US - Recession v Rate Rise

News

|

Posted 05/08/2015

|

4073

As discussed many times, much of the pressure on gold is the expectation of an imminent US Fed rate hike because everything is so awesome. We’ve also established public consumption is the key component to GDP growth. The precursor to consumption is either producing the goods to be consumed or importing them. So where is the US right now on that measure?

On importing – the latest ISM Index showed the import component falling to its lowest in 3 years.

The graph below appears to paint an incredibly clear picture of US factory orders (making things to consume). They have just dropped YoY for the 8th month in a row – the longest streak of declining factory orders outside of a recession in history. We say ‘appears’ because if you remove the defence aircraft component (up 21% courtesy of, you guessed it, US government deficit spending…aka debt) it is actually much worse. The pink vertical bands indicate previous recessions.

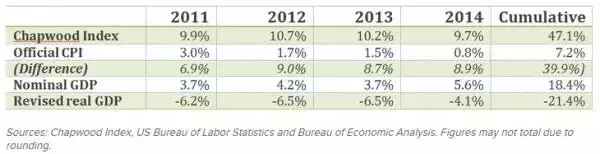

The reason there is no pink recession band in 2015 in the chart could simply be the changes made over the years to how CPI (inflation) is calculated and the subsequent effect on real GDP. There is one index that hasn’t changed and that is the Chapwood Index – defined as follows - "The Chapwood Index reflects the true cost-of-living increase in America. Updated and released twice a year, it reports the unadjusted actual cost and price fluctuation of the top 500 items on which Americans spend their after-tax dollars in the 50 largest cities in the nation.". If you apply that index to GDP, the US is already in recession anyway. Pretty rare for rates to rise in a recession…