US Fed Hikes with Dovish Twist

News

|

Posted 20/12/2018

|

6522

Further to our preview yesterday, last night the Fed took option 3 and gave a somewhat ‘dovish hike’ in that they did indeed hike as most expected, up another 0.25% to 2.5%, but they wound back their expectations for 2019 to 2 more hikes not the previously conveyed 3 (though some still expecting 3).

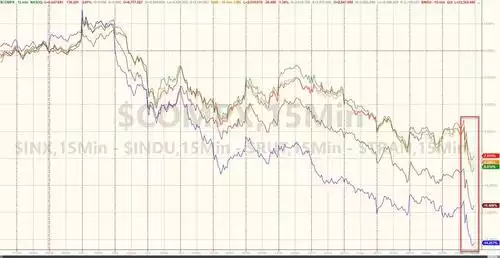

But it wasn’t dovish enough for markets, with many saying it was more hawkish than expected, and from the high of the night the Dow crashed 800 points (around 3%) to finish the session down 352 points or 1.5%. The NASDAQ faired worse down 2.2%.

That crash didn’t come all in one hit though. There were a couple more legs when the Fed Chair, Jerome Powell further clarified they have no intentions of easing off the Quantitative Tightening process of reducing their bond hoard. To wit:

“Some years ago, we took away the lesson that the markets were very sensitive to news about the balance sheet, so we thought carefully about how to normalize it and thought to have it on automatic pilot, and use rates to adjust to incoming data. That has been a good decision, I think, I don't see us changing that.... we don't see balance sheet runoff as creating problems"

Well… clearly the market disagreed…

If December wasn’t already bad enough, last night made it worse. Now easily the worst December since 2008

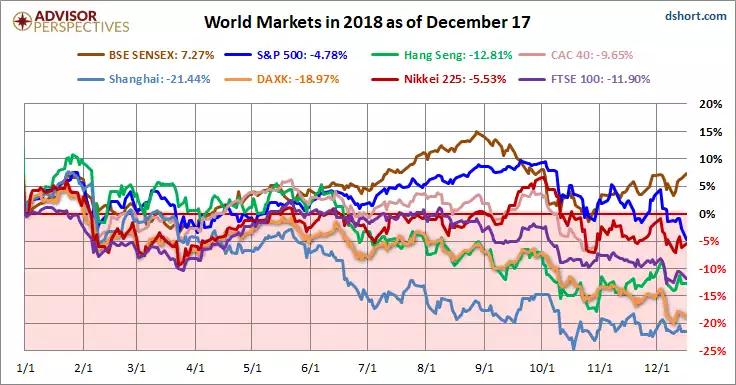

…and indeed the worst year since 2008 as well. It’s not just the Dow but all major indices are in negative territory for 2018.

As you can see in the top chart gold came off slightly on the news, down around $7 but held stronger in comparison to financial markets. Silver was more resilient, only down 4c. The stronger USD saw the AUD fall and therefore dish up some good gains of around $10 for gold and 10c for silver in the local currency.

Yesterday we talked of the Fed acknowledging Trump’s plea not to hike whilst the world is ‘blowing up’. Well they kind of did…

"[Fed] will continue to monitor global economic and financial developments and assess their implications for the economic outlook."

This is what the world markets look like year to date:

You can take a couple more percent off the S&P500 (blue line) since this was prepared. As you can see India (brown line) is the only major market in the black for 2018 and China is pushing 25% losses (our ASX is down nearly 8% too).

And so only time will tell where to from here. The Dow is down 10% since the last hike in September. What will it be by the next after this December hike? The Fed knows it needs to build its artillery for the inevitable crash that’s getting closer and closer. And so in the face of causing a sharemarket crash, EM chaos, a flatter and flatter yield curve, and the disdain of the US President let us leave you with Powell’s words last night:

“Nothing will deter us from doing the right thing”

Good luck with that. It’s a comforting time to hold precious metals.