Silver Demand Continues to Surge

News

|

Posted 20/07/2020

|

11507

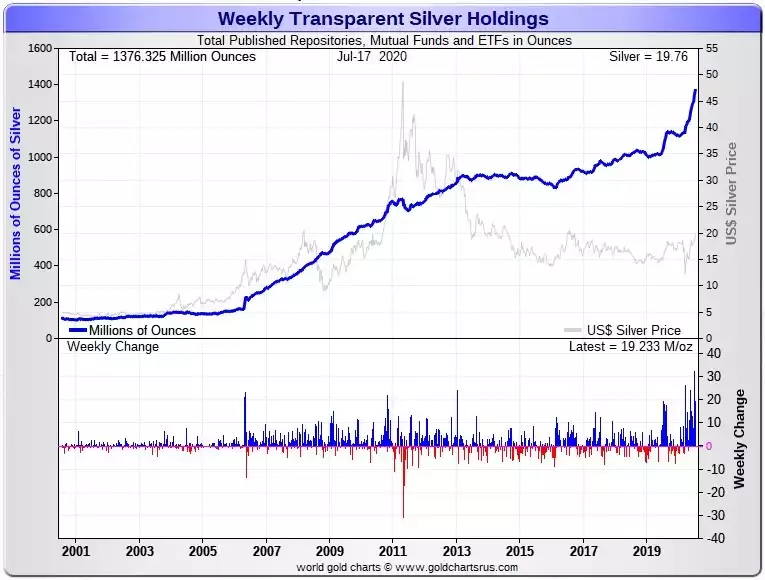

Another week and another massive inflow of silver into ETF’s, some 19,230,000 oz or nearly 600 tonne in just one week. For context that is about 3m oz more than was mined globally in the same period…

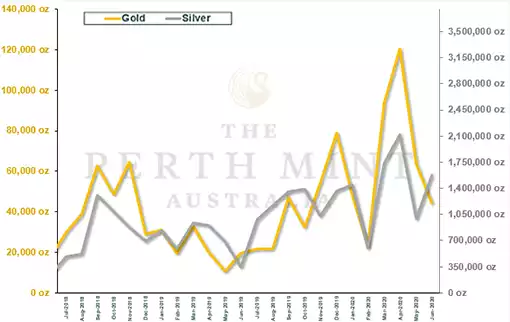

Now that is just ETF’s and mutual funds etc. On top of that is all the bullion produced for those buying the direct metal, not the paper promise. Perth Mint recently released their figures for June 2020 and showed sales that were only ever exceeded by March and April this year.

Their figures curiously only included minted product and hence don’t include cast bars or their other storage products. The figures marry with our observations in store with a slowdown in May when people started to relax and think ‘we’d got through it’. June came with the realisation we hadn’t, and July is already shaping up to much stronger demand again with the 2nd wave proving to be a very real phenomenon, not just a possibility. From CoinNews.net:

“Perth Mint sales of gold coins and gold bars tallied to 44,371 ounces in June, down 30% from May but 128.1% higher than in June 2019.

Gold sales through the first half of 2020 at 393,263 ounces are 194.1% higher than the 133,700 ounces sold during the first half of last year.

Perth Mint sales of silver coins and silver bars totaled 1,573,752 ounces last month, marking gains of 57.8% from May and 356.9% from June 2019.

Silver sales through the first half of this year at 8,486,395 ounces nearly doubled the 4,281,258 ounces sold through the first half of last year.”

In addition to these figures not including cast bars, they are remarkable for the fact that for much of this market activity since the effects of COVID playing out, Perth Mint has not been able to keep up with market demand, halting or severely limiting wholesale orders of most of their silver (and indeed gold too) product line. In other words if they had the supply and production capacity, the numbers would have been much higher.

This strong demand for silver continues to put pressure on supply which is playing out in premiums from mints and refiners still at elevated levels despite gold premiums retracing more so. This disconnect between what you need to pay for physical compared to the ‘paper’ dominated spot price is not a new phenomenon as the physical realities play out. Add in freight logistics costs and the effects of COVID-19 are in plain sight.

Until recently that silver spot price was not responding to these forces and the supply / demand / price equation appeared momentarily broken. As we wrote last week, that now seems to have started to correct with the price both surging this month and the important resistance of US$19 both broken and held. Only further hindsight will allow us to know if that March low was the end of the silver secular bear market, but it certainly appears robust so far and hence the appeal for some of silver over gold which bottomed in late 2015.

Most bullion dealers still are taking pre-orders for most of their silver lines as they struggle with supply lags. Ainslie has long established and robust supply lines meaning we have nearly all silver lines currently available, and where we don’t, we clearly tell you up front in the webshop for each. As Perth Mint’s Primary Distributor we also have all available Perth Mint product for sale now too.