US Faces Downgrade on Soaring Debt

News

|

Posted 13/02/2018

|

7051

As rating agency Moodys issued a warning to the US that it may see a downgrade in its credit rating and another Government Shutdown was narrowly averted, we see the results of the latest US Budget showing…. More debt!

Last week Moodys warned:

“The stable credit profile of the United States (Aaa stable) is likely to face downward pressure in the long-term, due to meaningful fiscal deterioration amid increasing levels of national debt and a widening federal budget deficit….Moody's has already indicated that rising entitlement costs and rising interest rates will cause the US's fiscal position to further erode over the next decade, absent measures to reduce those costs or to raise additional revenues. The recently-agreed tax reform will exacerbate and bring forward those pressures.”

Such a move would be only the second time in history after S&P’s famously downgraded the Obama administration’s rating on the back of the Government shutdown on yet another debt ceiling showdown.

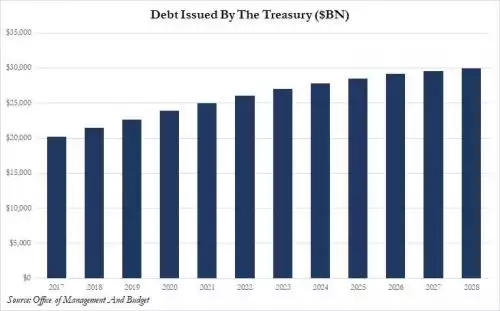

Whilst a shutdown was averted in the middle of the night on Friday and the debt ceiling can kicked down the road for a couple of years, the true extent of what that might look like has just come to light with the new budget passing. So, in the context of the US debt jumping to $20.7 trillion on the removal of the ceiling, spiking bond yields (the 10Y UST hit 2.9% on the news) and market volatility amongst concerns of the impacts on rates and inflation….we learn the US Debt is projected (and remember they nearly always under estimate) to reach $29.9 trillion by 2028:

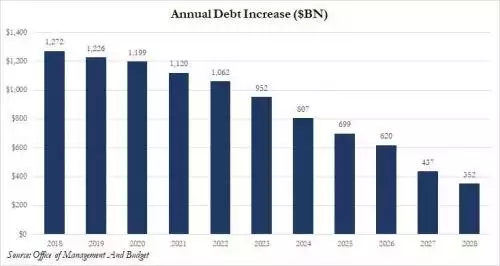

…after increasing more than $1 trillion for each of the next 5 years and miraculously reducing to ‘only’ a $352b increase by 2028…

But we shouldn’t be concerned as we then heard these reassuring words from Trump’s director of the Office of Management Budget:

“This is not a fiscal stimulus; it’s not a sugar high,” (referring to the $1.5 trillion tax cut). “If we can keep the economy humming and generate more money for you and me and for everybody else, then government takes in more money and that’s how we hope to be able to keep the debt under control,”

Did you catch the key word and technical input parameter in there? “hope”….

In another interview, noting the risk of a “spike” in interest rates with such a debt burden, he conceded rising budget deficits are:

“a very dangerous idea, but it’s the world we live in.”

What could possibly go wrong….