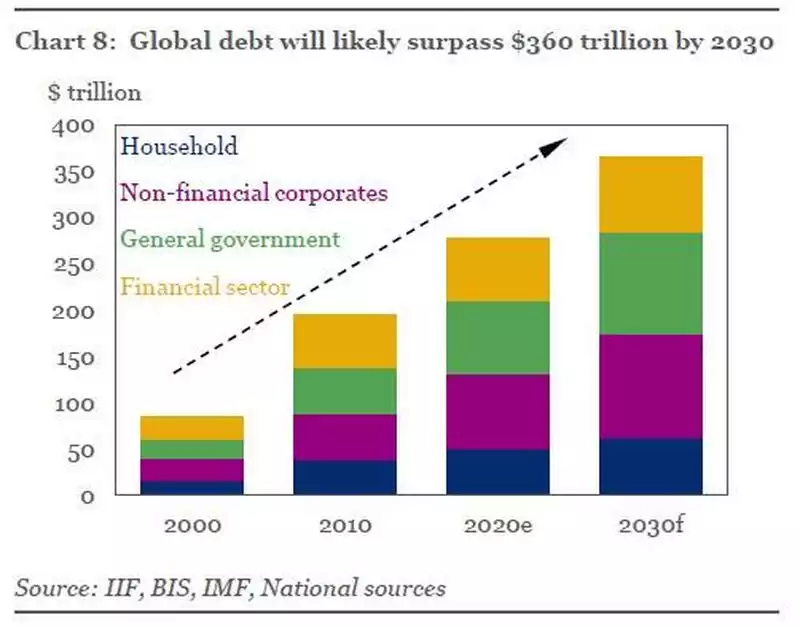

"As a result, there is significant uncertainty about how the global economy can deleverage in the future without significant adverse implications for economic activity. The next decade could bring a reflationary fiscal response, in sharp contrast to the austerity bias in the 2010s. If the global debt pile continues to grow at the average pace of the last 15 years, our back-of-the-envelope estimates suggest that global debt could exceed $360 trillion by 2030 - over $85 trillion higher than current levels."

Lets just unpack that a little. At the onset of the 2008 GFC, a crisis borne of too much debt, the IIF’s global debt figure was $168 trillion. The global response to that debt crisis was to pile into more debt. At the onset of the pandemic the figure was around $255 trillion. So in 11 years we added around 50% more debt, or $87 trillion or nearly $8 trillion per year. Unsurprisingly that debt load was starting to materially drag the global economy before the pandemic even took hold. The debt was largely inflating asset bubbles as opposed to a productive economy, further exacerbating that debt burden drag effect. Since the pandemic we have added a staggering $18 trillion in just 9 months or $24 trillion annualised, 3 times the pace since the GFC.

We haven’t reminded you in some time about the word trillion. It’s one we weren’t even using in finance at the turn of this century. 1 million seconds is 12 days. 1 billion seconds is 32 years. I trillion seconds is you saying one-Mississippi for 31,710 years….

A vaccine may save some lives but it appears way too late for it to save the global economy.