USD AUD GSR - Gold & Silver

News

|

Posted 02/09/2015

|

4688

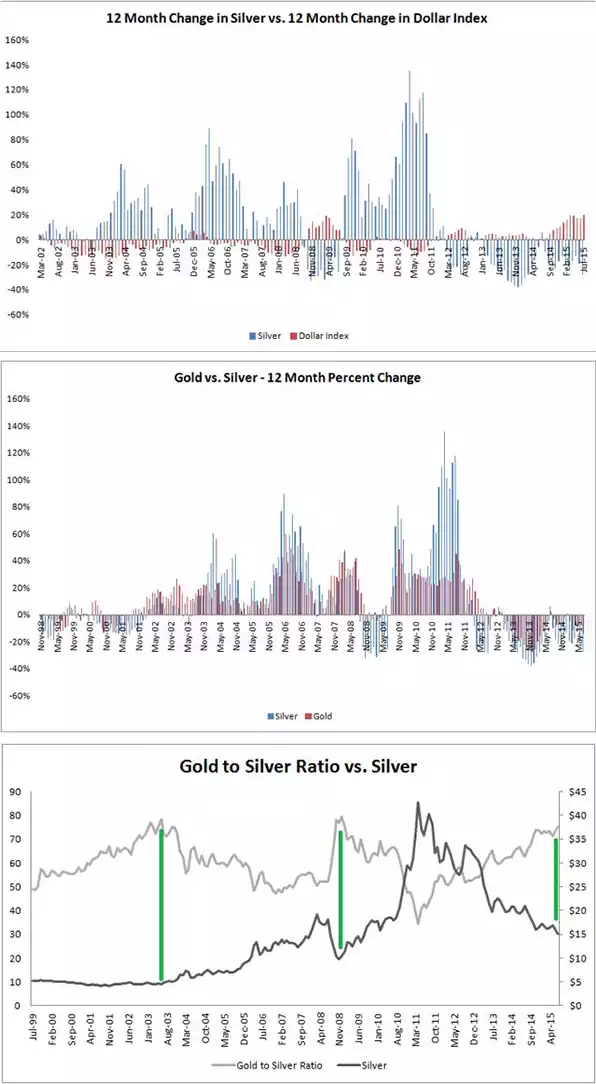

In the first of the scenarios we discussed yesterday, we touched on the correlation between rising Discount Rates in the US courtesy of the Fed and the USD falling. This is contradictory to a lot of commentary that predicts a rising USD this time. Over the last 42 years every time the Fed has increased the discount rate the USD has declined 10-12% and as discussed yesterday there is a strong correlation between a falling USD and rising gold and silver prices. Check out the chart below for silver.

Some might be thinking however that a falling USD will mean a rising AUD as in the recent past there has been a decent correlation to that effect. However the current market forces need to be considered. Last night we saw another crash on Wall Street and the USD coming off. But the very same cause of the crash also saw the AUD come down to just 70c. Why? Because it is the troubled Chinese economy (last night was due to bad manufacturing data) that looks like it might be the ‘prick’ for this unprecedented global financial assets bubble. Anyone listening to Ross Greenwood on Today this morning or indeed most commentary knows Australia is in for a very rough period ahead as the mining boom is over and we have little else to give us real growth. Canada is a worrying preview of what we have ahead of us. So there is little support for a higher AUD and indeed most are calling 60’s. That is good news if you own gold and silver as you get the double whammy of a likely rising USD spot price, turbo boosted by a falling AUD. It potentially becomes a triple whammy for silver holders as the gold silver ratio is so high. The charts below show clearly the more volatile nature of silver – seeing higher highs and lower lows.