Trouble Ahead for USD?

News

|

Posted 30/04/2018

|

7411

The news last week of Turkey having repatriated its gold sitting in the US Federal Reserve again highlighted the changing dynamics currently at play in the world. Turkey has 18% of its reserves in the form of 220 tonne of physical gold, that’s about $25b worth.

In announcing the move the Turkish president also declared that international loans should now be made in gold instead of the USD hegemony. Last week we saw Iran announce it was shifting to the Euro over the USD and of course we have reported previously the direct trade between giants China and Russia without a USD changing hands, and the gold backed Yuan based oil contacts challenging the petro USD.

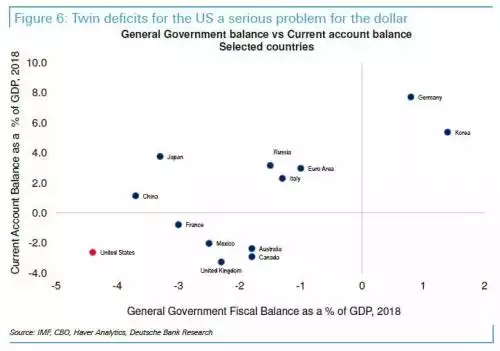

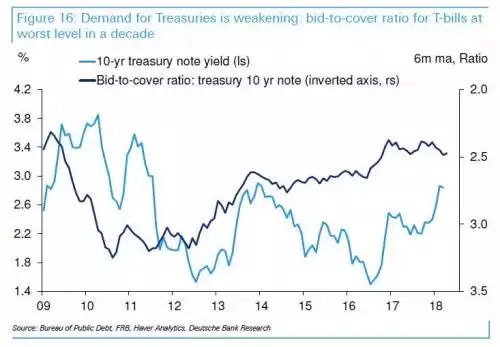

Of course one of the main vehicles for the USD is buying US debt in the form of US Treasuries. Last week saw a new record short (betting on bond prices dropping) position of $1.1 trillion for 10 year bonds. As Deutsche Bank pointed out last week the US is running “twin deficits” in that they have a fiscal deficit (spending more than tax coming in) and a current account deficit (the value of its foreign liabilities outgrew its assets). That means it is completely reliant on the sale of more and more debt in the form of those US Treasuries. The chart below shows they are the worst in the world in this double whammy situation. Note Australia is in the same boat…

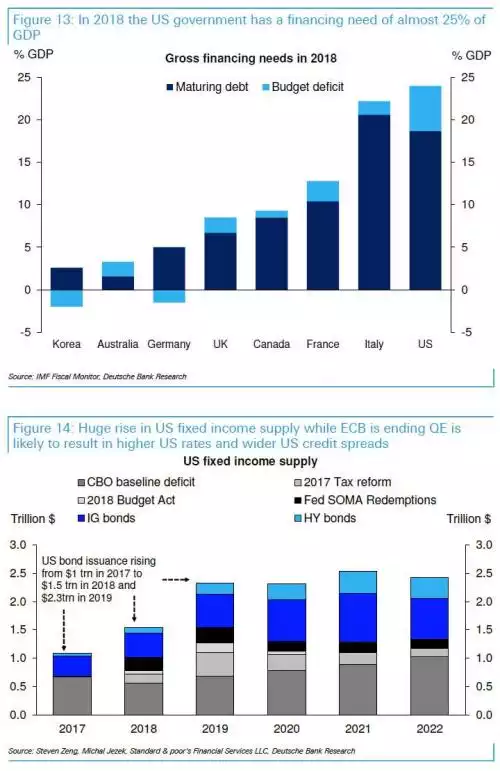

To put that into very stark perspective, they illustrate below that the US Government’s financing need is a quarter of its entire GDP and higher rates are on the way to service it all…

Traditionally US Treasuries have been the other safe haven together with gold. As gold’s price has been rising this year amongst the early signs of a coming crash, US Treasuries have instead been in decline.

The growing signs of a loss of faith in the USD continue to mount. Just as Turkey has just demonstrated, owning and holding gold ahead of any exacerbation of this trend could well be the best course of action.