USD Spikes PM’s Fall – But ‘Impossible Trinity’ Remains

News

|

Posted 04/06/2021

|

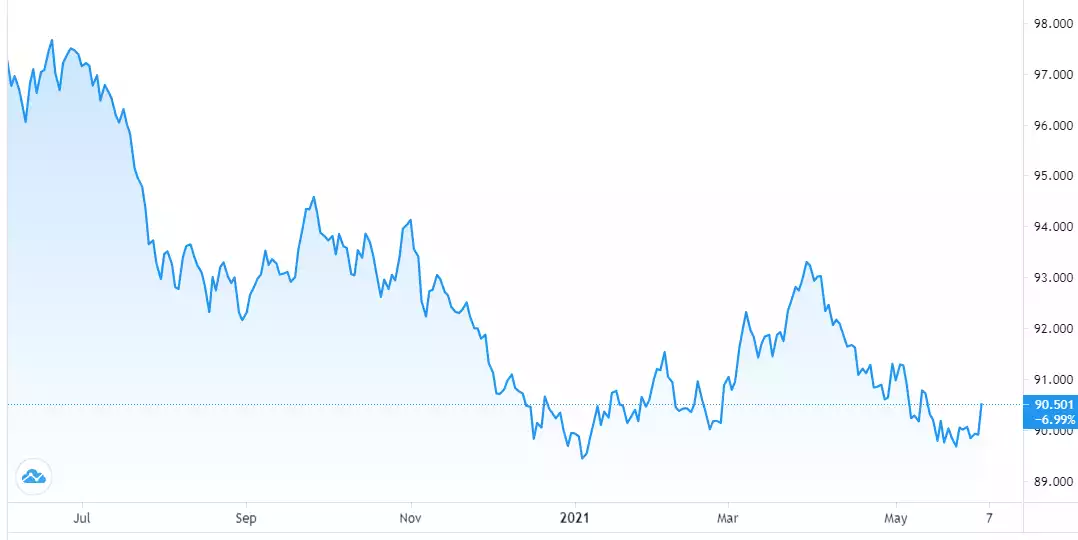

7668

Last night saw the biggest daily gain for the US dollar since September last year on the back of better than expected employment figures via the ADP ahead of the all important NFP employment figures tonight. The USD index jumped 0.65% and back above 90 to 90.5 (see chart below). The spike saw nearly all financials in the red and USD gold smacked down nearly 2% and back under the $1900 line to $1870. Silver was down over 2.5% and back under $28 to $27.53. The AUD dropped to 76.6c on the back of the USD rise and cushioned the falls in AUD terms to 0.8% and 1.4% respectively.

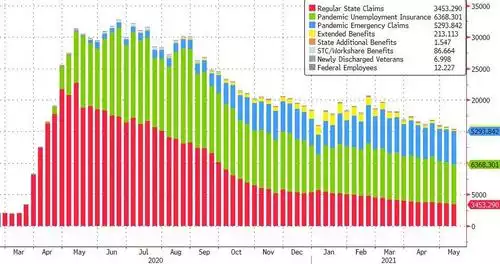

The employment figures saw first time jobless benefit claims fall to 385,000 last week, the 5th week in a row of falls and the lowest since the start of lockdowns in March last year.

Whilst great news (including for inflation!) it has prompted nearly half of the US Governors to bring forward an end to the Federally funded COVID unemployment programs from next week affecting around 4m workers on a $300/wk subsidy. There is widespread concern this will not lead to more hiring but rather slow the economy. The employment data glosses over the fact that over 15.4m Americans are on some form of government employment benefits, dwarfing that 4m.

So how ‘sticky’ is this stronger USD? Global Macro Insider’s Julian Brigden (Rauol Pal’s partner in GMI) has been calling this inflation surge for some time, arguing it is not transitory, and also calling for a much weaker USD, which until last night too was playing out on trend. Does last night change anything? No.

“Normally, an economy this strong should be bullish for equities. But we remain worried about US stocks. They continue to be extraordinarily expensive and investors remain beholden to ‘growth’ names that have yet to show any sign of adjusting to the move higher in long rates in nominal terms, notwithstanding a rather volatile attempt at growth/value rotation.

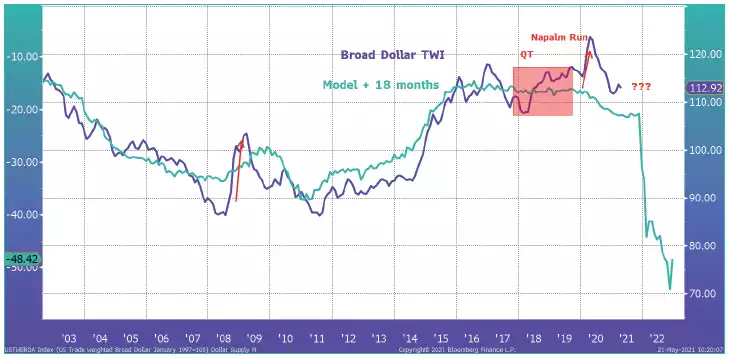

Ultimately, if I am right about inflation, then bonds are sitting in the eye of the storm and, at some point, the Fed will have to face its trilemma or – as I prefer to call it – the Impossible Trinity. I touched on this a little on the Insider Talks session with Raoul and also in the May In Focus. Does the Fed hike rates to address pressure at the long end of the curve at the risk of catapulting the dollar higher and threatening stocks, the economy and the Biden Administration’s political goals? Or does it choose to support bonds, equities and the Administration, sacrificing the dollar?

Since the GFC, the latter has consistently been their M.O. It was also precisely what happened in the late 1960s. If I am right, then after a bit of pain to demonstrate that their hands are well and truly tied, the dollar will be allowed to take the strain, and our models suggest we could be looking at an extreme decline.”

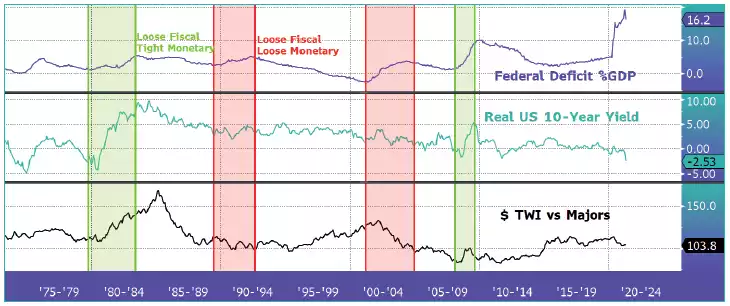

“To attract the capital the US requires, we will need either higher yields or a lower dollar or some combination of the two. As I have discussed, I believe the trigger for the dollar’s next leg lower will be a shift to looser fiscal and monetary policy (flat to lower real yields). Historically, this has been a toxic combo for the buck and, given the dollar chart above, will be the catalyst for a major decline.”

Brigden talks about the Impossible Trinity above. This is abundantly evident when you consider that we are now in territory where the total market cap of US shares is now twice the size of the entire US GDP. Just let that sink in…

As Raoul Pal points out above, when measuring things such as market cap of shares against USD we are losing the perspective of the sheer amount of that fiat USD that has and is being created. Pal compares these to the US Fed’s balance sheet as a proxy for the latter and it changes the perspective incredibly. The minute the Fed tries to reign in that stimulus things turn very nasty. This reinforces Brigden’s Impossible Trinity and the prospect of a tanking USD and rising precious metals.