Turkey and Venezuela turn to gold

News

|

Posted 25/11/2021

|

6973

Gold is going parabolic in Turkey just as the citizens of Venezuela turn to flakes of gold to pay for goods and services. Yesterday, the Turkish Lira fell to a historic low in USD terms, as annual inflation now nears 20%. They aren’t the only two inflation hot-spots, with threats of “super-inflation” brewing across the globe.

Earlier this month, the Venezuelan government took six zeros off the Bolivar. The one million bolivar note was previously the highest denomination note, has been replaced with a one-bolivar note. The two notes are both worth less than US$0.23. At the same time, a new 100-bolivar note has been released - worth a cool 100 million in the old Bolivar. The move reduces the burden of carrying around bundles of notes, with a loaf of bread costing 7 million of the old bolivars.

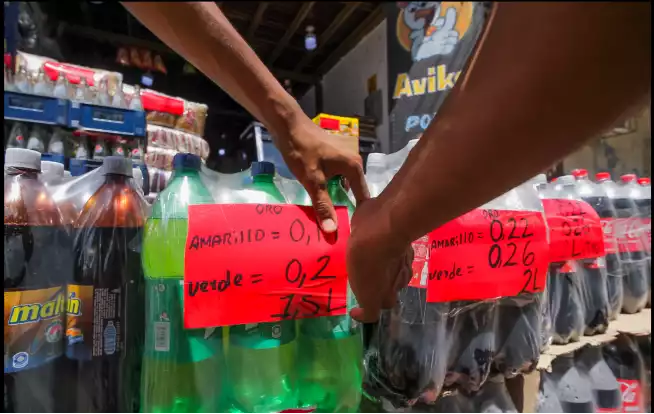

Close to the Colombian border, the Colombian peso functions as a medium of exchange, in the south, the Brazilian real holds sway, whereas in Caracas, the US dollar functions as a store of value for locals in the capital. In the remote areas of Tumeremo and El Callao, pure gold is used as currency. With the region being home to numerous producing mines, workers are paid in gold flakes that can be peeled with tools. Prices are quoted in grams of gold. A haircut will set you back an eighth of a gram, while a night in a decent hotel will leave your pocket half a gram lighter.

Source: Bloomberg. Oro = Gold; Amarillo = Yellow; Verde = Green.

Gold holders in Turkey may take some solace in the preservation of their purchasing power with gold going parabolic in both Gold and USD terms this year.

The run on the Lira is dramatically reducing living standards with scores of reports of regular wage earners now struggling to buy food. While the President argues that reducing borrowing costs will promote growth, lending and business expansion. While that typically is true, there are limits, and it seems that Turkey is now tumbling down that precipice.

Turkey may not be the only country facing a currency crisis according to famed investor Mark Mobius. Mobius argued that countries that have significant debt denominated in USD are likely to be hit hard if there are any increases in borrowing rates in the US. This is supported by a recent report from investment bank Nomura that has placed Egypt, Romania and Sri Lanka in the currency crisis crosshairs.